Bitcoin is on the rise. Taking advantage of the series bankruptcies of American banks, the oldest cryptocurrency is recording a rebound. Some observers are already predicting new records…

The price of Bitcoin is on the rise once more. The queen of cryptocurrencies has crossed the $28,000 threshold this weekend, rising steadily since the flash drop of March 10. This is the first time since June 2022 that Bitcoin has come so close to $30,000.

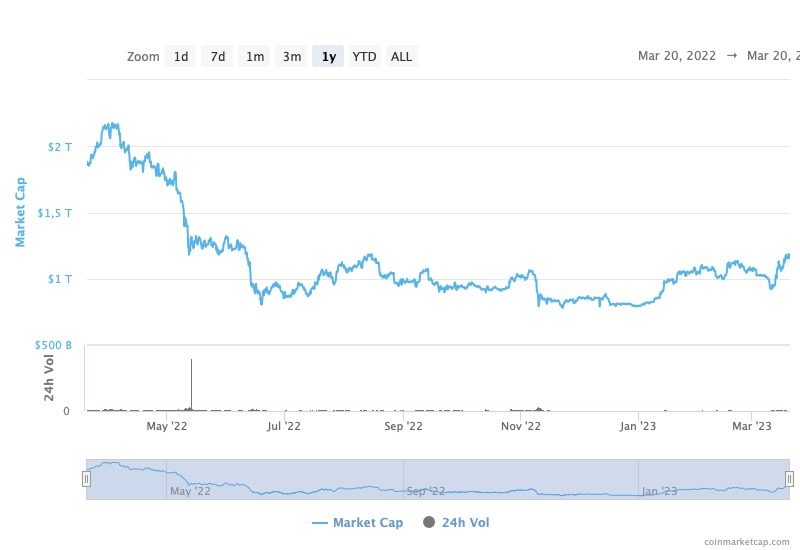

As always, Bitcoin has pulled other cryptoassets up. Ether, the currency of the Ethereum blockchain, approached the $1,900 mark. Most altcoins also rose in the wake of Bitcoin, whose dominance rose sharply on the sidelines of the rebound. The total market valuation has risen above $1 trillion.

Why is Bitcoin going up?

Bitcoin indirectly benefited from the earthquake that hit theamerican banking industry. In recent weeks, several renowned banks have closed their doors following a wind of panic. Silvergate Bank, a bank with strong ties to the crypto-asset sector, first bit the dust. A few days later, the Silicon Valley Bank, a bank financing many tech start-ups, recorded a capital flight. Unable to reimburse its customers, it was shut down by regulators, destabilizing Circle’s USDC stablecoin. It is the biggest bank failure in the United States since the financial crisis of 2008. Finally, the Signature Bank, another bank important to the American economy, also collapsed.

These repeated bankruptcies forced Joe Biden’s government to react. The US administration has pledged to reimburse all bank customers in full, well beyond the limits provided for by law. Subsequently, the US Federal Reserve, the central bank responsible for issuing the dollar, lent nearly $12 billion to American banks in order to avoid contagion to the entire banking sector. The Federal Reserve also announced emergency loans of up to $25 billion for “avoid a liquidity crisis” at all costs. Other central banks have taken similar steps to support the banking sector. This is the case of the European Central Bank or the Swiss central bank, which will moreover pay out 50 billion Swiss francs to save Credit Suisse, the second Swiss bank.

The massive injections of liquidity decreed by the American Federal Reserve, which printed nearly 300 billion dollars in less than a week, should stimulate interest in riskier assets, such as Bitcoin and cryptocurrencies. This is already what happened on the sidelines of the Covid-19 crisis. The Biden government’s bailouts kept the stock market on a drip, especially those of the tech giants, to which Bitcoin was correlated. This unbridled monetary creation had made it possible to revive the economy. The Federal Reserve’s future decisions, including the inevitable slowdown in the rise in key rates, should also benefit investments considered to be risky.

For some investors, Bitcoin also acts as a safe investment, like gold. Faced with the storm that threatens the banks, they prefer to keep their bitcoin assets rather than entrust them to a banking institution, perceived as fallible. For the record, Bitcoin was also designed in response to the 2008 subprime mortgage crisis, recalls Simon Peters, market analyst at eToro. This is why Bitcoin mechanically benefits from the fears surrounding the banking world:

“The inevitable echoes of 2008 left many anticipating a change in fortunes for crypto-asset investors and a revival in the use of bitcoin in particular.”

As the analyst points out, Bitcoin is a “alternative to the centralized financial system” born of a desire to do without banks. Unsurprisingly, the cascading bankruptcies of American banks have therefore reinforced the ideals of the maximaliststhese investors who swear by Bitcoin:

“The events of the past week will have already convinced many new and existing investors that the philosophy of bitcoin […] remains more relevant than ever ».

Bitcoin at $100,000

Despite this rebound, Bitcoin remains far from its historical record. In November 2021, the cryptocurrency approached $70,000, before contracting throughout 2022. Weighed down by the economic crisis and the successive disasters of UST and FTX, Bitcoin stagnated between $15 and $20,000 for weeks.

Faced with this unexpected surge, some observers prophesy the end of the bear market cryptocurrencies. According to an analysis by the French giant Coinhouse, Bitcoin will gradually regain value in the coming months, auguring new records for next year.

January was massive for Bitcoin, not just because price went up a lot. I believe it was the start of the bull market for Bitcoin for these 9 reasons:

— Charles Edwards (@caprioleio) February 28, 2023

For Charles Edwards, founder of the investment company Capriole Investments, Bitcoin is even on the way to $100,000. In his eyes, we are at the dawn of a new bull cycle for the entire industry. Arthur Hayes, the former CEO of the exchange platform BitMEX, agrees in a post published on Medium. Finally, Ryan Selkis, CEO of the analysis firm Messari, even expects the cryptocurrency to reach $100,000, for the first time in its history, in the next 12 months.

My rough prediction for the next twelve months:

1. More bank failures in the next couple of weeks.

2. Fed cuts / QE is back!

3. BTC climbs, sustained moderate inflation.

4. “Outside Money” / “Sound Money” -> $100k / BTC.

5. Institutions buy faster than Feds can shut down.Game.

— Ryan Selkis ???? (@twobitidiot) March 17, 2023

Cautious, Simon Peters asserts that he is still too early to announce the strong comeback of Bitcoin and cryptocurrencies. According to him, “continuing uncertainty in financial markets” is always likely to put new obstacles in the way of digital assets…