Yves, a resident of Liège, contacted us via the orange Alert us button to let us know of his concern. This owner regularly rents out his apartment on Airbnb. He fears that with all the taxes put in place by the legislator in recent months, renting accommodation for a short period is no longer profitable.

“Every weekend of every month, there are reservations.“ In front of the summary table of the rentals of his apartment, Yves is worried. This Liégeois contacted us via the orange Alert us button.

He fears that the tax system put in place by the authorities will no longer make it profitable to rent his accommodation for short stays. The father of the family rents his apartment regularly via the Airbnb platform. The site allows passing travelers to quickly get in touch with him, to stay in his apartment. “It is a small financial contribution. It allows the apartment to pay for itself, to pay for its energy. It doesn’t represent a huge gain.”he says.

If I rented it for the year, I would have more profit

It was in 2019 that Yves began by renting out his apartment. After a separation, he acquired an apartment in his favorite city in 2017: Liège. “The goal was to get closer to my children“, he explains. Shortly following, Yves meets a new girlfriend and will gradually move in with her.

Result, his apartment is more and more free. His come then the idea of putting it up for rent on Airbnb. “If I rented it for the year, I would have more profit. But the idea is to maintain flexibility and access to my children who have their school not far away. And for us, being able to come there when we are free”.

“I love my city”

Yves defines himself above all as a lover of his city: Liège. Renting out your apartment is promoting your city, but also the opportunity to welcome tourists from all walks of life: Germany, Netherlands Quebec, etc. “I have always been from Liège. I never moved, even when I worked in Brussels or Charleroi. I love my city, I have always promoted my city.“ Notre alerter leaves documentation on his region for his tenants and says not to be stingy in advice: “There is a real tourist agent system. I advise on restaurants, outings, museums…“he says.

Taxation that will depend on the frequency of rental

Since he became a “host” on the site of the giant AmericanYves’ income has been growing. But this year, its profits – as for all the other owners of the platform – will no longer be able to escape the tax authorities. Indeed, Belgium has forced community housing rental platforms such as Airbnb to collaborate with the tax authorities. Concretely, companies like Airbnb must now each year to communicate to the tax authorities the amounts received by individuals who rent out their property. Only problem, the contours and mechanisms of this taxation are still unclear for some, including Yves. He fears that this small additional income will melt away. “If this is confirmed, I will have to stop everything”.

The tax authorities will make a distinction between occasional renters and professionals.

- If it is occasional, three types of taxation will be taken into account: one on property income, one on movable income and a last one on miscellaneous income (cleaning, breakfast, etc.).

- On the other hand, if the activity is perceived by the tax authorities as professional, the income is considered as professional income and therefore taxed as such.

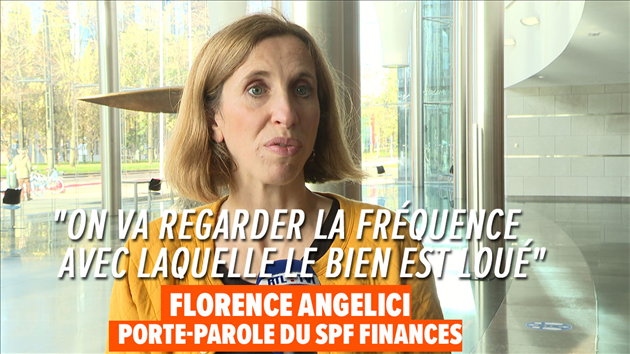

So how do you know which of the two categories you fall into? Florence Angelici is the spokesperson for the FPS Finances. She details:When you rent your property through Airbnb, we will look at the frequency with which the property is rented out as well as your investment in time and money”. The FISC does not set a precise amount to distinguish between the two possibilities: “There are no figures to determine whether you have professional income or not. It’s really the investment of time and money that is made that will determine whether it is professional income…” or not!

A lack of clarity according to Yves which leaves a doubt for the next tax declaration: “If the definition of occasionally isn’t every weekend, then I’m just going to block out weekends so I don’t go into (business) taxation. The apartment will become less available and therefore less profitable, at some point I will stop selling it or renting it for the year.”

Added to all this are new regulations. Indeed, since July 1, 2022, the supply of furnished accommodation is subject to 6% VAT. In quick succession, the legislator got their hands on the taxation of overnight stays on the platform. “The problem is that either we will no longer earn or even lose money, or we will have to increase the prices. It requires additional administrative work, having a VAT number, etc. It starts to make a lot of money and of time that goes to the state.” Yves insists, he is not once morest taxation, but he considers them too high.

On the side of the SPF Finances, it is recalled that the objective of these taxations is “to have more fairness at the tax level. That everyone pays taxes on all of their income.” Hosts who do not complete their future tax declaration correctly incur an administrative penalty: “Either fines of between 50 and 1,250 euros, or a tax increase with % that vary according to the recidivism.