“`html

Federal Reserve Rate Decision Looms Amidst Trade Tensions

Table of Contents

- 1. Federal Reserve Rate Decision Looms Amidst Trade Tensions

- 2. Analysts Eye Fed’s Next Move

- 3. Economic Data: A Mixed Signal for Federal Reserve Rate Policy

- 4. Eur/Usd pair Tests Resistance Amidst Federal Reserve Rate Speculation

- 5. Understanding Federal Reserve Rate Decisions: An Evergreen Outlook

- 6. The Role of Inflation

- 7. Given the provided article, what are the key risks associated with trading EUR/USD during a period of high forex volatility, as triggered by the Fed decision, and how can a trader mitigate those risks?

- 8. EUR/USD Trading Strategy: Navigating the Fed Decision & Forex Volatility

- 9. Understanding the Impact of the Fed Decision on EUR/USD

- 10. Key Factors to Watch Before the Fed Announcement

- 11. The Importance of the FOMC Statement and Press Conference

- 12. EUR/USD Trading Strategy in Preparation for the Fed Announcement

- 13. Technical Analysis Before the Fed Decision

- 14. Fundamental Analysis and Market Sentiment

- 15. risk Management strategies: essential for Forex Trading

- 16. Setting stop-Loss Orders

- 17. Position Sizing

- 18. Volatility Analysis

- 19. practical Tips and examples

- 20. Case Study example

Global markets are keenly awaiting the Federal Reserve’s imminent interest rate decision, a pivotal moment overshadowed by persistent trade disputes and a mixed bag of economic indicators. Stock and currency markets have shown surprising resilience despite rising geopolitical tensions between Israel and Iran. All eyes are now on the *Federal Reserve rate* announcement and any forward guidance it provides.

Analysts Eye Fed‘s Next Move

with expectations largely set for interest rates to remain unchanged this week, investors are laser-focused on deciphering any subtle hints about the *Federal Reserve’s rate* policy trajectory for the remainder of the year. The central bank’s assessment of the economic outlook will be crucial.

Meanwhile, the Euro/Usd currency pair continues its upward momentum. A more dovish stance from the Fed could propel the euro past the $1.16 mark,establishing a new,higher trading range.

Economic Data: A Mixed Signal for Federal Reserve Rate Policy

The Federal Reserve is widely expected to implement its next *Federal Reserve rate* cut in September, a timeline that has already been pushed back from earlier forecasts due to ongoing trade uncertainties and tariff disputes. However, recent economic data paints a more complex picture.

Key indicators, including recent data showcasing a quarterly decline for the first time sence late 2022, suggest the Federal Reserve might be compelled to act sooner. Sustained negative trends in upcoming data releases could force the Fed to reconsider its current stance.

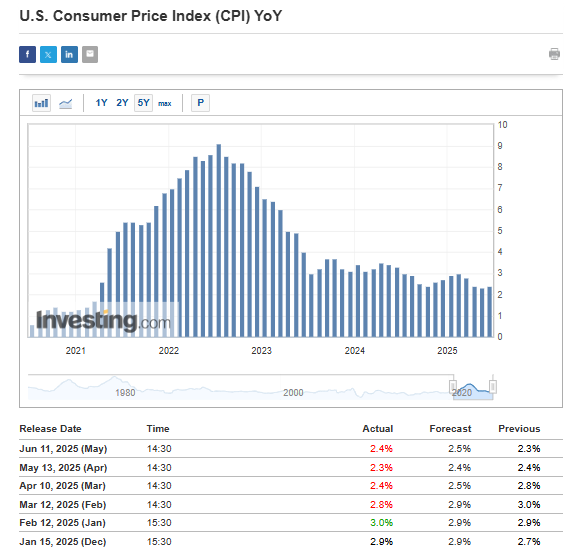

The current rate range of 2-2.5% does not preclude potential rate cuts, especially given that inflation has consistently fallen short of expectations for the past four months.

Were it not for the prevailing tariff war, interest rates in the United States would likely be lower, with any positive developments on trade deals-particularly with China or the EU-potentially exerting downward pressure on the US dollar’s valuation.

Simultaneously, the Fed remains vigilant regarding the labor market’s performance. Sustained strength in job data would give the Federal Reserve less impetus to rush into further rate cuts.

Conversely, the eurozone is still navigating its monetary easing cycle, even though there are nascent indications that this cycle might potentially be approaching its conclusion.Recent remarks from European Central Bank President christine Lagarde reflect concerns that inflation could resurge if trade agreements between the EU and the US remain unresolved.

Eur/Usd pair Tests Resistance Amidst Federal Reserve Rate Speculation

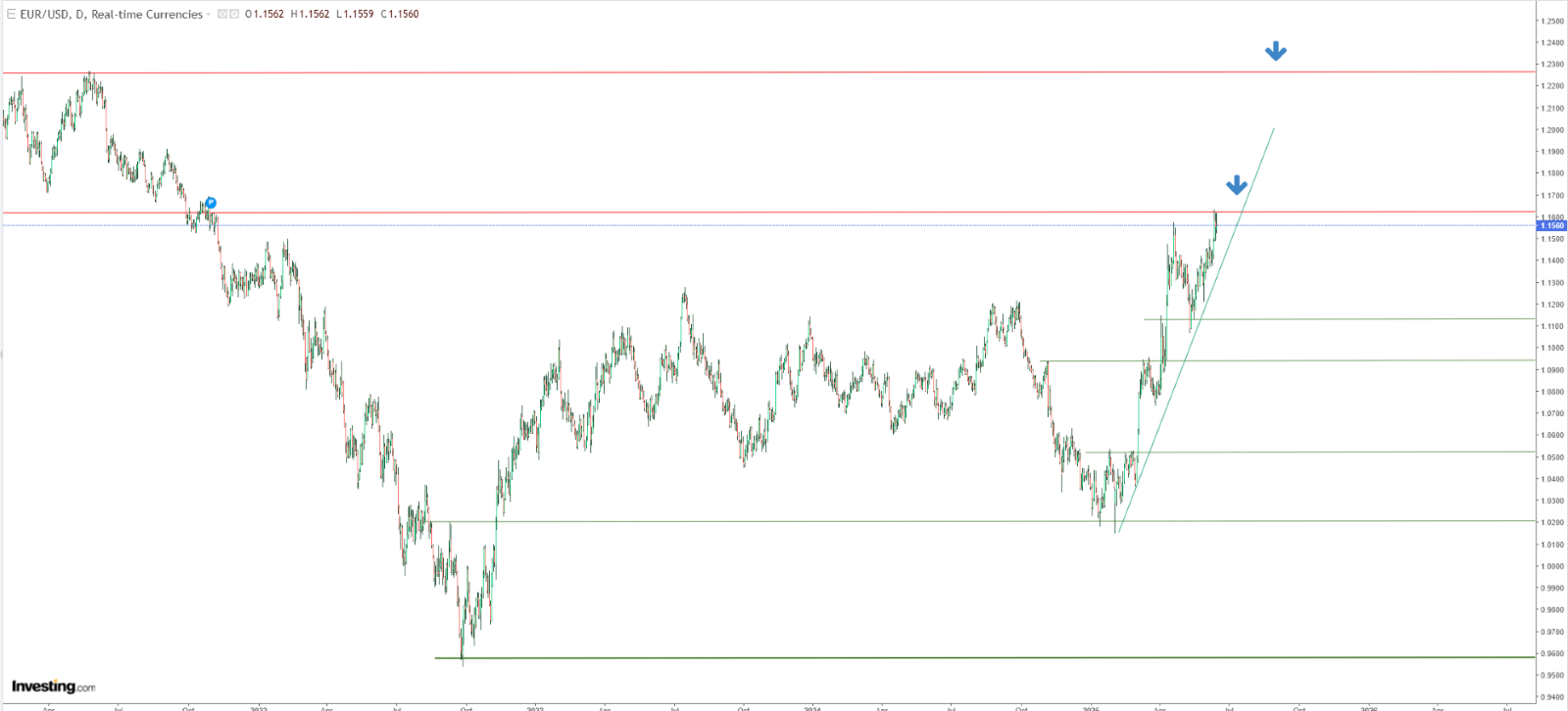

Buyers have recently encountered stiff resistance around the 1.16 level for the Eur/Usd pair. While sellers have defended this level thus far, continued upward pressure may lead to a breakout, contingent on prevailing macroeconomic conditions.

EUR/USD Technical analysis” style=”width:100%”>

EUR/USD Technical analysis” style=”width:100%”>A decisive break above the 1.16 resistance could pave the way for significantly higher levels,potentially targeting above 1.23. Realizing this upside potential, however, hinges on factors that could weaken the US dollar, such as advancements in trade negotiations or indications of a more accommodative Fed policy.

Understanding Federal Reserve Rate Decisions: An Evergreen Outlook

The *Federal Reserve rate* decisions have far-reaching effects, influencing everything from mortgage rates to business investments. Here’s a look at some related topics.

The Role of Inflation

Given the provided article, what are the key risks associated with trading EUR/USD during a period of high forex volatility, as triggered by the Fed decision, and how can a trader mitigate those risks?

The federal Reserve’s (Fed) decision is a pivotal event for the EUR/USD currency pair. This article provides a comprehensive guide to understanding how to trade EUR/USD effectively in the face of impending forex volatility triggered by such decisions.We’ll cover essential aspects of analysis and strategy, crucial for traders of all experience levels.Understanding the potential market movements and crafting a robust trading plan before the declaration is key.

Understanding the Impact of the Fed Decision on EUR/USD

The Fed’s interest rate decisions directly influence the value of the US dollar, creating ripple effects that considerably impact the EUR/USD exchange rate. Traders meticulously follow the Federal Open Market Committee (FOMC) meetings,where policymakers discuss economic conditions,inflation,and potential monetary policy adjustments.

Key Factors to Watch Before the Fed Announcement

Several factors contribute to the expected price action in the EUR/USD pair before, during, and after the Fed meeting. These factors should be carefully examined to form a reasonable trading strategy. Key LSI keywords here include “FOMC meeting minutes” and “monetary policy outlook”.

- Interest Rate Hikes/Cuts: Anticipated changes to the federal funds rate.

- Inflation Data: Consumer Price Index (CPI) and Producer Price Index (PPI) releases.

- Employment Figures: Non-Farm Payrolls (NFP) and unemployment rates.

- GDP Growth: economic output data indicating the health of the US economy.

- Fed Statements & Projections: Commentary from the Fed Chair and forecasts for future rate changes.

- Market Sentiment: Gauging overall market sentiment through the VIX which helps forecast future volatility.

The Importance of the FOMC Statement and Press Conference

The official FOMC statement and the press conference provide crucial insights.Scrutinize the language used, paying close attention to whether the Fed signals a hawkish (tightening policy) or dovish (loosening policy) stance. the tone can dramatically influence market direction.

EUR/USD Trading Strategy in Preparation for the Fed Announcement

A successful EUR/USD trading strategy requires preparedness and a well-defined plan. This necessitates anticipating the likely market scenarios and executing appropriate tactical approaches. Before the Fed announcement, consider the following strategies:

Technical Analysis Before the Fed Decision

technical analysis plays a key role. Traders will use technical tools to track price history and assess potential support and/or resistance levels.It also provides an understanding of the historical movements. Focus on key levels and identify patterns to estimate probability of the price action.

- Support and Resistance Levels: Identify critical price points where reversals are likely.

- Trendlines: Recognize prevailing directional trends.

- Chart Patterns: Look for patterns (head and shoulders, flags, etc.) suggesting potential price movements.

- Technical Indicators: Use tools such as moving Averages (MA), Relative Strength Index (RSI), and Fibonacci retracements to identify potential entry and exit points.

Fundamental Analysis and Market Sentiment

Fundamental analysis involves examining economic data and other factors that influence the EUR/USD exchange rate. Consider market sentiment to predict trader behavior.

Key Considerations:

- Economic Indicators: Review US and Eurozone economic data to gauge relative economic strength.

- Market News: Monitor any major events that affect the market, notably in either country.

- Sentiment Indicators: Utilize tools such as the Commitment of Traders (COT) report and various sentiment surveys to gauge market bias.

risk Management strategies: essential for Forex Trading

Risk management is crucially crucial. Employ these risk management techniques to protect your capital.

Setting stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. The placement of stop-loss orders should be based on technical analysis and risk tolerance depending on the level of volatility

Position Sizing

Calculate the appropriate position size based on your risk appetite and account balance.The higher the volatility index, the smaller your position must be.

Volatility Analysis

Assess the anticipated volatility. Fed interest rate decisions can cause large price swings and sharp movements in the markets. Adjust your strategy accordingly to stay safe.

| Strategy Element | Explanation | Submission |

|---|---|---|

| Stop-Loss Orders | Pre-set orders to automatically exit a position if the price moves against you. | Placed strategically below key support levels to limit potential losses. |

| Position Sizing | Calculating how much you should trade, based on risk parameters. | Determine the position size that does not exceed the predetermined maximum risk tolerance. |

| Take-Profit Orders | Orders to automatically exit a position at a profit target. | set take-profit levels at predetermined profit goals, based on trading strategies. |

practical Tips and examples

Here are some helpful real-world tips for trading during Fed announcements:

- Avoid Trading Immediately Before the Announcement: Consider waiting until the initial volatility subsides to obtain a clearer picture of the market’s reaction.

- Use a Demo Account: Practice your strategy in a demo account to refine it without risking real capital.

- Follow the Experts: Keep up with expert opinions from respected economists and analysts.

- Review Previous Fed Decision Impacts : Observe the previous announcements to recognize trends and possible potential outcomes.

Case Study example

Consider a situation where the Fed signals it will begin increasing interest rates. the EUR/USD could potentially drop due to a weaker Euro,thus increasing the dollar which causes such a situation and could significantly impact trading strategy decisions.

By consistently applying these strategies and staying updated with market developments, traders can significantly increase their chances of making informed and successful EUR/USD trades during significant news events like the Fed meeting decisions.