The Minister of Economy and Finance, Nadia Fettah Alaoui, who leads the commission responsible for pension reform, presented Wednesday, October 5 her vision of this project in the making. Here are the details.

Develop a common and complementary vision for the implementation of a two-pronged public and private retirement system within a reasonable timeframe, while taking into account the related issues and constraints. This is the objective set by the commission devoted to pension reform, led by the Minister of Economy and Finance, Nadia Fettah Alaoui.

This commission held a meeting last Wednesday at the headquarters of the Ministry of Economy and Finance, with the various stakeholders. These are the representatives of the most representative trade unions – the Moroccan Labor Union (UMT), the General Union of Moroccan Workers (UGTM) and the Democratic Confederation of Labor (CDT) -, the representatives of the General of Moroccan Enterprises (CGEM) and the Moroccan Confederation of Agriculture and Rural Development (COMADER), as well as the respective directors of the National Social Security Fund (CNSS), the Collective Retirement Allowance Scheme ( RCAR) and the Moroccan Pension Fund (CMR).

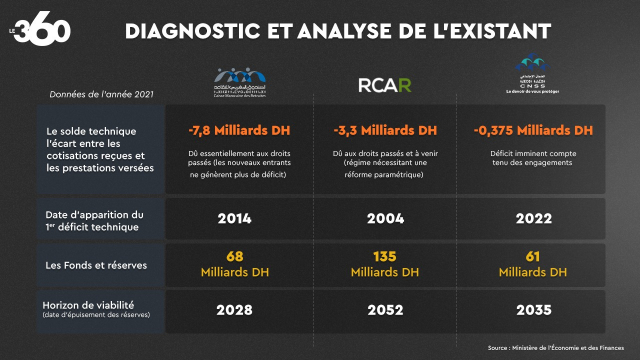

During this meeting, Nadia Fettah Alaoui made a diagnosis of the problems facing pension funds. These include in particular the heterogeneity and financial difficulties of these schemes.

© : Le360

To solve these problems, the minister was asked by the head of government to lead a technical study to define in detail the elements necessary for the implementation of the reform of the two poles. The results of this study were presented at the meeting.

The objectives of a long-awaited reform

At the end of this study, the department headed by Nadia Fettah Alaoui set the objectives of the reform while complying with the recommendations and guiding principles enacted in 2013 by the National Commission.

© : Le360

The first is to ensure the plan’s viability over the very long term. This first objective is necessary in view of the technical deficit generated by the three pension management funds (7.8 billion dirhams for the CMR, 3.3 billion dirhams for the RCAR and 375 million dirhams for the CNSS) and their viability horizons (2028 for CMR, 2052 for RCAR and 2035 for CNSS)

Preparing for convergence, in the long term, towards a single basic scheme is the second objective set by the ministry. To achieve this, it is essential to harmonize the operating parameters of the funds, in particular the contribution and replacement rates as well as the pension ceilings.

Other objectives have been assigned to this major reform, in particular the improvement of equity and the safeguarding of acquired rights, the maintenance of reserves given their importance for the financing of the economy, the limitation of the impact of the reform on the state budget and finally the safeguard of the competitiveness of the Moroccan company, we learn from the document.

A first proposed model

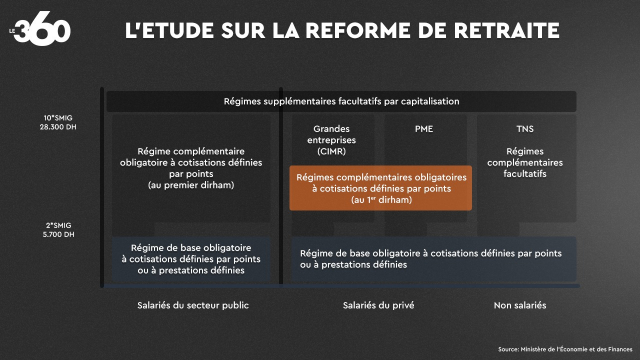

The Minister of Economy and Finance also presented a first model proposed for the pension system. The latter must introduce an identical ceiling for the basic scheme of 2 SMIGs for the public and private sectors to facilitate eventual convergence towards a unified basic scheme. It will also be a question of freezing the rights acquired in the current schemes and of revaluing pensions over a period of 10 years.

The new system should also reduce the replacement rate of high earners in public sector schemes. This is set at 60% by the CMR and 57% for the RCAR. At the level of the private sector, managed by the CNSS, this rate is 58% for salaries below 2 SMIG and 11% for salaries above 10 SMIG.

It is also recommended to increase the retirement age to 65, including for the private sector, and to raise contribution rates, in particular by the CNSS.

An ad hoc committee to steer the reform

The conduct of this reform project will be ensured by an ad hoc committee, in accordance with the agreement resulting from the social dialogue. This would be chaired by the Minister for the Economy and Finance and made up of representatives of the State (the ministerial departments concerned, the Insurance and Social Welfare Control Agency and the pension funds), the representatives employees (the most representative trade unions), and employer representatives (CGEM and COMADER).

According to Nadia Fettah Alaoui’s presentation, this commission will be organized into two sub-committees: the first for the public sector and the second for the private sector. They will be primarily responsible for analyzing the current situation of pension schemes and the diagnosis which concerns them, examining the variants of reforms proposed by the study, agreeing on the guiding principles which should guide the reform of pensions and, on On this basis, propose to the next social dialogue session the target reform scenario and the roadmap for its implementation.

The work schedule already set

The ad hoc committee has already set its schedule of work which should lead to the start of the implementation of the roadmap from May 2023. Thus, it will proceed during this month of October to update the diagnosis and the status of pension schemes.

The results of the study will be presented and discussed between November and December of the same year. The commission will be required, between January and March 2023, to present the strategic orientations, the target plan and the roadmap for the pension reform. The following April, the selected reform scenarios must be presented before the validation of the roadmap and the start of its implementation.