“`html

Table of Contents

- 1. navigating Corporate Bond Market Opportunities in 2025

- 2. The Institutional Grip On Corporate Bonds

- 3. Key Resources For Corporate Bond Analysis

- 4. Credit Risk And Year-To-Date Returns

- 5. Strategic implications For Investors

- 6. Navigating The Current Landscape

- 7. Evergreen Insights For Corporate Bond Investing

- 8. Frequently Asked Questions About Corporate Bonds

- 9. Given the improvement in corporate credit spreads, what are the biggest potential risks for investors in this scenario?

- 10. Corporate Credit Spreads Improve: What Investors Need to Know

- 11. Decoding Corporate Credit Spreads: A Primer

- 12. Understanding the Improvement

- 13. The Signal: What Causes Credit Spreads to Improve?

- 14. Economic Impacts of Credit Spread improvement

- 15. Opportunities and Risks for Investors

- 16. Investment Opportunities:

- 17. Potential Risks:

- 18. Practical Tips for Investors

Amidst the ceaseless chatter surrounding the stock market, a significant opportunity ofen overlooked is the corporate bond market. This arena, encompassing securitized products and municipal bonds, presents a wealth of potential for astute advisors and individual investors alike.

The Institutional Grip On Corporate Bonds

Historically, the corporate bond market has been the domain of institutional giants, including major mutual fund firms and influential sell-side entities like Goldman Sachs and Morgan Stanley. Though,emerging trends are leveling the playing field,offering smaller investors a chance to participate.

The key is understanding “relative value” within corporate bonds. While direct purchases may not suit all client accounts, gaining perspective on corporate credit enhances informed discussions and strategic financial planning.

Key Resources For Corporate Bond Analysis

Several resources can provide crucial insights into corporate bond performance:

- The St. Louis Fed (FRED): Offers spread-related charts. Visit FRED

- ICE (Intercontinental Exchange): Features a dedicated website on corporate, structured, and municipal bonds.

- S&P Global Ratings: Provides credit information and default studies.

Pro Tip: regularly check thes resources for updated data and analysis.

Credit Risk And Year-To-Date Returns

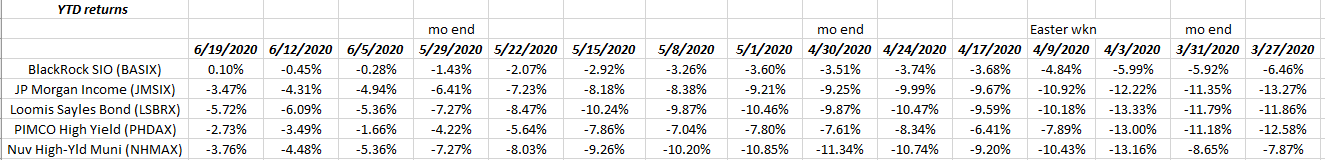

Tracking year-to-date (YTD) returns of corporate bond funds reveals significant performance improvements over time. Funds like the Blackrock Strategic Income Opportunities Fund, managed by Rick Rieder, have demonstrated resilience in navigating economic challenges.

The improvement in credit spreads, contextualized against past data, further underscores the dynamic nature of the corporate bond market. Waiting for lagging economic indicators could mean missing substantial gains.

Credit Risk YTD Returns

Did You Know? Credit spreads can often foreshadow economic recovery, making them crucial indicators for bond performance.

Strategic implications For Investors

predicting the precise corporate bond default rate remains a hindsight exercise.However, monitoring corporate spreads offers real-time insights.

For client allocations, bond funds can adeptly manage high-yield debt and credit rating downgrades, especially with the expertise of larger fund credit staffs. The Federal Reserve’s policies and election outcomes could also influence market dynamics.

Overweighting corporate credit risk and high-yield municipal bonds may present opportunities, but continuous evaluation is essential, especially as the political landscape evolves.

Treasury yields may offer limited value, but their negative correlation to other assets provides a safety net during market corrections. Currently, corporate credit risk appears favorable for the near term.

Always approach market opinions with skepticism, tailoring investment decisions to individual financial profiles.

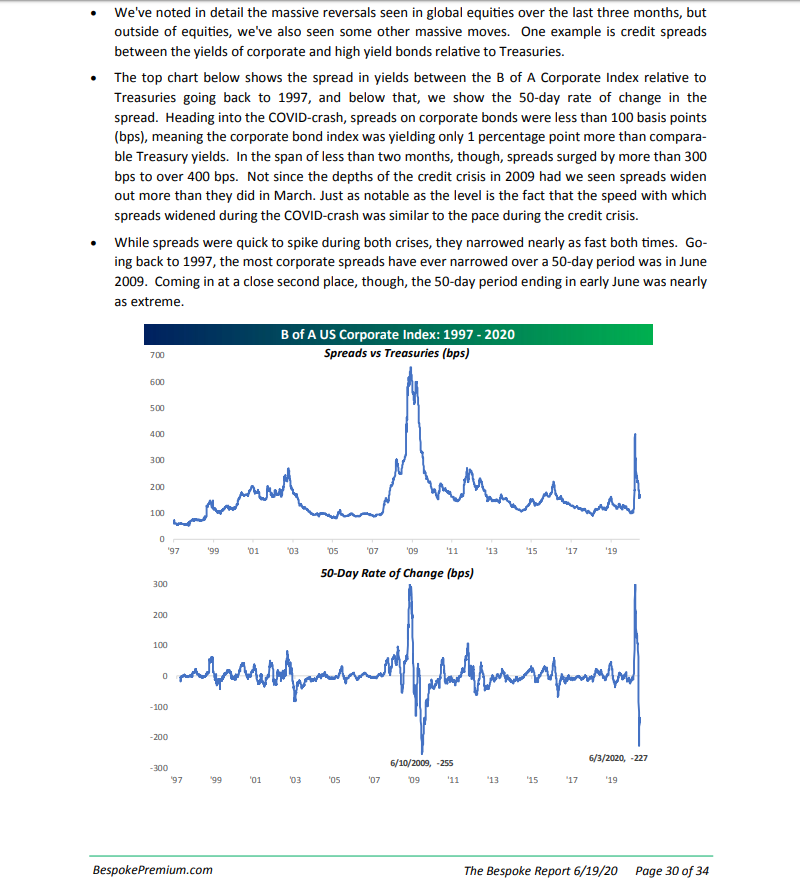

Bespoke Credit Spread

Evergreen Insights For Corporate Bond Investing

| Factor | Impact | Considerations |

|---|---|---|

| Credit Spreads | Indicator Of Risk Appetite | Monitor regularly for early signs of market shifts. |

| Fund Management | Expertise In Risk Mitigation | Evaluate fund managers with strong credit analysis teams. |

| Economic Data | Lagging vs. Leading Indicators | Don’t solely rely on backward-looking data for investment decisions. |

| Political Environment | Policy And regulatory Changes | Assess potential impacts of elections and legislative actions. |

| Treasury Yields | Safe-haven Asset | Balance risk with the stability offered by Treasuries during volatility. |

Frequently Asked Questions About Corporate Bonds

-

Question: What makes the corporate bond market attractive?

Answer: The corporate bond market offers potential for returns, especially when factoring in credit spreads and active management by funds. -

Question: How can individual investors gain corporate bond market insights?

Answer: Individual investors can leverage resources like the St.Louis Fed (FRED), S&P Global Ratings, and fund performance data to understand the corporate credit landscape. -

Question: what role do fund managers play in corporate bond investments?

Answer: Fund managers with specialized credit staffs can navigate loan covenants and credit rating downgrades more effectively than individual investors. -

Question: How does economic data impact corporate bond returns?

answer: Waiting for definitive economic data improvements might cause investors to miss significant opportunities in corporate bond funds, as spread improvements can precede lagging economic indicators. -

Question: Why consider corporate credit risk in investment strategies?

Answer: overweighting corporate credit risk can be advantageous, especially when treasury yields offer limited value and corporate debt shows potential for higher returns. -

Question: What factors should be considered before investing in corporate bonds?

Answer: Investors should carefully consider their financial profile and risk tolerance, and approach market opinions with healthy skepticism.Evaluate diverse sources of information. -

Question: Where can investors find data on corporate bond default rates?

Answer: Corporate bond default rates are typically assessed in hindsight;Given the improvement in corporate credit spreads, what are the biggest potential risks for investors in this scenario?

Corporate Credit Spreads Improve: What Investors Need to Know

Understanding the movement of corporate credit spreads is crucial for any investor looking to navigate the complexities of the bond market and assess the overall health of the economy. An improvement in corporate credit spreads signifies a positive shift, offering valuable insights into market sentiment and potential investment opportunities. This article dives deep into the definition of credit spreads, the meaning of improvement, what causes credit spread compression, how to interpret market signals, and their impacts on investments and the overall economy.

Decoding Corporate Credit Spreads: A Primer

Corporate credit spreads represent the difference between the yield of a corporate bond and the yield of a comparable U.S.Treasury bond. This spread reflects the additional risk premium that investors demand for holding corporate debt, considering the potential for default. Key terms often associated with credit spreads include: credit risk, yield spreads, default risk, and bond yields.

Understanding the Improvement

When corporate credit spreads improve (also known as credit spread compression), it means the spread between corporate bond yields and Treasury yields is decreasing. This demonstrates that investors are becoming less concerned about the default risk associated with corporate debt. This often indicates greater investor confidence in the underlying companies and the overall economic outlook.This is a sign of improved economic conditions and lowered default risk.

The Signal: What Causes Credit Spreads to Improve?

Several factors can contribute to the improvement of corporate credit spreads.These factors frequently enough include: economic growth,positive earnings reports,strong balance sheets,and increased investor appetite for risk.

- Strong Economic Growth: A robust economy generally leads to higher corporate profits and a reduced risk of default, prompting investors to demand lower yields on corporate bonds.

- Positive Earnings Reports: When companies post strong earnings, it reassures investors about their financial health, reducing perceived risk.

- Improved Company Fundamentals: Healthy balance sheets with low debt levels and strong cash flow generation provide confidence, leading to lower credit spreads.

- Increased Risk Appetite: A period of increased risk appetite among investors (often driven by positive sentiment or rising confidence) leads to more investors buying corporate bonds,pushing yields down.

Economic Impacts of Credit Spread improvement

An improvement in corporate credit spreads typically has several positive impacts on the economy. These effects can be seen across various sectors and influence market behavior. Several search term related topics here include: economic expansion, business investment, and consumer confidence.

- Increased Business investment: Lower borrowing costs encourage corporations to invest in capital expenditures, contributing to economic growth and job creation.

- Higher Consumer Confidence: A robust corporate sector strengthens consumer confidence, leading to increased spending and economic activity.

- enhanced Market Liquidity: Improved conditions often lead to higher trading volumes and lower transaction costs, bolstering market liquidity.

- Reduced Cost of Capital: Companies can access capital more cheaply, facilitating expansion, innovation, and strategic initiatives.

Opportunities and Risks for Investors

Improving corporate credit spreads present both opportunities and risks for investors. A deeper look shows consideration of the potential benefits and crucial factors for investors in assessing the related investment habitat.Related search terms include: bond investments, investment strategies, and risk management.

Investment Opportunities:

- Capital Appreciation: As credit spreads tighten, the prices of existing corporate bonds tend to rise, potentially leading to capital gains for investors.

- Higher Yields (Compared to Treasuries): corporate bonds still offer higher yields than comparable Treasury bonds, even with improving spreads.

- Portfolio Diversification: Adding corporate bonds can diversify a portfolio, potentially improving risk-adjusted returns.

Potential Risks:

- Interest Rate Risk: Rising interest rates can cause bond prices to fall, potentially offsetting some of the gains from improving credit spreads.

- Credit Downgrades: While spreads are improving, there is always a risk that a company’s credit rating could be downgraded, leading to a price decline.

- economic Slowdown: if the economic outlook deteriorates, credit spreads could widen again, causing losses.

Scenario Impact on Credit Spreads Potential Investor Action Economic Growth Accelerates Spreads Compress Increase Allocation to Corporate Bonds Inflation Expectations Rise Spreads May Widen Slightly Monitor interest Rate Trajectory; Consider Inflation-Protected Bonds Earnings Misses reported spreads Can Widen in Specific Sectors Conduct Detailed Credit Analysis Practical Tips for Investors

Here’s what investors may consider when dealing with credit spread improvements. Additional related search terms include: bond portfolio, credit ratings, and market analysis.:

- Monitor economic Indicators: Keep a close watch on economic data, such as GDP growth, inflation figures, and employment rates, to assess the broader economic environment.

- Perform Credit Analysis: Evaluate the creditworthiness of the companies whose bonds you are considering, including their balance sheets, earnings reports, and industry outlook.

- Diversify yoru Portfolio: Ensure that your bond portfolio is diversified across various sectors and credit ratings to mitigate risk.

- stay Informed: Keep abreast of market news, analyst reports, and rating agency actions to stay informed about market developments.

By carefully analyzing the indicators and understanding the market, investors can make informed decisions and potentially capitalize on opportunities presented by improving corporate credit spreads.