“`html

dust Storm on Mars Boosts Water Vapor to Record Heights, Challenging Climate Models

Table of Contents

- 1. dust Storm on Mars Boosts Water Vapor to Record Heights, Challenging Climate Models

- 2. The Red Planet’s Hidden History

- 3. Seasonal Water Loss and the Role of Dust

- 4. Anomalous Northern Hemisphere Storm

- 5. How do Martian dust storms contribute to water loss on Mars?

- 6. Dust Storms on Mars May Have Been Key to Water Loss, New Study Finds

- 7. How Dust Storms impact the Martian Atmosphere

- 8. New Research & Modeling

- 9. Evidence from Mars Reconnaissance Orbiter (MRO)

- 10. The Role of Mars’ Weakened Magnetic Field

- 11. Implications for the Search for Past Life

- 12. Martian Weather Patterns & Dust Storm Prediction

- 13. Future Research Directions

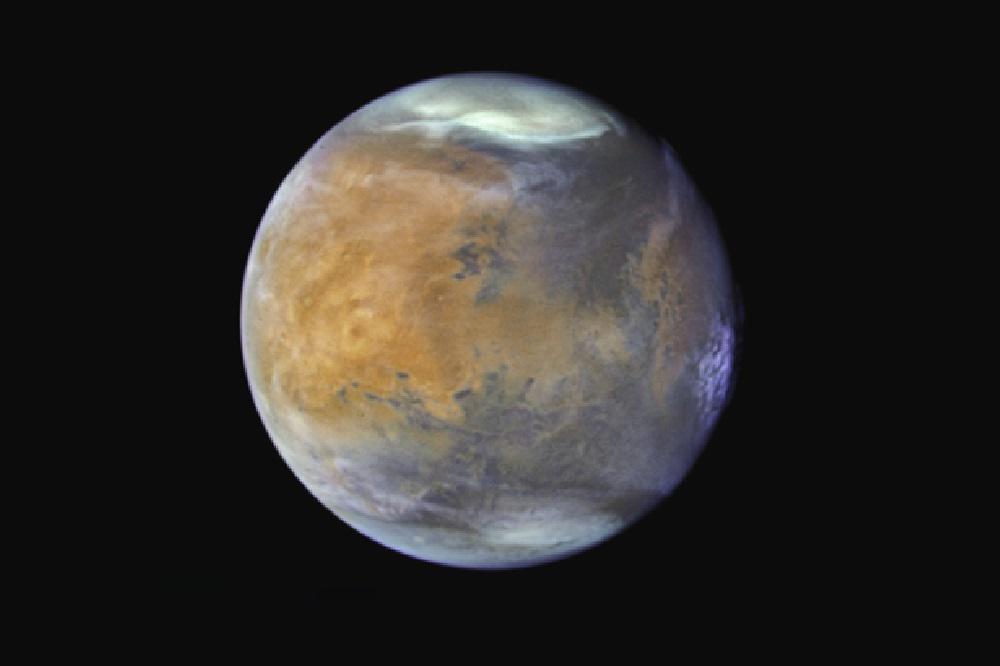

A recent study reveals an unexpected surge of water vapor into the Martian atmosphere, triggered by an unusual dust storm during the planet’s northern hemisphere summer. The findings, stemming from observations made in 2022-2023, are reshaping our understanding of water loss on the Red Planet and have significant implications for the search for past or present life.This revelation challenges existing climate models and opens new avenues for research into Mars’s atmospheric processes.

For decades,scientists have known that Mars was once a much wetter world,exhibiting features like ancient riverbeds and mineral deposits indicative of past water activity. However, over billions of years, the planet has transformed into the arid desert we observe today. Determining the fate of this lost water is a central question in planetary science.Current estimates suggest Mars has lost enough water to cover it’s entire surface hundreds of meters deep.

Seasonal Water Loss and the Role of Dust

Mars, much like Earth, experiences distinct seasons due to its axial tilt. However, its elliptical orbit causes varying distances from the Sun, resulting in warmer, more dynamic summers in the southern hemisphere. During the austral summer, increased solar energy warms the atmosphere, driving water vapor to higher altitudes where it can be broken down by solar radiation and lost to space as hydrogen. Researchers have long considered the southern summer to be the primary period for water loss on Mars.

Anomalous Northern Hemisphere Storm

The new research, based on data from the European Space agency’s Trace Gas Orbiter and NASA’s Mars Reconnaissance Orbiter, focuses on an unexpected event: a powerful dust storm that occured during the northern hemisphere summer of Martian year 37 (roughly 2021-2023 by Earth reckoning). This storm injected a ample amount of water vapor into the Martian atmosphere,reaching altitudes of 60 to 80 kilometers – a behavior not previously observed or predicted by current climate models.

The amount of water detected at these altitudes was up to ten times higher than usual. This surge suggests that localized dust storms can play a far more significant role in transporting water to the upper atmosphere,even during times when this process was not thought to be dominant. According to the How do Martian dust storms contribute to water loss on Mars?

The mystery of Mars’ missing water has captivated scientists for decades. while evidence suggests the Red Planet once boasted rivers, lakes, and perhaps even oceans, today it’s a cold, arid world. A recent study is shedding new light on this conversion, pointing to a meaningful, and perhaps previously underestimated, role played by Martian dust storms in the planet’s atmospheric and water loss.Dust Storms on Mars May Have Been Key to Water Loss, New Study Finds

How Dust Storms impact the Martian Atmosphere

Martian dust storms aren’t your average terrestrial dust devils. They can grow to encompass the entire planet, obscuring the surface for weeks or even months. These massive events aren’t just visually dramatic; they have profound effects on the Martian atmosphere and, crucially, its water.

Here’s how the process unfolds:

* Heating and Expansion: Dust particles absorb sunlight, warming the atmosphere. This warming causes the atmosphere to expand outwards.

* Hydrogen Escape: Water vapor exists in the Martian atmosphere, albeit in small quantities. As the atmosphere expands, it reaches higher altitudes where solar radiation can break down water molecules (H₂O) into hydrogen and oxygen. The lighter hydrogen then escapes into space.

* Enhanced Escape Rates: Dust storms significantly increase the rate at which hydrogen escapes. The warmer temperatures and expanded atmosphere provide a more efficient pathway for this process.

New Research & Modeling

The latest research, utilizing complex atmospheric modeling, demonstrates a stronger link between global dust storms and water loss than previously understood. Scientists have long known about the escape of hydrogen, but the extent to which dust storms accelerate this process was a key question.

This new modeling incorporates:

* Dust Particle Size & Composition: Different sizes and compositions of dust affect how efficiently they absorb sunlight and heat the atmosphere.

* Atmospheric Dynamics: The complex circulation patterns within the martian atmosphere play a crucial role in transporting water vapor to higher altitudes.

* Solar Radiation Effects: The intensity and spectrum of solar radiation impacting the upper atmosphere influence the rate of water molecule breakdown.

The results indicate that major dust storm events could have contributed significantly to the cumulative water loss over billions of years, potentially accounting for a considerable portion of the planet’s missing water.

Evidence from Mars Reconnaissance Orbiter (MRO)

Data collected by the Mars Reconnaissance Orbiter (MRO) supports these findings. MRO’s instruments have detected:

* Increased Hydrogen Levels: During and immediatly after global dust storms, MRO has observed elevated levels of hydrogen in the upper Martian atmosphere.

* water Vapor Transport: The orbiter has tracked the movement of water vapor towards the poles during dust storm seasons, suggesting a connection between storm activity and atmospheric water distribution.

* Surface Feature Analysis: MRO imagery continues to reveal geological features indicative of past water activity, providing context for understanding the planet’s hydrological history.

The Role of Mars’ Weakened Magnetic Field

It’s important to note that the loss of Mars’ global magnetic field billions of years ago also played a critical role in its water loss. A magnetic field deflects the solar wind,a stream of charged particles from the Sun. Without this protection, the solar wind directly interacts with the Martian atmosphere, stripping away atmospheric gases, including water vapor. Dust storms, in this context, act as an accelerator of water loss, exacerbating the effects of the weakened magnetic field.

Implications for the Search for Past Life

Understanding the mechanisms behind Mars’ water loss is crucial for assessing the planet’s potential to have once harbored life. If Mars was once a warmer, wetter world, it may have provided habitable conditions for microbial life. Determining how and when the planet lost its water helps scientists pinpoint the timeframe during which life might have existed.

Furthermore, the study of Martian dust storms has implications for future human exploration. Dust poses a significant challenge to equipment and astronaut health, and understanding storm dynamics is essential for mission planning and safety.

Martian Weather Patterns & Dust Storm Prediction

Predicting Martian dust storms remains a challenge, but advancements are being made. Scientists are using data from orbiters and landers, combined with sophisticated modeling, to improve forecasting capabilities. key factors being monitored include:

* Seasonal Variations: dust storm activity tends to peak during the southern hemisphere’s spring and summer.

* Temperature Gradients: Strong temperature differences between regions can trigger dust lifting.

* Atmospheric Pressure Changes: Fluctuations in atmospheric pressure can contribute to storm advancement.

Improved prediction models will be vital for protecting future Martian missions and ensuring the success of long-term exploration efforts.

Future Research Directions

Ongoing and future research will focus on:

* Detailed Dust Composition Analysis: Determining the precise mineral composition of Martian dust will refine atmospheric models.

* Long-Term Monitoring: Continued observations from orbiters and landers will provide a more comprehensive understanding of dust storm frequency and intensity.

* Laboratory Simulations: Recreating Martian atmospheric conditions in the lab will help validate modeling results and explore the complex interactions between dust, water vapor, and solar radiation.

The story of water on Mars is far from complete. However, with each new study, we gain a clearer picture of the processes that have shaped this fascinating planet and its potential for past – or even present – life.