“`html

Defense Industry Stocks: Key Players Positioned for Growth as nato Increases Spending

The Defense Industry is bracing for a potential boom as NATO member states commit to increasing their defense budgets. This move follows agreements made at The Hague summit, where a target of 5% of GDP was set for defense spending. With geopolitical tensions rising globally, understanding which companies stand to benefit moast is crucial for investors.

Nato’s Defense Spending Boost: A Game Changer for The industry

At The Hague summit, NATO members agreed to ramp up defense spending to 5% of GDP by 2035. The breakdown allocates 3.5% specifically to defense,while the remaining 1.5% will support infrastructure development, research, and innovation. While most nations are on board, Spain has voiced reservations, advocating for a more moderate 2% target.

Former President Donald Trump weighed in, labeling those hesitant to meet the goals as “stowaways,” highlighting the urgency and differing opinions surrounding this financial commitment. Can all members meet this enterprising goal within the next decade? Time will tell.

Top Defense Stocks With Growth Potential

The increased defense spending will provide companies within the defense industry stocks sector with more resources and opportunities to expand. Here are three companies poised to capitalize on this trend.

V2X Inc: A Leader in Radar Systems and Infrastructure Defense

V2X inc (NYSE: V2X) provides diverse services related to radar systems, critical infrastructure defense, and multi-role aircraft. Recent analysis indicates the company has over 20% growth potential.

V2X Inc has shown consistent positive net income over the last three quarters, a significant enhancement. The latest earnings per share reached $0.98, surpassing consensus estimates by 5.1%. A breakout above $52 per share could signal a strong buying opportunity.

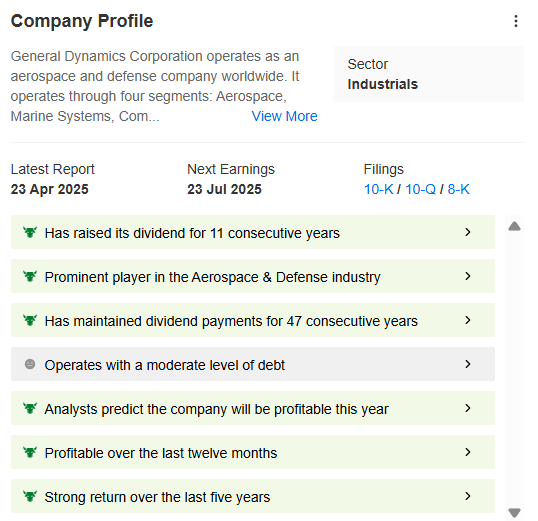

General Dynamics Corporation: A Dividend Investor’s Dream

General Dynamics Corporation (NYSE: GD) specializes in manufacturing military sea and land systems. The company’s stock shows upside growth potential exceeding 12%.

With a 47-year history of consistent dividend payouts and growth, General Dynamics is an attractive option for dividend-focused investors. Net income has remained stable as 2019, with projected increases in 2024 and 2025.

Lockheed Martin Corporation: Waiting for The Technical Signal

Lockheed Martin Corporation (NYSE: LMT). Lockheed Martin’s key strengths include stable net profits and near 14% upside potential.

Currently,the technical chart shows consolidation between $420 and $490 per share since the start of the year. A sustained pressure on the upper boundary may form an ascending triangle pattern, which is a bullish indicator.Should a breakout occur, a target price slightly above $520 per share is anticipated.

Defense Industry Stocks Performance Table

| Company Name | Symbol | Growth Potential | Key Focus | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stock Ticker | Company | Key products/Services | Why to Watch |

|---|---|---|---|

| LMT | Lockheed Martin | Aircraft, Missiles, Space Systems, Cybersecurity | Significant contracts with NATO member nations, strong R&D portfolio and growing position in cyber defense. |

| RTX | RTX Corporation (formerly Raytheon Technologies) | Missiles, Radar Systems, Aerospace & Defense Electronics | A major supplier to NATO countries due to an increased focus on advanced missile defense. |

| BA | The Boeing Company | Aircraft, Defense, Space, and Security | Strong presence in defense aviation, anticipating continued growth in military aircraft production to meet increased needs.boeing’s defense and space segment is heavily involved with multiple NATO countries. |

Lockheed Martin (LMT): A Leader in Defense Technology

Lockheed Martin is a leading global security and aerospace company engaged in the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services. its strong presence in several NATO countries makes it a prime beneficiary of increased defense budgets. Consider investments by LMT towards research and the development of new innovative equipment to meet the evolving security needs of NATO countries.

RTX Corporation (RTX): Focus on Missile Systems and Advanced Technologies.

RTX Corporation,a world leader in aerospace and defense,operates through four key segments: Collins aerospace,Pratt & Whitney,Raytheon Intelligence & Space,and Raytheon Missiles & Defense.RTX offers a range of products and services tailored to NATO military requirements. Due to the increase focus on advanced missile defense systems in Europe, this company is expected to do well with NATO contracts.

The Boeing Company (BA): Strong Market Share in Aerospace and defense

The Boeing Company, a leading global aerospace company, develops, manufactures, and services commercial airplanes, defense products, and space systems. Boeing Defense, Space & Security (BDS) is a primary supplier to NATO countries, providing everything from fighter jets to military helicopters. boeing’s broad range of capabilities and ongoing contracts with NATO members position it well for growth. With the world’s increasing instability as well as Russia’s invasion of Ukraine, Boeing has a solid long term position in the market.

Investing in Defense Stocks: Practical Tips

investing in the defense sector requires due diligence and a strategic approach.

- stay Informed: Subscribe to financial news, and follow industry reports to stay ahead of market shifts and updates from NATO officials.

- Diversify: Create a diversified portfolio including a variety of defense stocks.

- Consider Long-Term: The defense industry is generally considered a good long term investment.

- Understand Risks: Be aware of geopolitical risks and any shifts in defense policies.