Discover the latest in health: evidence‑based wellness tips, medical breakthroughs, nutrition guidance, fitness insights, and expert advice for a healthier, happier life.

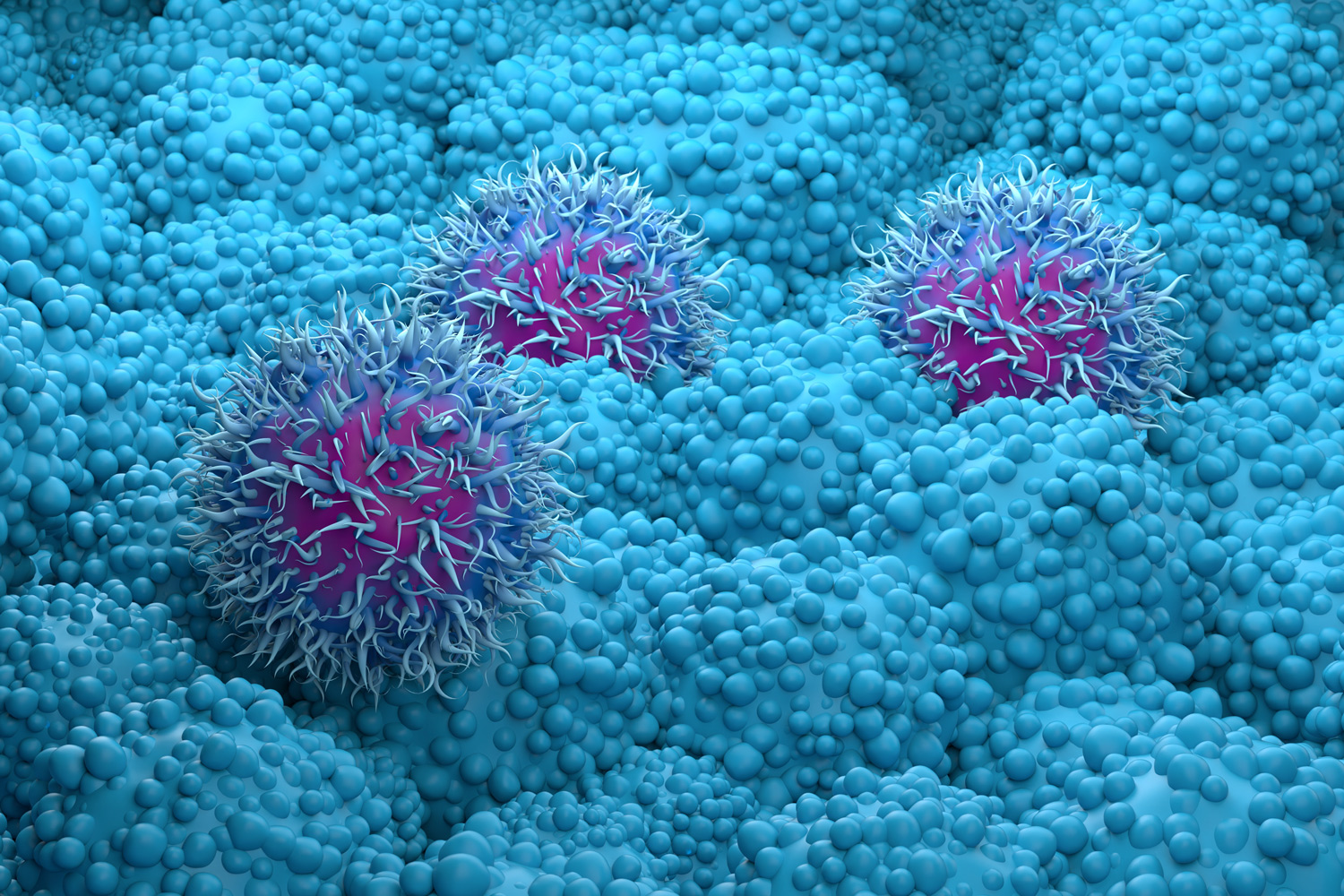

Pancreatic cancer, one of the deadliest forms of the disease, is notoriously difficult to treat. Now, research published February 16 in the journal Cell reveals a surprising level of adaptability within pancreatic tumors, where cancer cells appear to “choose” between growth and survival based on their immediate surroundings. This ability to toggle between biological states significantly impacts how they respond to chemotherapy, making treatment a complex challenge.

The study, led by researchers at NYU Langone Health, sheds light on how pancreatic cancer cells regulate autophagy – a process where cells break down their own components for nutrients. When autophagy is activated, cancer cells prioritize survival over rapid division, effectively shielding themselves from chemotherapies designed to target quickly multiplying cells. Conversely, when autophagy is low, cells proliferate more quickly. This dynamic is heavily influenced by the tumor’s microenvironment, specifically the cells’ interaction with the extracellular matrix (ECM).

Researchers discovered that the ability of pancreatic cancer cells to detect the ECM, the network of fibers surrounding tumors, is a key determinant of their behavior. Cancer cells thrive when anchored to a guiding ECM, but those that fail to detect these fibers ramp up autophagy levels. “Our findings show that the sensing of the ECM by pancreatic cancer cells enables them to switch between states of active growth and autophagic survival,” explained study first author Mohamad Assi, PhD, a postdoctoral fellow in the Department of Radiation Oncology at NYU Grossman School of Medicine.

How Cancer Cells Sense Their Surroundings

The team found that cancer cells detect specific ECM proteins, such as laminin, through a protein on their surface called integrin subunit alpha-3 (integrinα3). To investigate this, researchers grew clusters of pancreatic cancer cells in three-dimensional spheres embedded in gel-like substances, mimicking the tumor environment. By tracking autophagy levels using fluorescent proteins, they observed a clear correlation between ECM interaction and cellular behavior. The study confirmed that autophagy regulation isn’t solely dependent on nutrient availability, but is also significantly influenced by changes in the ECM type or structure.

Within pancreatic tumors, a distinct pattern emerged: cancer cells close to the ECM exhibited low autophagy and rapid growth, while those further away displayed high autophagy and increased resistance to chemotherapy. This spatial arrangement suggests that a single drug is unlikely to effectively target the entire tumor, as not all cells are in the same state. This observation aligns with the limited success of hydroxychloroquine, a drug approved by the Food and Drug Administration to block autophagy, when used as a standalone treatment. Researchers believe this is due to the drug’s limited ability to reach all tumor cells and the fact that not all cells are actively utilizing autophagy at the time of treatment.

Targeting Autophagy and the ECM for Improved Treatment

To explore potential therapeutic strategies, the researchers genetically suppressed integrinα3 in their cell cultures, forcing nearly all cancer cells into a high-autophagy state. This made them significantly more vulnerable to hydroxychloroquine, resulting in a 50 percent reduction in cancer cell survival compared to hydroxychloroquine alone.

Further experiments involved disabling the protein NF2, which normally hinders the signal from integrinα3. Removing NF2 significantly reduced autophagy by slowing down the function of lysosomes – cellular structures crucial for both autophagy and other survival pathways. This disruption led to substantial reductions in tumor growth and triggered cancer cell death. These findings suggest that simultaneously targeting both the ECM-mediated regulation of autophagy and lysosomal function could lead to more durable antitumor responses.

Future Directions in Pancreatic Cancer Research

The research team acknowledges that current autophagy-blocking strategies are often short-lived, as cancer cells adapt and identify alternative survival mechanisms. Their work points towards a more nuanced approach, focusing on disrupting the complex interplay between the tumor microenvironment and cancer cell behavior. Further investigation is needed to determine how these findings can be translated into effective clinical therapies for pancreatic cancer.

This research was supported by National Cancer Institute grants P30CA016087, R37CA289040, P01CA117969, R35CA232124, P30CA016087-38, and 1R01CA251726-01A1, as well as funding from the Damon Runyon Cancer Research Foundation, the Lustgarten Foundation, and Stand Up to Cancer. Dr. Alec C. Kimmelman has financial ties to Rafael/Cornerstone Pharmaceuticals, Deciphera, and AbbVie, and holds a patent related to autophagy and iron metabolism.

Disclaimer: This article provides information for general knowledge and informational purposes only, and does not constitute medical advice. It is essential to consult with a qualified healthcare professional for any health concerns or before making any decisions related to your health or treatment.

What are your thoughts on these new findings? Share your comments below, and please share this article with anyone who might find it helpful.