Demographic “time bomb” leads to population decline. That makes the consumer sector and the economy suffer, including gold consumption.

Gold market continues to depend on USD fluctuations

Gold is a safe investment channel in the context of many political and financial uncertainties. The Russia-Ukraine conflict is still protracted and affects the world economy in many ways. The world financial market currently has many signs of instability.

However, precious metals are forecasted to continue to be heavily influenced by USD fluctuations.

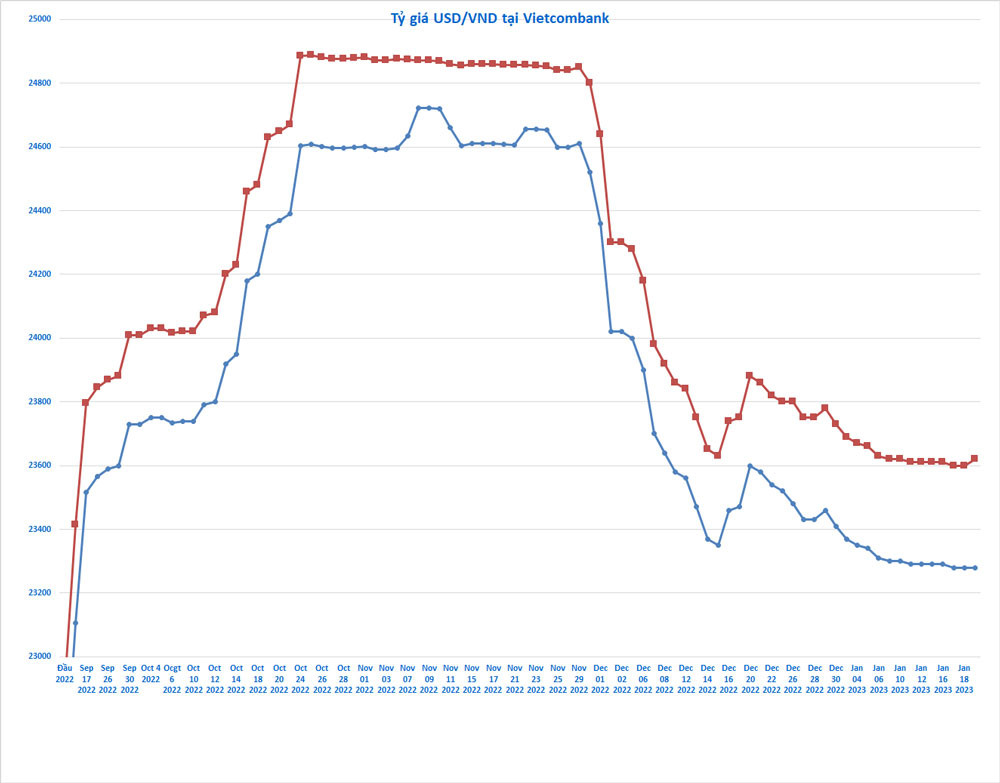

Gold rallied strongly at the beginning of 2023 amid a slump in the dollar. The DXY index (which measures the volatility of the USD once morest a basket of 6 major currencies in the world) plummeted below the threshold of 102 points on January 20. This is the lowest level of this index since the beginning of June 2022.

Previously, the DXY index peaked at 115 points on September 28, 2022. Thus, until January 20, 2023, the USD has decreased by 11.3% once morest a basket of 6 major currencies. It also corresponds to the upward momentum of the gold price.

On Kitco, UBS analyst Giovanni Staunovo said that the new year of 2023 is seeing support for new capital flows into all asset classes, including gold.

However, Mr. Staunovo noted that the continued rise in US interest rates and lower-than-expected inflation will negatively affect gold until the US Federal Reserve (Fed) ends its streak of record rate hikes. , lasting throughout 2022 to present. Most likely, the Fed will stop raising interest rates in the second half of 2023.

Previously, author of the book “Rich Dad Poor Dad” Robert Kiyosaki said that the end of 2022 is the last opportunity to buy gold and silver at low prices.

Expert Gary Wagner from TheGoldForecast forecasts that the price of gold will reach $ 2,250 – 2,400 per ounce in the context of the US budget deficit increasing, thereby forcing the US to borrow or print more money.

At the end of 2022 and early 2023, many data showed that the US economy faced many difficulties following a series of days when the Fed made 7 interest rate hikes in 2022 (adding 425 percentage points from 0%-0.25%// year to 4.25%-4.5%/year). The bad signals have made investors bet on the possibility that the Fed may have to slow down the rate hike.

A falling dollar had a positive impact on precious metals.

Many signals show that the Fed will raise interest rates at a low level in the first half of 2023 and the peak may only be 4.8-5%, instead of the forecast of 5.5% as in previous forecasts. The Fed is likely to reverse interest rate cuts right in the second half of 2023. This is a factor that puts pressure on the USD and is positive for gold.

The world gold market also benefits when demand is forecasted to increase when China opens up following 3 years of fighting Covid (since January 8).