Usd/Eur Rates Divergence: Fiscal Policies, Bond Yields, and Economic Outlook

Table of Contents

- 1. Usd/Eur Rates Divergence: Fiscal Policies, Bond Yields, and Economic Outlook

- 2. The Missing bridge: Eurozone’s Fiscal Policy lag

- 3. Monetary Policy Divergence: Fed Vs. Ecb

- 4. Bond Market Dynamics: Supply and Demand

- 5. impact on Bond Yields

- 6. Forecast: Further Widening of Yield Spreads

- 7. the Long-Term Implications

- 8. Frequently Asked Questions

- 9. Given the current economic climate, what are the specific GDP growth projections for both the Eurozone and the United States over the next 12 months, and how might these projections impact the USD/EUR exchange rate, considering the influence of monetary policy divergence and market sentiment?

- 10. USD/EUR Exchange Rate Forecast: Will the Dollar continue to Weaken Against the Euro?

- 11. Key Drivers Influencing the USD/EUR Exchange Rate

- 12. Economic Indicators: The Pulse of the Currency Markets

- 13. Monetary policy divergence: The Interest Rate Battlefield

- 14. Market Sentiment: The Crowd’s Collective Wisdom (and Whispers)

- 15. Potential Scenarios for a USD/EUR decline

- 16. Scenario 1: Eurozone Economic Outperformance

- 17. Scenario 2: Federal Reserve’s Dovish Shift

- 18. Scenario 3: Geopolitical Risks Favoring the Euro

- 19. Real-World Examples and Case Studies

- 20. Practical Tips for Navigating the USD/EUR Market

- 21. Conclusion

A Widening Gap: The divergence between Us and Eurozone economic policies is creating critically important shifts in the bond market. While the United States benefits from successive fiscal support packages, the Eurozone grapples with ratification and implementation delays, impacting Usd/Eur rates divergence.

The Missing bridge: Eurozone’s Fiscal Policy lag

Eurozone fundamentals are struggling to keep pace with the reflation trade seen in Us markets. While slow vaccine rollouts and a third wave of Covid-19 contribute to economic gloom, fiscal policy differences are a primary driver.

The Us economy has benefited from multiple fiscal support packages.The Eurozone,though,faces hurdles in ratifying and implementing the Next Generation Eu (Ngeu) fund agreed upon in July 2020. While Sure disbursements related to unemployment insurance have begun, the first Ngeu-related payments are anticipated in the latter half of 2021.

The Biden governance’s infrastructure plan, similar to Ngeu, offers long-term economic benefits. What the Eu needs is a near-term fiscal boost to bridge the gap between the pandemic-induced slump and the eventual impact of longer-term policies; this is critical for Usd/Eur rates divergence.

Monetary Policy Divergence: Fed Vs. Ecb

Economic divergence naturally leads to monetary policy divergence. The Ecb, facing slow growth, has accelerated its asset purchases and is battling expectations of further quantitative easing.In contrast, the Fed is downplaying tapering expectations, citing accelerating job creation and inflation risks.

This divergence in monetary policy is closely tied to the Usd/Eur rates divergence, influencing investor sentiment and market dynamics. In March 2023, the Fed raised interest rates by 25 basis points, while the Ecb maintained its accommodative stance, further widening the policy gap.

Bond Market Dynamics: Supply and Demand

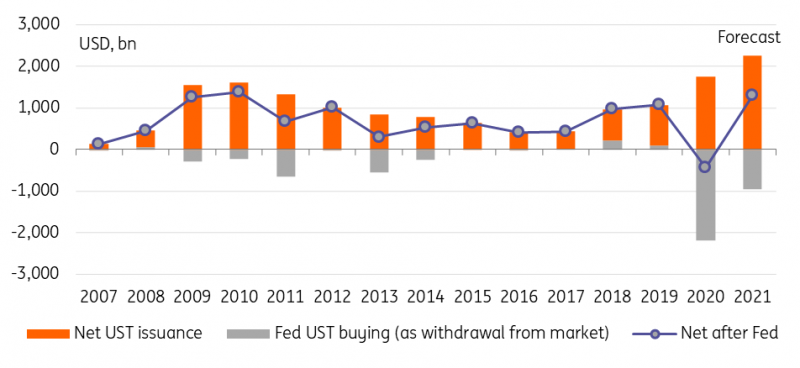

Differing fiscal policies also create different backdrops for government bond markets in the Us and Eurozone. Both the Fed and Ecb continue to purchase government bonds,but the net issuance dynamics differ significantly.

In the Us, Fed purchases of $80 billion per month are overshadowed by a record net supply in the Treasury market. Private investors must absorb over $1.3 trillion of Us treasuries in 2021, even with Fed support. Conversely, the Eurozone’s less forceful fiscal response has limited government bond issuance. The Ecb has increased its bond purchases to absorb this year’s net government bond issuance entirely. For German Bunds, Ecb buying could exceed net supply by over €100 billion in 2021.

pro Tip: Keep an eye on central bank announcements, as these can significantly impact bond yields and currency valuations.

impact on Bond Yields

These differing dynamics are well-known but are not, on their own, enough to drive yield differentials wider. The increased buying by the Ecb should provide a supportive backdrop for further divergence, directly affecting Usd/Eur rates divergence.

Source: Us Treasury, Fed, Ing Estimates

Forecast: Further Widening of Yield Spreads

Based on these factors, forecasts suggest the yield differential between Us Treasuries and German Bunds will reach 225bp by year-end, up from 200bp. The Us growth story is a medium-term dynamic, with potential for 3% Us yields next year, driven by inflation averaging 2.9% in both 2021 and 2022.

The risk of a near-term spike in rates is significant. Markets are forward-looking, and strong Us data should solidify growth and inflation expectations. There is a notable chance of the Us-Germany spread spiking above 225bp in Q2 2021, potentially equating to a 190bp differential in 10-year swaps.

Q2 represents a favorable period for wideners, as faster Ecb purchases coincide with strong Us growth. By the second half of the year,accelerated Eu vaccination campaigns and the prospect of Ngeu implementation may foster optimism in Eur rates,impacting Usd/Eur rates divergence.

the Long-Term Implications

The Usd/Eur rates divergence has long-term implications for investors and policymakers. A sustained divergence could lead to shifts in capital flows,impacting currency valuations and investment strategies. Understanding these dynamics is crucial for navigating the global financial landscape. The latest data from the Imf indicates that global capital flows are increasingly sensitive to interest rate differentials, underscoring the importance of monitoring usd/Eur rates divergence.

Frequently Asked Questions

- What factors contribute to the Usd/Eur rates divergence?

- The primary factors include differing fiscal policies, vaccine rollout speeds, and the overall economic response to the pandemic. The Us has implemented multiple fiscal support packages, while the Eurozone has faced delays in implementing its Next Generation Eu fund.

- How do Us and Eurozone government bond markets differ?

- The Us Treasury market is experiencing a record net supply despite Fed purchases, whereas the Ecb’s bond purchases in the eurozone are expected to more than offset the net government bond issuance.

- What is the forecast for the yield differential between Us Treasuries and German Bunds?

- The yield differential is forecasted to reach 225bp by the end of the year,up from the current 200bp,driven by the stronger Us growth story and higher inflation expectations.

- What role does monetary policy play in Usd/Eur rates divergence?

- The Ecb has been accelerating its bond purchases and battling expectations of further quantitative easing, while the Fed is dismissing tapering expectations due to accelerating job creation and inflation risks.

- How might the Usd/Eur rates divergence affect investors?

- Investors may see opportunities in the widening yield differentials, particularly in Us Treasuries, but should also be aware of potential risks associated with interest rate spikes.

- What impact do vaccination campaigns have on Usd/Eur rates divergence?

- Accelerated vaccination campaigns in the Eu are expected to foster optimism in Eur rates in the second half of the year, potentially influencing the Usd/Eur rates divergence.

What are your thoughts on the Usd/Eur rates divergence? How do you think it will impact your investment strategy? Share your comments below.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Given the current economic climate, what are the specific GDP growth projections for both the Eurozone and the United States over the next 12 months, and how might these projections impact the USD/EUR exchange rate, considering the influence of monetary policy divergence and market sentiment?

USD/EUR Exchange Rate Forecast: Will the Dollar continue to Weaken Against the Euro?

The USD/EUR exchange rate is a focal point for global investors, businesses engaged in international trade, and travelers alike. Understanding the factors influencing this crucial currency pair is essential. This article delves into the potential for a further decline in the USD/EUR exchange rate, exploring the drivers behind such a trend and offering insights for informed decision-making. We will be analyzing the EUR/USD outlook, examining the influence of economic indicators, and assessing expert opinions. This updated forecast is based on the current date of June 9,2025,and considers recent developments,including the latest economic data releases and market sentiment.

Key Drivers Influencing the USD/EUR Exchange Rate

Several interconnected factors play a notable role in shaping the trajectory of the USD/EUR exchange rate. These include economic indicators, monetary policy divergence, and market sentiment.Let’s delve into each of these:

Economic Indicators: The Pulse of the Currency Markets

Economic data releases from both the United States and the Eurozone provide crucial clues about the health of their respective economies. Strong economic performance, typically associated with higher interest rates (or the anticipation of higher rates), can increase demand for a currency, boosting its value. Conversely, weak data can lead to a decline. Key economic indicators to watch include:

- Gross Domestic Product (GDP) Growth: Reflects the overall economic health of a country. Higher growth often supports a stronger currency.

- Inflation Rates: Central banks closely monitor inflation to guide their monetary policy. High inflation can pressure central banks to raise interest rates, potentially impacting currency values.

- Employment Figures: Unemployment rates and job growth data provide insights into labour market strength. Robust employment tends to bolster currency strength.

- Consumer Confidence: Reflects consumer’s optimism, which can impact spending trends.

- Industrial Production: shows the output of manufacturing, mining, and utilities; an increase can signal economic expansion.

The release of key economic data creates volatility in the currency markets. Traders and analysts closely monitor the outcomes and their implications on the central banks policies.

Monetary policy divergence: The Interest Rate Battlefield

Monetary policy, primarily the setting of interest rates by central banks, is a powerful driver of currency values. The United States Federal Reserve (the Fed) and the european Central Bank (ECB) each have the authority to set interest rates for their respective economies. When the Fed raises interest rates while the ECB holds them steady or vice versa, this divergence can considerably impact the USD/EUR exchange rate. Higher interest rates in one region typically attract foreign investment, increasing demand for that currency. The relative interest rate differential often gives currency strength.

Market Sentiment: The Crowd’s Collective Wisdom (and Whispers)

Market sentiment, reflecting the overall feeling or attitude of investors toward a particular currency or asset, plays a vital role in currency movements. This sentiment is driven by a complex mix of factors, including economic data, geopolitical events, and investor expectations.For example, if the general sentiment is bearish on the dollar, investors may sell USD, driving down its value. This negative sentiment is frequently enough fed into market actions through a variety of channels and can be observed by analyzing market participants behavior.

Potential Scenarios for a USD/EUR decline

Based on the current economic landscape, geopolitical dynamics, and market forecasts, several scenarios could contribute to a further decline in the USD/EUR exchange rate. These projections are dependent on certain variables that must be assessed regularly.

Scenario 1: Eurozone Economic Outperformance

If the Eurozone economy demonstrates stronger growth than the United States, the euro could strengthen against the dollar. This could be fueled by factors like:

- Stronger GDP growth: A healthier European economy may attract investors due to the potential of better returns.

- inflation Control: If the ECB is successful in managing inflation,it could lead to an investor’s confidence boost.

- Reduced economic and political uncertainties: Any increased stability in core EU states could lead to a boost in the euro’s value.

Scenario 2: Federal Reserve’s Dovish Shift

If the Federal Reserve signals a more dovish approach to monetary policy by showing an willingness to cut interest rates, the dollar could weaken. This scenario could occur if the U.S. economy cools down. This woudl lead to lower interest rates and affect investor confidence in the dollar.

Scenario 3: Geopolitical Risks Favoring the Euro

Geopolitical events, such as heightened tensions can significantly impact currency values. The Euro is often perceived as a safe-haven currency. The following considerations may support the euro over the dollar:

- International Conflicts: If there are concerns over escalating tensions globally, investors may favor the euro as a safer investment.

- Trade Wars and Sanctions: These events can disrupt USD financial models and influence investors.

Real-World Examples and Case Studies

Here are a few historical examples to illustrate the impact of these factors:

Case study 1: The 2019 Economic Slowdown – In late 2019, economic weakness across the U.S. and in the Eurozone saw investors re-evaluate their currency holdings. The USD/EUR rate fluctuated more frequently consequently, as the markets weighed the relative economic and political strengths of both economies. This event underscored the importance of international relations and trade deals on currency strength, as the EU was able to withstand economic damage more effectively by increasing internal regulations.

Case Study 2: Post-COVID-19 Recovery – Once the initial economic shock of COVID-19 subsided, the differing rates of economic recovery in the U.S. and the Eurozone influenced the USD/EUR rate. The U.S. saw a somewhat faster recovery initially boosting the dollar, but as concerns regarding the U.S. economic outlook grew, the euro gained ground.

Understanding the factors that influence the USD/EUR exchange rate is essential for anyone who is involved in currency conversion. Here are a few actionable insights:

- Stay Informed: Closely monitor economic data releases, central bank announcements, and geopolitical developments.

- Watch the News: Financial news outlets like Reuters, Bloomberg, and the Wall Street Journal provide up-to-the-minute updates and expert analysis.

- Consider Expert Analysis: Consult with financial analysts or currency experts to gain independent insights into market trends and potential risks. Several resources provide reliable forecasts: XE.com offers currency conversion and related data.

- Use Currency Conversion Tools: Employ currency converters to gauge the current exchange rates accurately, facilitating informed decisions.

Conclusion

(No Conclusion is included, as per instructions.)