Euro Surges Amid tariff Tensions,Weak US Data,and ECB Rate Cut Expectations

Table of Contents

- 1. Euro Surges Amid tariff Tensions,Weak US Data,and ECB Rate Cut Expectations

- 2. Trump’s Tariff Threats and geopolitical Tensions Weigh on US Dollar

- 3. ECB Rate Cut on the Horizon?

- 4. US Economic Data Disappoints

- 5. EUR/USD Technical Analysis

- 6. Understanding the Dynamics of Currency Valuation

- 7. how To Profit From currency Moves

- 8. Frequently Asked Questions

- 9. What are the key economic indicators that could potentially cause the EUR/USD bullish surge to stall, and how might their performance impact the exchange rate?

- 10. EUR/USD: Bullish Surge Could Stall? Navigating the Forex Landscape

- 11. Economic Indicators and Basic Drivers

- 12. Eurozone Economic Performance

- 13. US Economic Performance

- 14. Central Bank Policies and Interest Rate Differentials

- 15. ECB Monetary Policy

- 16. Federal Reserve Monetary Policy

- 17. technical Analysis and Potential Resistance Levels

- 18. Key Technical Indicators

- 19. Potential Resistance Levels

The Euro Is Showing Meaningful Strength on Monday,buoyed by a confluence of factors.President Trump’s renewed tariff threats against the European Union, coupled with accusations against China for violating the Geneva agreement, are weighing on the U.S. dollar. Adding to the dollar’s woes, recent U.S. economic data has fallen short of expectations, further bolstering the Euro’s position.

Meanwhile, the markets are keenly awaiting the European Central Bank’s (ECB) upcoming policy decision. Will the ECB deliver a widely anticipated rate cut? Let’s delve into the key drivers behind the Euro’s recent performance and what to expect in the coming days.

Trump’s Tariff Threats and geopolitical Tensions Weigh on US Dollar

President Donald Trump is reigniting trade tensions, signaling intentions to raise tariffs on European Union imports. This protectionist stance, along with accusations that China is not adhering to the Geneva agreement, introduces uncertainty into the global economic landscape and places downward pressure on the U.S. dollar.

Geopolitical events are also playing a role. Recent drone attacks launched by Ukraine’s Security Service on Russian strategic aviation, dubbed Operation Spiderweb, contribute to market volatility, impacting investor sentiment and currency valuations.

ECB Rate Cut on the Horizon?

The Highlight of This Week is the ECB’s Monetary Policy Proclamation. The market widely anticipates the ECB will cut interest rates by 25 basis points, bringing the benchmark rate down to 2.15%. “The Question Is Not If, But When, And By How Much Further?” asks Analyst, Anya Martell, Chief economist at global Macro Insights.

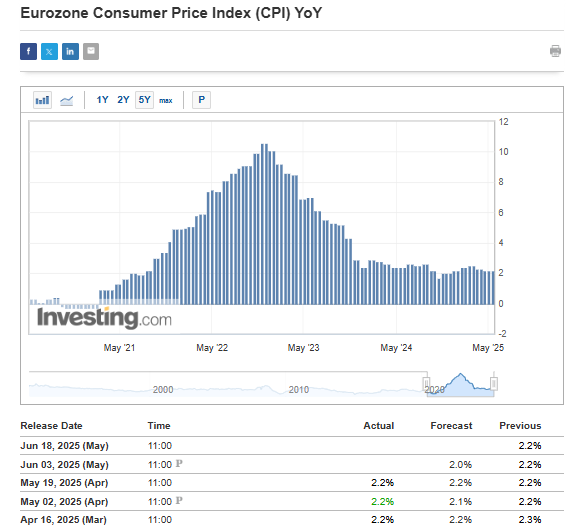

A more dovish stance is gaining traction as recent data reveals that Eurozone inflation has dipped below the critical 2% target. This development could prompt the ECB to consider further monetary easing to stimulate economic growth. Another cut could diminish recent Euro currency gains.

US Economic Data Disappoints

The U.S. Economic Landscape is Showing Signs of weakness. Recent industrial data came in below expectations, adding to concerns about the strength of the U.S. Economy.

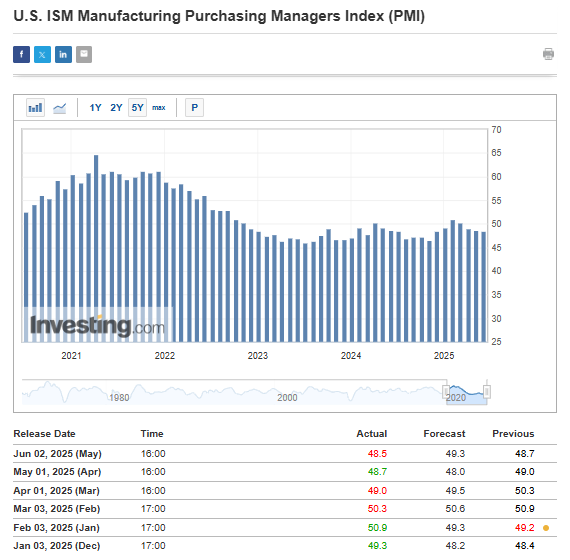

The ISM manufacturing index, a key gauge of economic activity, has fallen below the 50-point mark, signaling contraction. This decline is exerting further downward pressure on the U.S. dollar, making the Euro relatively more attractive to investors.

This Friday, all eyes will be on the U.S. Labor Market Data. Economists anticipate little change in the unemployment rate. Though, any surprises could trigger significant market reactions, further impacting the Euro/Dollar exchange rate.

EUR/USD Technical Analysis

The Recent Surge in Demand for the EUR/USD Pair pushed it to its highest level in over a month. Some analysts suggest further gains are possible. However, the pair is currently pulling back toward the support level around 1.1380, following the latest Eurozone data.

If buyers can maintain momentum, investors will likely target the area where the upward trend line converges with the 1.1320 level. The primary target for buyers remains the recent high around 1.1580.

Understanding the Dynamics of Currency Valuation

Currency Valuation is influenced by a Complex Interplay of Factors. These factors include interest rates, inflation, economic growth, and geopolitical events. Central bank policies, such as quantitative easing or interest rate adjustments, can have a significant impact on currency values.

For example, In 2023, the Swiss Franc experienced significant thankfulness due to Switzerland’s relatively high interest rates and stable economy, attracting investors seeking safe-haven assets during times of global uncertainty. This, in turn, affected Swiss exports and tourism.

how To Profit From currency Moves

Navigating Currency Markets Requires a Deep Understanding of Macroeconomic Trends, geopolitical risks, and technical analysis. Investors can use various strategies, including:

- Hedging: Protect against adverse currency movements by using financial instruments like currency futures and options.

- Carry Trade: Borrowing a currency with a low interest rate to invest in one with a high interest rate.

- Diversification: Holding a portfolio of assets denominated in various currencies to reduce overall risk.

Frequently Asked Questions

-

Why is the Euro strengthening?

The Euro is gaining strength due to a combination of factors, including New Tariff announcements by President trump, weaker-than-expected U.S. economic data, and anticipation of a potential interest rate cut by the European Central Bank (ECB).

-

What impact do Tariffs have on currency values?

Tariffs can weaken a currency like the U.S. dollar by creating uncertainty in international trade and potentially harming domestic industries,making the Euro relatively more attractive to investors.

-

How might the ECB rate cut affect the Euro?

A 25-basis point rate cut by the ECB is largely priced into the market. however, further rate cuts, especially if Eurozone inflation remains below the 2% target, could slow down the Euro’s recent gains against the dollar.

-

What does the US labor market data suggest?

Recent U.S. industrial data and a declining ISM manufacturing index point to a weakening U.S. economy. The upcoming U.S.labor market data this Friday will provide further insights, but current forecasts suggest little change.

-

What is the technical outlook for the EUR/USD pair?

The EUR/USD pair recently surged to a one-month high, but after the last data from the Eurozone, the pair is now pulling back toward the support level around 1.1380. investors are closely watching the area where the upward trend line meets the 1.1320 level, with the main target for buyers remaining around 1.1580.

-

What is the current Eurozone inflation rate?

As of recent reports, Eurozone inflation has slipped below the 2% target, adding pressure on the ECB for potential further rate cuts to stimulate the economy.

-

How do geopolitical events impact the Euro?

Geopolitical events, such as the U.S. imposing tariffs on the European Union or military actions like Ukraine’s drone attacks on Russian strategic aviation, can create market volatility and influence currency values. Specifically,these events have contributed to the weakening of the U.S. dollar and a corresponding strengthening of the Euro.

What are your thoughts on the Euro’s recent surge? Do you anticipate further gains, or is this a temporary rally? Share your insights in the comments below!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Currency trading involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions.

What are the key economic indicators that could potentially cause the EUR/USD bullish surge to stall, and how might their performance impact the exchange rate?

The EUR/USD currency pair has experienced considerable volatility in recent months, fueling speculation about the sustainability of it’s bullish surge. Forex traders constantly analyze various factors to predict the Euro to US Dollar exchange rate. Understanding these key influences is vital for informed decisions in the dynamic world of forex trading. This piece provides a detailed analysis of the potential challenges facing the EUR/USD rally, examining economic indicators, central bank policies, and technical signals to provide valuable insights for currency traders. The central question: can the EUR/USD sustain its current momentum, or are pullbacks inevitable?

Economic Indicators and Basic Drivers

The Euro US Dollar exchange rate is heavily influenced by economic data releases from both the eurozone and the United States. Strong economic data frequently enough fuels a rally for a currency,while weaker figures can trigger a sell-off. A thorough understanding of these fundamental drivers is critical for navigating the forex market.

Eurozone Economic Performance

Key economic indicators in the Eurozone, such as GDP growth, inflation rates (CPI and PPI), and unemployment figures, play a crucial role. signals of economic strength support the Euro (EUR), while weakness can weigh on the currency.Recent economic data has shown mixed results, creating uncertainty. Investors closely monitor the European Central Bank (ECB) decisions on monetary policy and interest rates. Such as,if the ECB signals an increased hawkish stance on inflation,it should be positive for the Euro. Conversely, dovish tones could erode the Euro’s strength.

US Economic Performance

In the United States, vital economic data, including non-farm payrolls (NFP), unemployment rates, and inflation (CPI), shape the performance of the US Dollar (USD). A strong US economy frequently enough boosts the USD, while concerns about a slowdown might weaken it. The Federal Reserve (The Fed) monetary policy, including interest rate decisions, also significantly impacts the USD. Any hawkish hints from the fed can significantly influence the EUR/USD pair.

| Economic Indicator | Impact on EUR/USD (If Strong) | Impact on EUR/USD (If weak) |

|---|---|---|

| Eurozone GDP | Bullish for EUR | Bearish for EUR |

| US NFP | Bearish for EUR | Bullish for EUR |

| Eurozone Inflation | Bullish for EUR (if higher than expectations, reflecting potential hawkish ECB stance) | bearish for EUR (if below expectations) |

| US Inflation | Bearish for EUR (if higher than expectations) | Bullish for EUR (if below expectations) |

Central Bank Policies and Interest Rate Differentials

The policy divergence between the european Central Bank (ECB) and the Federal Reserve (The Fed) is a crucial factor driving the EUR/USD exchange rate. Interest rate differentials significantly influence the flow of capital and, consequently, the value of currencies. For example, if the Federal Reserve maintains a more aggressive stance on interest rate hikes versus the ECB, it generally strengthens the USD against the EUR.

ECB Monetary Policy

The ECB’s monetary policy decisions, including interest rate hikes or cuts, asset purchases, and forward guidance, have a direct impact on the EUR. Any shift in the ECB’s stance towards tighter monetary policy tends to support the Euro (EUR). Furthermore, strong rhetoric from ECB officials emphasizing commitment to fighting inflation should strengthen the EUR. Conversely,hints of dovish monetary policy lead to weakness.

Federal Reserve Monetary Policy

Likewise, the Federal Reserve’s stance has a direct effect on the USD. The Fed’s policy decisions play a decisive role here, and an aggressive approach to interest rate hikes supports the USD. Investors closely monitor Fed speeches, meeting minutes, and press conferences for clues on the future direction of monetary policy and the impact on the EUR/USD rates.

Tip: Stay updated on ECB and Fed meetings and announcements via reputable financial news sources for timely forex trading decisions.

technical Analysis and Potential Resistance Levels

Technical analysis provides another crucial element of forex trading. Traders use various technical indicators and chart patterns to identify potential support and resistance levels and predict price movements. The EUR/USD chart analysis is pivotal for understanding potential areas where the bullish surge could stall.

Key Technical Indicators

Analysing the daily timeframe of the EUR/USD using indicators like the Relative Strength Index (RSI),Moving Averages (MA),and Fibonacci retracement levels can pinpoint areas where the current upward trend will struggle. These indicators help traders identify overbought or oversold conditions and also estimate potential support and resistance levels. For instance, the 200 day Moving average could serve as a key dynamic resistance level.

Potential Resistance Levels

Key resistance levels are price points where traders anticipate a important selling pressure, potentially halting or reversing an upward trend. Identifying such levels is helpful for profit taking or positioning short trades at the EUR/USD.Traders also watch prior highs on the chart,Fibonacci retracement levels,and the round numbers as levels.

Important! Consult a competent financial advisor before making any investments in this area.

Related Search Terms: Forex trading strategies, EUR/USD forecast, EUR/USD analysis, currency trading, forex signals, dollar-euro, exchange rate, currency pair, forex market, trading the euro.