Nvidia’s Stumble and the Looming AI Chip Competition

Over $410 billion wiped from its market cap in under a month. That’s the stark reality facing Nvidia as its stock dipped 2.7% on Friday, a descent sharply contrasted by Broadcom’s impressive 9.4% surge fueled by its partnership with OpenAI. This isn’t just a market correction; it’s a potential inflection point signaling a shift in the power dynamics of the rapidly evolving artificial intelligence hardware landscape. The question now isn’t *if* competition will intensify, but *how* Nvidia will navigate a future where its dominance is actively challenged.

The $4 Trillion Threshold and the Correction

Nvidia briefly joined Microsoft as one of only two companies to surpass a $4 trillion market capitalization in early July. However, the recent pullback has put that milestone at risk, with the company currently hovering just above the mark. This correction follows Nvidia’s peak on August 12th, when its stock reached $184.48, and a subsequent 11.1% decline to its Friday closing price of $164. The tech sector as a whole has experienced a similar cooling period, but Nvidia’s fall is particularly noteworthy given its central role in the AI revolution.

Broadcom’s Ascent: A Direct Challenge to Nvidia

Broadcom’s significant gains are directly linked to its collaboration with OpenAI on designing and producing chips for the AI giant. This partnership represents a strategic move by OpenAI to diversify its supply chain and reduce its reliance on Nvidia’s GPUs. The implications are clear: OpenAI, and potentially other major AI players, are actively seeking alternatives to ensure a stable and competitive supply of essential hardware. This is a critical development, as control over AI infrastructure translates to significant power.

The Rise of In-House Chip Design

OpenAI’s move isn’t isolated. Tech giants like Google and Amazon are also investing heavily in in-house chip design, aiming to reduce costs and tailor hardware specifically to their AI workloads. This trend, coupled with Broadcom’s success, suggests a future where Nvidia’s market share will be increasingly contested. The era of near-monopoly in AI chips may be drawing to a close.

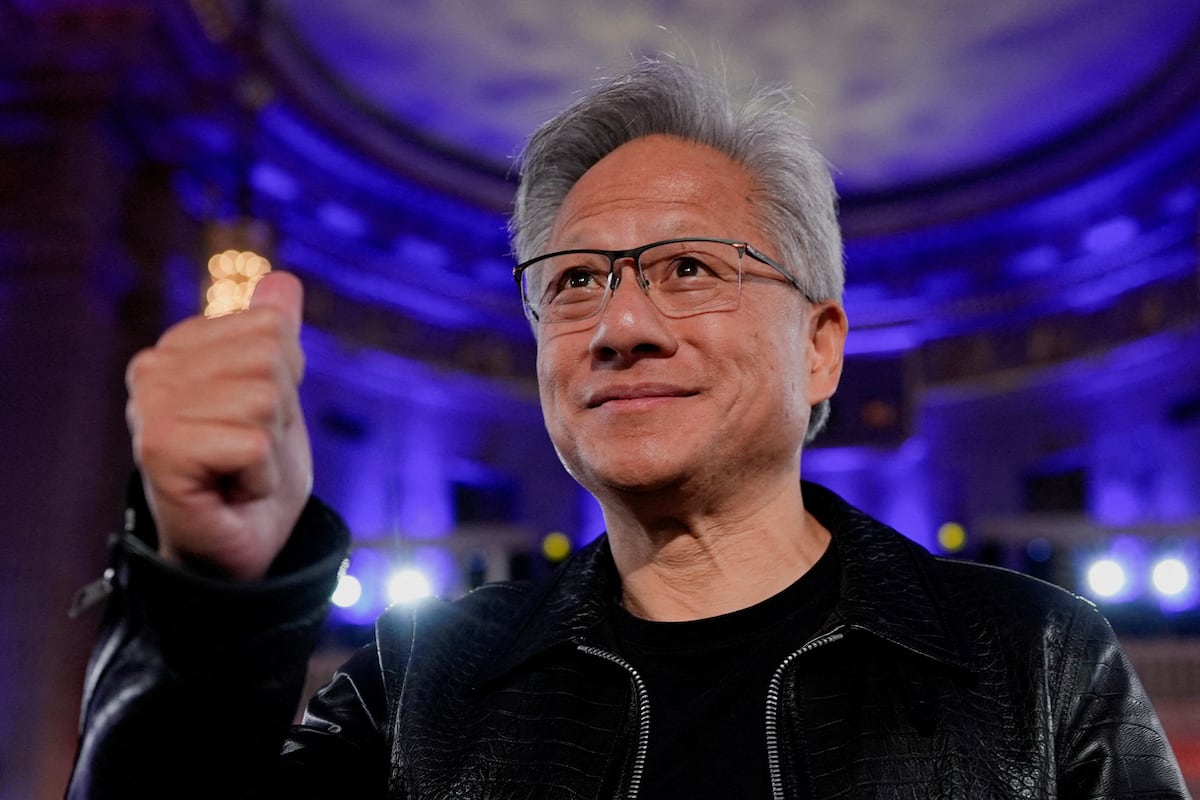

Insider Selling: A Signal of Caution?

Adding to the concerns, Nvidia’s CEO, Jensen Huang, and other company insiders have been selling shares in recent weeks, totaling over $54 million in transactions. While these sales were conducted under pre-approved 10B5-1 plans – designed to prevent accusations of insider trading – they nonetheless raise eyebrows. Such actions often signal a belief that the stock may be overvalued or that future growth prospects are less certain. It’s important to note that Huang remains a significant shareholder, holding a 3.52% stake in the company.

The China Factor and Regulatory Shifts

Nvidia’s recent gains were partially fueled by the lifting of restrictions on exporting certain advanced chips to China. However, geopolitical tensions remain a constant threat, and future regulatory changes could significantly impact Nvidia’s revenue stream. The company’s reliance on the Chinese market makes it vulnerable to shifts in international trade policy. Diversifying its customer base and strengthening relationships with other key regions will be crucial for long-term stability.

Looking Ahead: The Future of AI Hardware

The current situation highlights a critical turning point in the AI hardware market. Nvidia’s dominance isn’t guaranteed, and the company faces increasing pressure from competitors like Broadcom, as well as the growing trend of in-house chip development. The next 12-18 months will be pivotal, as we see how these competitive forces play out. Expect to see increased investment in research and development, strategic partnerships, and potentially even consolidation within the industry. The race to build the next generation of AI accelerators is on, and the stakes are incredibly high. Furthermore, the development of specialized AI hardware tailored to specific applications – beyond general-purpose GPUs – will likely accelerate, creating new opportunities for innovation.

What are your predictions for the future of Nvidia and the AI chip market? Share your thoughts in the comments below!