Navigating Market Turbulence: Short-Term Investment Grade Corporate Bonds Offer stability

In an era marked by economic uncertainties, investment grade corporate bonds, particularly those with shorter terms, are gaining prominence as a strategic asset class. These bonds provide a compelling balance of income potential, controlled interest rate and credit risk, and attractive risk-adjusted returns. By strategically diversifying into instruments beyond standard indexes, such as floating rate notes (FRNs) and asset-backed securities (ABS), investors can further enhance their portfolios.

Defensive Strategies for Volatile Markets

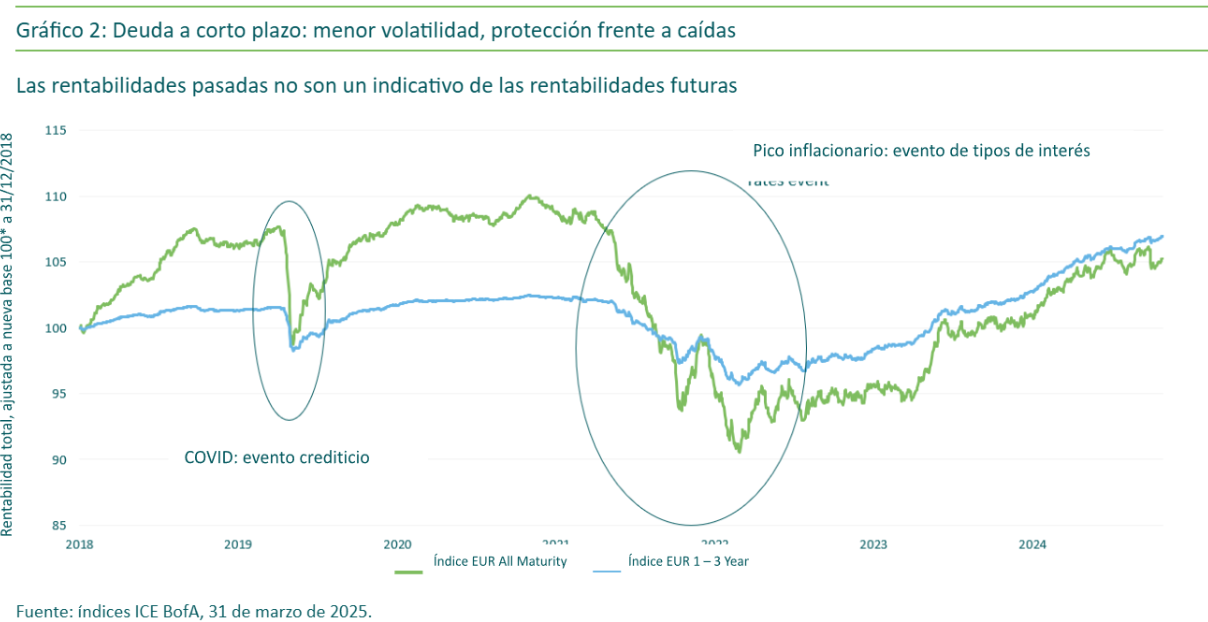

Global markets have recently faced turbulence stemming from various factors, underscoring the importance of duration in fixed income investments.The initial sections of the yield curve have demonstrated more resilience than longer-dated maturities, highlighting an opportunity for investors to capitalize on short-term assets.

In fixed income, the initial sections of the type curve have shown more resilience than those of greatest expiration. With regard to volatility, markets have received multiple reminders that the entire duration spectrum.

Historical performance of Short-Term Investment Grade Credit vs. All Maturity index.Past performance is not indicative of future results.

Short-term investment grade corporate bonds offer profitability similar to traditional corporate debt but with reduced volatility. This is particularly appealing for investors who are hesitant to commit to longer durations, providing a strategic advantage in uncertain economic climates.

While accurately forecasting the peaks and troughs of monetary policy cycles can be profitable, it’s a difficult endeavor. Thus, combining a structural allocation to short-term investment grade debt with a more traditional credit strategy seems a prudent approach.

The Merits of Active Management

The short-term debt market, while attractive, is not ideally suited for passive indexing.Mimicking an index can expose investors to concentration risk (over-reliance on specific sectors or countries) and default risk (exposure to low-quality credit or unsanitized balance sheets).Active management, conversely, allows for a more nuanced approach.

the inefficiencies inherent in fixed income markets create opportunities for investors who adopt active strategies. Experienced credit analysts can leverage these inefficiencies to generate surplus profitability over time, enhancing overall portfolio performance.

Advantages of Investing in Investment Grade Corporate bonds

Investing in investment grade corporate bonds offers several key benefits:

- Active Global Credit Management: Strategies are not confined to Euro-denominated credit or benchmarked solely against Euro-based indexes. This versatility allows fund managers to pursue relative value opportunities across currencies and regions, accessing companies that may not issue debt in Euros.

- exposure to Floating Rates: Floating rate notes (FRNs) provide credit exposure without the burden of interest rate risk. these instruments, which typically reset their coupons quarterly, have near-zero duration, benefiting from increases in the underlying risk-free rate and offering additional carry in rising rate environments.

- Asset-Backed Securities (ABS): expertise in ABS allows for the inclusion of high-quality, thoroughly analyzed instruments that offer yield advantages over traditional AA-rated credit, providing an additional income stream for the portfolio.

Robust analytical capabilities are crucial. The fundamental question remains: “is the risk adequately compensated?” Credit analysts evaluate corporate bond fundamentals, and the management team assesses whether the quoted price is attractive relative to its intrinsic value.

Identifying mispriced bonds is a cornerstone of a value-based approach, driving long-term surplus profitability.

Did You Know?

According to a recent report by Bloomberg, short-term corporate bonds have shown remarkable resilience, outperforming their longer-dated counterparts by nearly 2% in the first half of 2024, amidst rising rate concerns.

Pro Tip

Consider re-balancing yoru portfolio quarterly to maintain your desired asset allocation. This ensures that you continue to benefit from the stability offered by short-term investment grade corporate bonds.

Comparing Fixed Income Options

Here’s a comparison of different fixed income investment options:

| Asset Class | Typical Maturity | Risk Level | Potential Return |

|---|---|---|---|

| Short-Term Investment Grade Corporate Bonds | 1-5 Years | Low to Moderate | Moderate |

| Long-Term Government Bonds | 10-30 Years | Low | Moderate |

| High-Yield Corporate Bonds | 5-10 Years | High | High |

| Floating Rate Notes (FRNs) | 1-5 Years | Moderate | Moderate |

Evergreen Insights on short-term Investment Grade Corporate Bonds

Short-term investment grade corporate bonds consistently provide a stabilizing influence in diverse economic conditions. Their lower sensitivity to interest rate fluctuations, combined with the backing of established corporations, positions them as a cornerstone for risk-averse investors.

the strategic inclusion of FRNs and ABS further diversifies income streams and mitigates risks tied to rising interest rates. Active portfolio management, with its focus on identifying undervalued assets, remains vital for optimizing returns in this asset class.

Frequently Asked Questions

- What are the typical maturities for short-term investment grade corporate bonds?

These bonds typically mature within one to five years, offering a shorter investment horizon compared to long-term bonds.

- How do floating rate notes (FRNs) protect against rising interest rates?

FRNs have interest rates that adjust periodically based on a benchmark, allowing them to maintain their value as interest rates increase.

- Are asset-backed securities (ABS) riskier than traditional corporate bonds?

while ABS can offer higher yields, they also carry more complexity and may be subject to specific risks related to the underlying assets.

- What role does active management play in optimizing returns from investment grade corporate bonds?

Active managers can identify undervalued bonds, manage risk exposure, and adjust portfolios to changing market conditions, enhancing potential returns.

- What are the primary risks associated with investing in investment grade corporate bonds?

Key risks include credit risk (issuer default), interest rate risk (bond value decline), and liquidity risk (difficulty selling bonds quickly).

Disclaimer: Investment involves risk, including the potential loss of principal. Past performance is no guarantee of future results.Consult with a financial advisor before making any investment decisions.

What are your thoughts on the role of short-term investment grade corporate bonds in today’s market? Share your comments below.