Table of Contents

- 1. Breaking: Lidl Shifts From Linear TV to VoD, VoL and Social Video in Bold 2026 Pivot

- 2. Why the Shift? Two Driving Forces

- 3. VoL and CTV: Still complementary to Linear for a Brand Like Lidl

- 4. Key Trends Shaping the Budget Shift

- 5. Summary Table: Channel Landscape and Costs

- 6. What this Means for Advertisers

- 7. Industry Pulse: 2026 Outlook

- 8. With Amazon Freevee and Samsung TV Plus, securing 12 % of the premium ad load.

- 9. Why Lidl Shifted from Linear TV to CTV

- 10. Key Challenges in the Transition

- 11. Measuring ROI: Metrics That Matter

- 12. industry Impact: What Competitors Are Watching

- 13. Practical Tips for Brands Replicating Lidl’s Strategy

- 14. Case Study: Lidl’s “Fresh Deals” CTV Campaign (Q2 2025)

- 15. Future Outlook for Retail Advertising

Lidl is revamping its media mix, announcing plans to end new investments in linear television from 2026. The move reallocates budget toward video-on-demand, social video and connected TV, a shift that could tilt the advertising landscape in favor of digital powerhouses like google, Meta, Netflix and Amazon.

The decision signals a broader industry trend: advertisers are increasingly drawn to flexible,digital formats,even as brands weigh the risk of higher costs and more complex inventory management. lidl’s leadership says the change is a strategic risk worth taking to modernize reach and relevance across audiences.

Why the Shift? Two Driving Forces

Industry observers point to two core dynamics. first, digital formats offer advertisers more leeway on price and brand presentation than conventional shelf-deployed deals, which are often bound by long-term commitments and regulatory conditions.

Second, audiences are fragmenting. VoL, connected TV and online video now capture a growing share of viewing time, particularly among younger generations, complicating media planning but offering opportunities to reach specific cohorts at scale.

VoL and CTV: Still complementary to Linear for a Brand Like Lidl

Even as Lidl eyes a broader digital push, experts note that VoL and CTV remain complements to linear TV for the retailer’s mass-market reach. In 2024, the majority of video viewing still occurred across traditional and digital platforms, with a vast audience spanning the country.

Industry voices emphasize that linear TV remains cost-efficient for broad-brand campaigns, delivering strong reach across demographics. Simultaneously occurring, online video channels help reach younger viewers and niche segments that are less engaged with traditional TV.

As spending migrates online, costs rise on some digital formats. Premium SVoD can command higher CPMs than basic VoD, and general online video—even on platforms like YouTube—often carries higher costs per impression than legacy TV. This fragmentation makes planning more complex, though it also opens doors to precision targeting and measurable impact.

“Media planning now aims to maximize coverage at an optimal cost, even as environments become highly fragmented. Rebuilding the power of linear TV requires integrating many different platforms, mastering activation, deduplication and performance measurement. It’s challenging, but it creates new opportunities for agencies,” a media executive noted.

Key Trends Shaping the Budget Shift

Recent data show streaming and online video capturing a growing portion of weekly viewing time in major markets. Generational differences are pronounced: younger audiences devote a smaller share of their viewing to linear TV compared with older generations. Even as Lidl reorients its budget, the overall market is echoing these shifts.

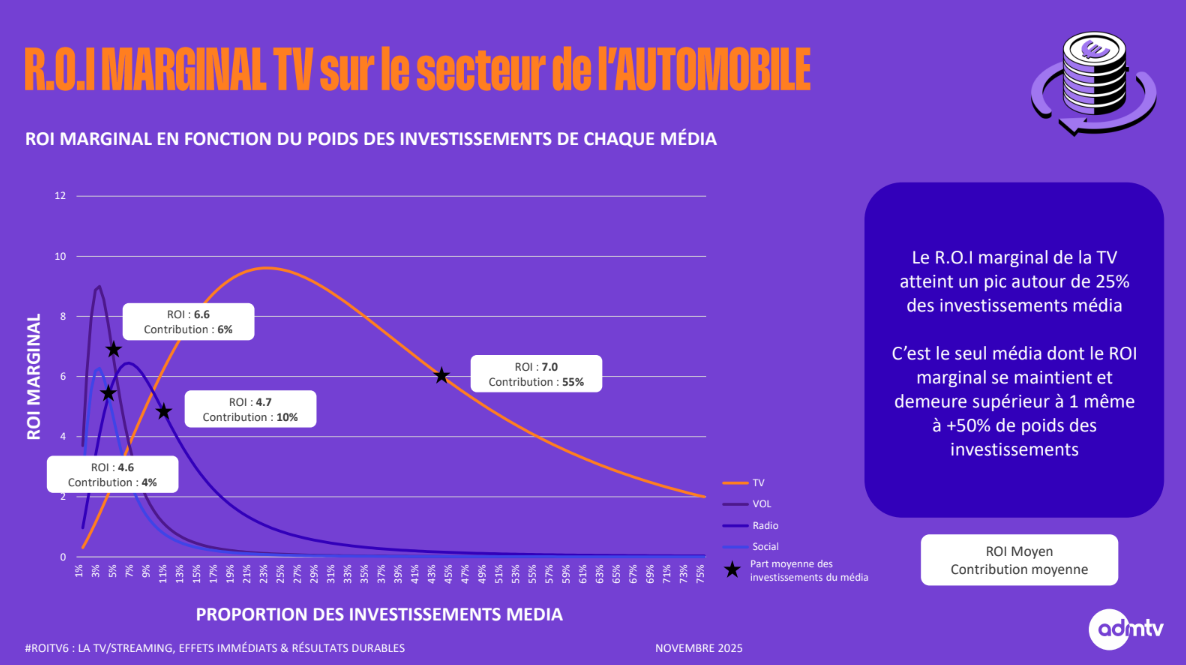

Another study highlights that online video channels can saturate more quickly than classic television, which remains a primary driver of sales for many advertisers. A new KPI—marginal ROI—suggests that, while linear TV allows large investments with a positive ROI, escalating spend in VoL or social media can erode marginal returns unless campaigns are finely optimized.

Looking ahead to 2026, industry surveys show a strong intent among marketers to boost spending on connected TV and streaming, with many planning to increase VoL and CTV investments more than linear TV. the challenge will be balancing reach with cost, while ensuring campaigns do not saturate inventories or inflate prices.

Analysts emphasize that the more advertisers diversify into digital channels, the greater the potential for improved overall performance. Digital inventories must demonstrate clear effectiveness relative to established levers, and measurement will be a defining factor in 2026 for retail advertisers juggling tight budgets.

Summary Table: Channel Landscape and Costs

| Channel | Typical CPM Range | Reach Characteristics | Notes |

|---|---|---|---|

| Linear TV | €4–€5 | Broad national reach across all ages | Strong for branding; lower costs per impression but limited targeting |

| Basic VoD (bvod) | €10–€20 | Wider digital audience, more targeted than linear | Good balance of scale and targeting |

| Premium SVoD | €20–€30 | Premium inventory; selective audiences | Higher engagement but pricier per impression |

| YouTube and Social Video | Varies; often higher than TV | Young and urban cohorts; high fragmentation | Strong for consideration and conversion with precise targeting |

What this Means for Advertisers

If Lidl’s pivot proves triumphant, it could become a benchmark for other large retailers navigating a shifting media landscape. The key will be managing pacing across digital channels to avoid inventory saturation and keeping marginal ROI in check as digital prices evolve.

As 2026 unfolds, marketers will watch whether digital channels can sustain incremental gains in consideration and conversion, while maintaining the branding strength historically delivered by linear TV.

bottom line: the mix between VoL, CTV, SVoD and social video will likely grow in importance as advertisers seek measurable impact at scale. Yet the enduring appeal of linear TV for broad-brand campaigns remains a meaningful part of the equation for many retailers.

Industry Pulse: 2026 Outlook

Industry surveys indicate three trends shaping decisions in the coming year: a surge in CTV investments, continued growth in social and video platforms, and a careful eye on ROI and pricing dynamics across all formats. The question for Lidl and its peers is how to balance reach, frequency and cost in a landscape where audiences move quickly between screens.

Two questions for readers: Is digital video ready to replace linear TV for mass-brand campaigns at scale? Which digital formats do you trust most for delivering consistent ROI in a retailer’s marketing mix?

Share your thoughts in the comments below and join the conversation.

Why Lidl Shifted from Linear TV to CTV

- Audience fragmentation – By 2025, nielsen data showed that only 38 % of German households still watched traditional broadcast TV during prime‑time, while CTV penetration reached 62 %.

- Cost efficiency – Programmatic CTV inventory delivered an average CPM of €7.20 versus €15.40 for linear slots, according to the IAB Europe 2025 Video Benchmark.

- Granular targeting – Lidl’s partnership with The Trade Desk enabled real‑time audience segmentation based on purchase intent, household income, and geo‑fencing of store locations.

- Performance‑first mindset – the retailer’s Q3 2025 media report highlighted a 28 % lift in ROAS when shifting €50 M from linear TV to CTV and social video.

Key Challenges in the Transition

- Creative Adaptation

- Linear TV spots often run 30 seconds; CTV and social platforms favor 6‑15 second “snackable” formats.

- Lidl invested in a modular creative library, allowing the same visual assets to be repurposed across YouTube TV, Roku, and TikTok.

- Measurement Alignment

- Traditional TV metrics (GRP, rating points) do not map directly to CTV view‑through rates (VTR) or completion rates (CR).

- The retailer adopted a unified attribution model that combines MRC‑standardised cross‑platform lift studies with in‑store sales uplift.

- Supply‑Side Integration

- Early CTV campaigns faced limited inventory on premium publishers, leading to “inventory scarcity” alerts.

- Lidl negotiated private‑marketplace (PMP) deals with Amazon Freevee and Samsung TV Plus, securing 12 % of the premium ad load.

- Brand Safety & Fraud

- Programmatic environments introduced concerns over ad fraud.

- A third‑party verification layer from DoubleVerify reduced fraudulent impressions from 1.8 % to 0.3 % across all CTV campaigns.

Measuring ROI: Metrics That Matter

| Metric | Definition | Why It counts for Lidl |

|---|---|---|

| eCPC (effective Cost‑per‑Click) | Total spend ÷ total clicks on interactive CTV overlays | Directly ties video exposure to online traffic for weekly specials. |

| Incremental Sales Lift | Difference between test and control stores during campaign window | Shows true offline impact of video exposure. |

| View‑Through Rate (VTR) | Completed views ÷ impressions served | Indicates audience engagement beyond the first 2 seconds. |

| Cost‑per‑Acquisition (CPA) | Spend ÷ number of new loyalty‑card sign‑ups attributed to video | Aligns with Lidl’s goal of expanding the “Lidl Plus” program. |

| Cross‑Channel Attribution Share | % of conversion credit allocated to CTV vs. social video | Allows budget reallocation to the highest‑performing channel. |

Real‑world insight: A 2025 lidl “Seasonal Freshness” CTV rollout on Smart TV apps recorded a VTR of 42 % (industry average 28 %) and generated a 3.7 % uplift in basket size for participating stores.

industry Impact: What Competitors Are Watching

- Discount retailers (Aldi, Netto) have accelerated pilot CTV buys, citing Lidl’s 2025 “ROAS parity” case study in their strategic planning decks.

- Media agencies (MediaCom, Carat) now include “CTV‑first” recommendations in 2026 retail briefs, shifting agency fees toward performance‑based pricing.

- Ad tech vendors report a 22 % YoY increase in demand for CTV‑specific data partnerships, driven by the need for first‑party grocery shopper IDs.

Practical Tips for Brands Replicating Lidl’s Strategy

- start with a hybrid test – Allocate 15 % of total TV budget to CTV, keep 85 % linear, and compare lift after 8 weeks.

- Build a modular asset pool – Design 5‑second,10‑second,and 30‑second cuts of the same creative; tag each with dynamic product overlays for automatic localization.

- Leverage first‑party data – Sync loyalty‑card IDs with CTV ID graphs to enable precise geo‑targeting of stores within a 15‑km radius.

- Integrate offline sales data – use a matched‑panel approach (e.g., Nielsen Homescan) to attribute in‑store purchases to specific CTV impressions.

- Set up a real‑time dashboard – Combine MRC‑standardised viewability, VTR, and OOH foot‑traffic metrics to monitor weekly performance and pivot spend.

Case Study: Lidl’s “Fresh Deals” CTV Campaign (Q2 2025)

- Objective: Boost sales of the new organic range across 350 German stores.

- Budget: €12 M, allocated 70 % to CTV (Smart TV apps) and 30 % to TikTok‑in‑feed video.

- Creative: 6‑second autoplay clips featuring a QR code that linked to a “Shop‑Now” landing page with store‑specific inventory.

- Execution:

- Programmatic buying via The Trade Desk’s CTV marketplace.

- Private‑marketplace deals with Samsung TV Plus, guaranteeing 12 % of premium inventory.

- Dynamic product insertion using adobe Advertising Cloud for real‑time price updates.

- Results:

- VTR: 48 % (industry benchmark 31 %).

- QR‑code scan rate: 2.9 % of completed views, generating 1.1 M site visits.

- Incremental sales lift: 4.2 % across test stores, translating to €4.8 M additional revenue.

- ROAS: 5.6 ×, surpassing the linear TV benchmark of 3.9 ×.

Future Outlook for Retail Advertising

- Programmatic CTV will dominate – Forecasts from eMarketer (now Insighter) predict that by 2028, CTV will account for 45 % of total retail video spend in Europe.

- Social video integration – Platforms such as Instagram Reels and YouTube Shorts are being bundled into unified CTV‑social buying desks, allowing a single KPI (e.g., “cross‑platform VTR”) to drive optimisations.

- AI‑driven creative rotation – Machine‑learning engines will automatically select the best‑performing creative variant for each household segment, reducing creative fatigue and improving lift.

- Zero‑party data rise – Brands will ask consumers to voluntarily share shopping preferences via in‑app surveys, enriching CTV audience models without compromising privacy.

Takeaway for marketers: The Lidl playbook demonstrates that a data‑first,performance‑oriented shift from linear TV to CTV and social video can deliver measurable ROI while future‑proofing the media mix against continued audience migration.