According to the report of the Vietnam Bond Market Association (VBMA) compiled from HNX and SSC, as of the announcement date of January 31, 2023, there has been no corporate bond issuance in 2023.

While the same period in 2022, there were 7 corporate bond issuances to the public and 16 private corporate bond issuances with a total issuance value of up to VND 25,923 billion.

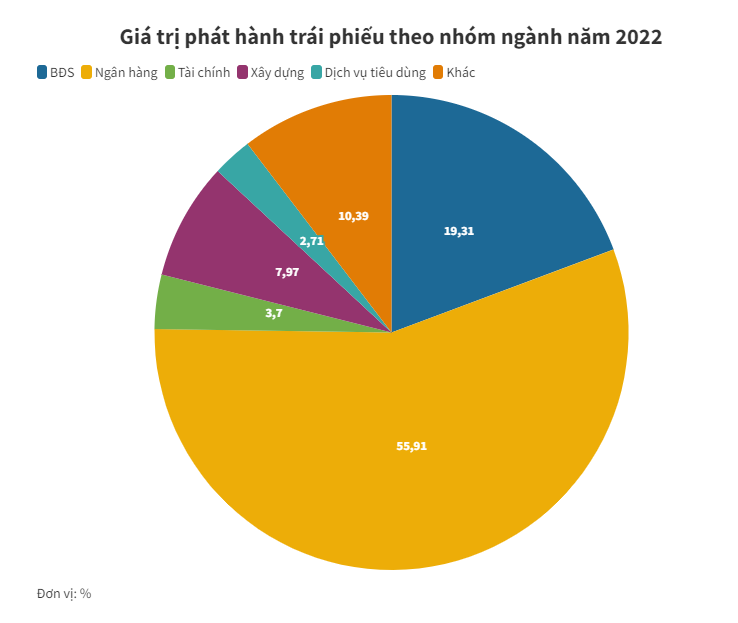

The corporate bond issuances announced in January 2023 were mostly issued in December 2022. In these issuances, the banking group continued to hold the majority with 3,269.5 billion dong of private bond issuance and 10,637.8 billion dong issued to the public. The remaining 3 issuances came from Securities and Real Estate companies, accounting for only regarding 3%.

In January 2023, businesses bought back 8,068 billion dong of bonds, up 56% over the same period in 2022. According to VBMA’s statistics, in 2023, there will be regarding 285,178 billion dong of bonds coming to maturity. maturity term.

Regarding the upcoming issuance plan, there are currently only 2 companies that are expected to issue bonds in the near future, namely Masan Group JSC with a plan to offer to the public VND 1,500 billion of non-convertible bonds, without warrants. and unsecured in January and February 2023, 60-month term with a fixed interest rate of 9.5% in the first 2 interest periods and a floating interest rate of Reference Rate + 3.975%/year in the remaining interest periods.

In addition, Bac A Commercial Joint Stock Bank announced a plan to offer the second public offering of more than VND2,564 billion in January and February 2023, with a term of 7 and 8 years with a floating interest rate of Interest, respectively. reference rate (LSTC) + 1.1%/year, LSTC + 1.3%/year and LSTC + 1.5%/year.

In January 2023, the State Treasury held 8 auction sessions of Government bonds with the total calling value (VAT) of 34,000 billion VND, the winning rate was 96.6%.

The State Treasury called for tenders for the terms of 5 years, 7 years, 10 years and 15 years. However, only the 10-year and 15-year bonds won the bid, at VND 16,332 billion and VND 16,500 billion, respectively. The average winning interest rate of the 10-year tenor decreased in January to 4.45% (down 0.3% compared to December 2022), the 15-year term also decreased to 4.65% (down 0. 22% compared to December 2022).

Government bond issuance value in January 2023 corresponds to 8.2% of the 2023 plan (VND 400,000 billion) and 30.4% of the plan for the first quarter of 2023 (VND 108,000 billion). In which, the value of 10-year bond issuance reached 36.3% of the plan in the first quarter of 2023 and the value of 15-year bond issuance reached 36.7%.

In addition, during the month, no government-guaranteed bonds were issued.