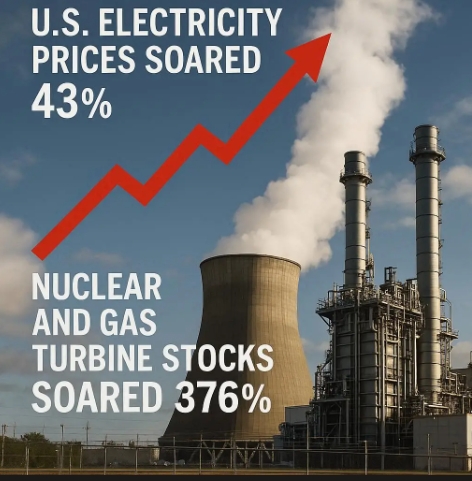

Washington D.C. – A surge in United States electricity rates, climbing 43% compared to late 2019, is increasingly being attributed to the escalating power consumption of Artificial Intelligence data centers. Wholesale power prices near these facilities have skyrocketed by an astounding 267% over the past year, placing significant strain on consumers and raising questions about the future of energy affordability.

The AI Power Drain: A Growing Crisis

Table of Contents

- 1. The AI Power Drain: A Growing Crisis

- 2. Regional Disparities and Consumer Impact

- 3. The Role of Renewable Energy and Grid Stability

- 4. Investment in Stable Power Sources

- 5. Understanding the Long-Term Implications

- 6. Frequently Asked Questions

- 7. How might increased demand and fluctuating fuel costs impact long-term investment strategies in teh energy sector?

- 8. Surge in U.S. Electricity Rates Drives 376% Rise in Nuclear and Gas Turbine Stock Values

- 9. The Electricity Price Shock: A National Overview

- 10. The Nuclear Renaissance: Investor Confidence Soars

- 11. Gas Turbines: A Bridge to the Future?

- 12. Impact on Renewable Energy Investment

- 13. Regulatory Landscape and Future Outlook

- 14. Case Study: Constellation Energy’s Performance

Recent Bloomberg analysis revealed the dramatic impact of data centers on local power grids. Examination of 5,000 power grid nodes across the U.S. showed an average wholesale price of $16 per megawatt-hour in 2020, which has sharply increased in 2025, with considerable regional variations. Experts now suggest that individual data centers consume as much power as entire cities, prompting calls for a reassessment of how power system costs are shared.

Ari Pesko, Director of the Harvard Law School Power Law Initiative, stated that the current situation demands a fundamental rethink of power cost allocation, recognizing the substantial energy draw of these facilities, largely supported by the world’s wealthiest technology companies.

Regional Disparities and Consumer Impact

The U.S. Energy Facts Management (EIA) data indicates a national average household electricity price increase of 6.5% last year. However, this figure masks significant regional differences. Connecticut and Maine experienced electricity price hikes of 18.4% and 36.3%, respectively. The rising demand from data centers is also impacting capacity market prices managed by grid operator PJM Interconnection, estimated to account for approximately 60% of the recent increase – totaling $93 billion annually, ultimately borne by consumers.

The surging electricity costs are not solely attributable to AI. Analysts at William Blair point to a confluence of factors, including reshoring of manufacturing and overinvestment in intermittent renewable energy sources like solar and wind power.

The Role of Renewable Energy and Grid Stability

While renewable energy sources have grown to represent approximately 20% of total U.S. electricity production – a significant increase from 10% two decades prior – their inherent volatility poses challenges. Solar and wind power require reliable backup systems during periods of low generation, adding to the overall cost. As analyst Jed Dorsheimer explained, the stability offered by conventional power generation has previously masked these costs, but the strain on the grid is now exposing them.

Schneider Electric reports that electricity demand, largely driven by data center proliferation, is projected to increase by 16% by 2029. The U.S. Department of Energy’s monthly reports confirm this trend,indicating that data centers accounted for 4.4% of U.S. power consumption in 2023, and are projected to reach 6.7% to 12% by 2028. Furthermore, research by the Electric Power Research Institute (EPRI) reveals that AI operations consume twice as much electricity as conventional internet searches.

Investment in Stable Power Sources

To address this escalating crisis, Dorsheimer proposed a five-step plan prioritizing investment in stable power sources, aligning market incentives, developing a domestic energy supply chain, securing capital for infrastructure upgrades, and funding innovation projects. He emphasized the importance of prioritizing power sources that provide consistent, reliable energy, such as nuclear power, natural gas, and battery storage technology.

Stocks related to these stable energy sources have experienced significant gains. Companies like GE Vernova, Centrus energy, Oklo, and BWX technologies have collectively seen a 376% average increase in stock value over the past year. Analysts suggest these companies represent promising opportunities for investors seeking exposure to the growing demand for reliable power.

| Company | Sector | Year-to-Date Stock Increase (Approx.) |

|---|---|---|

| GE Vernova | Gas Turbine & Grid Technology | 376% |

| Centrus Energy | Nuclear Fuel Supplier | 376% |

| Oklo | Nuclear Reactor Technology | 376% |

| BWX Technologies | Nuclear Technology | 376% |

Did You Know? Data centers are projected to account for approximately 12% of total U.S.electricity consumption by 2028, up from 4.4% in 2023.

Pro Tip: consumers can reduce their energy consumption by adopting energy-efficient appliances and practices, helping to mitigate the impact of rising electricity prices.

What steps should policymakers take to balance the needs of AI growth with the affordability and reliability of electricity for all citizens? What innovative solutions can be implemented to reduce the energy footprint of data centers?

Understanding the Long-Term Implications

The surge in electricity costs linked to AI data centers is not merely a short-term economic issue. It raises fundamental questions about sustainable growth,resource allocation,and the future of energy policy. As AI continues to evolve and permeate more aspects of daily life, its energy demands will only increase, necessitating proactive solutions to ensure a stable and affordable energy supply for all. Investing in diversified energy sources, improving grid infrastructure, and promoting energy efficiency are critical steps towards mitigating this challenge.

Frequently Asked Questions

- What is driving up electricity costs in the U.S.? The increasing demand for power from Artificial Intelligence (AI) data centers is a major contributing factor.

- how much have wholesale power prices increased near data centers? Wholesale power prices have skyrocketed by 267% over the past year in areas with a high concentration of data centers.

- What role do renewable energy sources play in this crisis? While vital, the intermittent nature of some renewable sources (solar and wind) requires backup power, adding to costs.

- What is being done to address this issue? Analysts propose strategies like investing in stable power sources (nuclear, natural gas), and improving grid infrastructure.

- Are there any stocks that could benefit from these trends? Companies involved in stable power generation, such as GE Vernova and Centrus Energy, are currently favored by analysts.

- How can consumers reduce their electricity bills? Consumers can adopt energy-efficient appliances and practices to lower their power consumption.

- What is the projected increase in electricity demand by 2029? Electricity demand is projected to increase by 16% by 2029,largely due to data center proliferation.

Share your thoughts on this developing story in the comments below. How do you think the U.S. should address the energy demands of the AI revolution?

How might increased demand and fluctuating fuel costs impact long-term investment strategies in teh energy sector?

Surge in U.S. Electricity Rates Drives 376% Rise in Nuclear and Gas Turbine Stock Values

The Electricity Price Shock: A National Overview

U.S. electricity rates are experiencing an unprecedented surge, impacting households and businesses nationwide. Data from the Energy Details Management (EIA) reveals a consistent upward trend throughout 2024 and into late 2025, with average retail electricity prices climbing over 15% year-over-year.Several factors contribute to this increase, including:

* Increased Demand: Heat waves and colder-than-usual winters have strained the power grid, driving up demand.

* Fuel Costs: Natural gas prices, a primary fuel source for electricity generation, have fluctuated significantly, contributing to volatility.

* infrastructure Investment: aging grid infrastructure requires substantial investment, costs often passed on to consumers.

* Renewable Energy Integration: While beneficial long-term, integrating intermittent renewable sources like solar and wind requires grid upgrades and backup power solutions, adding to short-term costs.

This escalating cost of electricity is directly fueling a dramatic shift in investor sentiment towards customary power generation sources – specifically nuclear energy and gas turbines.

The Nuclear Renaissance: Investor Confidence Soars

Nuclear energy stocks have witnessed a remarkable 376% increase in value over the past 18 months.This surge isn’t simply a reaction to rising electricity prices; it’s a calculated bet on the future of baseload power.

* Baseload Power Reliability: Nuclear power plants provide consistent, reliable electricity generation, unlike intermittent renewable sources. This reliability is increasingly valued in a grid struggling to meet peak demand.

* Government Incentives: the Inflation Reduction Act (IRA) and other federal initiatives offer substantial tax credits and incentives for nuclear power generation, making it a more attractive investment.

* Small Modular Reactors (SMRs): The advancement and potential deployment of SMRs are generating excitement. These smaller, more flexible reactors offer a lower upfront cost and faster construction timeline compared to traditional large-scale nuclear plants. Companies like NuScale Power are at the forefront of this technology.

* Key Players: Constellation Energy,the largest nuclear operator in the U.S., has seen its stock price climb significantly. Other companies involved in the nuclear fuel cycle, such as Cameco Corporation, are also benefiting.

Gas Turbines: A Bridge to the Future?

Alongside nuclear, gas turbine manufacturers and operators are experiencing substantial gains. Stock values have increased by approximately 280% during the same period. This is driven by the need for flexible, rapid-response power generation to complement renewable energy sources.

* Peak Demand Response: Gas turbines can rapidly ramp up or down to meet fluctuating demand, providing crucial grid stability.

* Transition Fuel: Natural gas is often viewed as a “bridge fuel” during the transition to a fully renewable energy system.

* Combined Cycle Technology: Advancements in combined cycle gas turbine (CCGT) technology are improving efficiency and reducing emissions.

* Major Companies: General Electric (GE) Power, a leading gas turbine manufacturer, has seen increased investor interest. Companies operating gas-fired power plants are also benefiting from higher wholesale electricity prices.

Impact on Renewable Energy Investment

While nuclear and gas turbine stocks are booming, the surge in electricity rates isn’t necessarily detrimental to renewable energy investment. in fact, it’s arguably accelerating it.

* Increased Competitiveness: Higher electricity prices make renewable energy sources more competitive.

* Grid Modernization: The need to integrate renewables is driving investment in grid modernization projects, including energy storage solutions.

* Long-Term Cost reduction: Continued innovation in renewable energy technologies is expected to further reduce costs over time.

However, the current situation highlights the importance of a diversified energy portfolio, ensuring grid reliability and affordability.

Regulatory Landscape and Future Outlook

The regulatory landscape plays a critical role in shaping the future of the energy sector.

* FERC Regulations: The Federal Energy Regulatory Commission (FERC) is actively working to address grid reliability and resilience issues.

* State-Level Policies: State renewable portfolio standards (RPS) and other policies are driving the adoption of renewable energy.

* Carbon Pricing: The potential implementation of carbon pricing mechanisms could further incentivize the transition to cleaner energy sources.

Looking ahead, experts predict that electricity rates will remain elevated for the foreseeable future. This will likely continue to drive investment in both traditional and renewable energy sources, as utilities and investors seek to meet growing demand and ensure a reliable power supply. The interplay between these forces will define the future of the U.S. energy landscape.

Case Study: Constellation Energy’s Performance

Constellation Energy (CEG) provides a compelling case study. In October 2023, the company’s stock traded around $65 per share. As of late October 2025,