Brazil Pivots Oil Exports: asia,India Stand to gain as US Market Shifts

In a notable recalibration of its oil export strategy,Brazil’s national oil company,petrobras,is reportedly redirecting a considerable portion of its crude oil supply away from the United states and towards Asian markets,with India emerging as a key beneficiary. This strategic move signals a broader shift in global energy trade dynamics, potentially reshaping supply chains and influencing pricing for major economies.

The decision by Petrobras to prioritize Asian demand comes as the company seeks to capitalize on growing economic powerhouses and burgeoning energy needs in the East. While specific details of the volume and timeline of this redirection remain under discussion, the intent to strengthen ties with Asian buyers, including India, is clear.

Evergreen Insights:

This advancement underscores a fundamental principle in global commodities: market dynamics are fluid and responsive to economic growth and strategic positioning. As emerging economies in Asia continue their rapid development, their demand for essential resources like oil naturally increases, creating lucrative opportunities for producers. Brazil’s move highlights the strategic advantage of diversifying export markets, reducing reliance on any single buyer and allowing for greater negotiation power.

For India, this potential influx of Brazilian crude oil could prove to be a significant advantage. As one of the world’s largest oil importers, India is constantly seeking reliable and cost-effective energy sources to fuel its economic engine. Securing direct access to Brazilian supplies could bolster its energy security, potentially temper import costs, and diversify its supplier base beyond traditional Middle Eastern sources. This scenario also reflects the increasing influence of nations like India in dictating global trade flows, as their sheer demand capabilities allow them to attract supply from diverse geographical origins. The ripple effects of such shifts can influence not only energy prices but also geopolitical relationships and the logistical networks that underpin international trade.

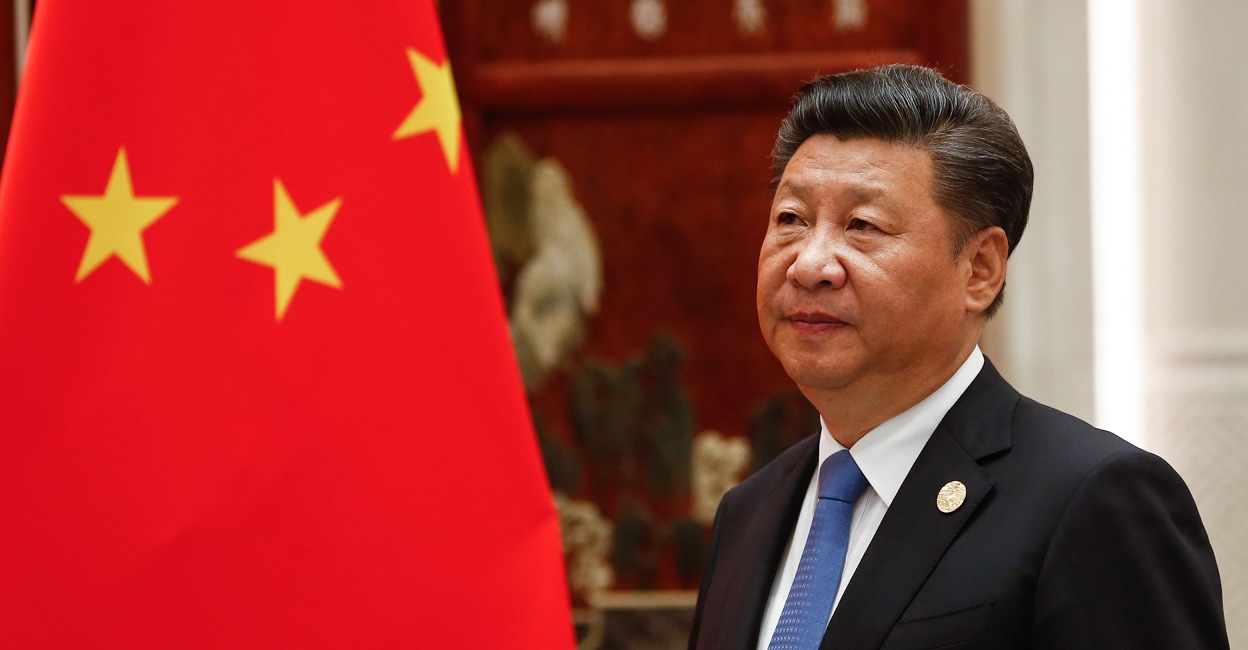

What are the key factors contributing to the economic slowdown in China?

Table of Contents

- 1. What are the key factors contributing to the economic slowdown in China?

- 2. Global Markets in turmoil: China Crisis, Japan Concerns, and India’s Sensex Watch

- 3. China’s Economic Slowdown: A Ripple Effect

- 4. Japan’s Economic Headwinds & Yen volatility

- 5. India’s Sensex: Resilience Amidst Global Uncertainty

- 6. Navigating the Turmoil: Investment Strategies

Global Markets in turmoil: China Crisis, Japan Concerns, and India’s Sensex Watch

China’s Economic Slowdown: A Ripple Effect

China’s recent economic performance is a primary driver of global market anxiety. Several factors contribute to this, including:

Real Estate Sector Woes: The ongoing crisis in china’s property market, particularly with developers like Evergrande, continues to weigh heavily on investor sentiment. Defaults and stalled projects are impacting confidence and broader economic growth.This has led to concerns about systemic risk within the Chinese financial system.

COVID-19 Lockdowns & Zero-COVID Policy Impacts: While officially abandoned, the lingering effects of China’s strict “Zero-COVID” policy continue to disrupt supply chains and consumer spending. The sporadic lockdowns throughout 2022 and early 2023 created notable economic friction.

Geopolitical Tensions: Rising tensions with the US and other nations over trade, technology, and Taiwan are adding to the uncertainty.These geopolitical risks are impacting foreign investment and business confidence.

Youth Unemployment: Record high youth unemployment rates in China are a significant concern,signaling underlying structural issues within the economy.

Impact on Global Markets: A slowdown in China, the world’s second-largest economy, directly impacts commodity prices, global trade flows, and the earnings of multinational corporations. Countries heavily reliant on Chinese demand, such as Australia and Brazil, are particularly vulnerable. The global economy is intrinsically linked to China’s performance, as highlighted by the World Economic Forum https://www.weforum.org/stories/2021/10/how-international-trade-works-global-economy/.

Japan’s Economic Headwinds & Yen volatility

Japan, traditionally a pillar of global economic stability, is facing its own set of challenges.

Aging Population & Declining Birth Rate: Japan’s demographic crisis – a rapidly aging population and declining birth rate – is creating labor shortages and putting pressure on social security systems. This limits long-term economic growth potential.

Persistent Deflation: Despite efforts by the Bank of Japan (BOJ), Japan has struggled to escape deflation for decades. This discourages investment and consumption.

yen Weakness: The Japanese Yen has experienced significant volatility,reaching multi-decade lows against the US dollar. This is driven by the divergence in monetary policies between the BOJ (maintaining ultra-low interest rates) and the US Federal Reserve (aggressively raising rates).

Global Supply Chain Disruptions: Japan’s reliance on imported energy and raw materials makes it vulnerable to global supply chain disruptions, exacerbated by geopolitical events.

Market Implications: A weak Yen can boost Japanese exports,but it also increases import costs,impacting consumers and businesses. The BOJ’s monetary policy stance is under intense scrutiny, with potential implications for global interest rates and capital flows. Currency markets are closely watching the Yen’s trajectory.

India’s Sensex: Resilience Amidst Global Uncertainty

While China and Japan face headwinds, India’s stock market, represented by the Sensex, has shown relative resilience.

Strong Domestic Demand: India benefits from a large and growing domestic market, driven by a young population and rising middle class. This provides a buffer against external shocks.

Government reforms & Infrastructure investment: The Indian government is implementing economic reforms and investing heavily in infrastructure, aiming to boost long-term growth.

Foreign Investment Inflows: Despite global uncertainty, india continues to attract foreign investment, particularly in sectors like technology and manufacturing.

Service Sector Strength: India’s robust service sector, particularly IT and business process outsourcing, contributes significantly to its economic growth.

Sensex Performance & Key Sectors: The Sensex has outperformed many other major global indices in 2023 and early 2024. Key sectors driving this performance include:

- Financial Services: Banks and financial institutions are benefiting from strong credit growth.

- Information Technology: India’s IT sector remains a global leader, driven by digital transformation trends.

- Consumer Goods: Rising disposable incomes are fueling demand for consumer goods.

- Pharmaceuticals: India is a major producer of generic drugs and is benefiting from growing healthcare spending.

Though,challenges remain:

Inflation: While moderating,inflation remains a concern.

Monsoon Risks: India’s agricultural sector is heavily reliant on the monsoon rains, and a poor monsoon can impact economic growth.

Global Economic Slowdown: A significant global economic slowdown could impact India’s exports and investment inflows. Indian stock market performance is not immune to global events.

Given the current market conditions, investors should consider the following strategies:

Diversification: Diversify yoru portfolio across different asset classes, geographies, and sectors to reduce risk.

Focus on Quality: Invest in companies with strong fundamentals, solid balance sheets, and proven track records.

Long-Term Perspective: Adopt a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations.

* Consider Emerging Markets: While