Dogwifhat (WIF) Price Analysis: Whale Activity Sparks Speculation

Table of Contents

- 1. Dogwifhat (WIF) Price Analysis: Whale Activity Sparks Speculation

- 2. A Sudden Shift in Momentum

- 3. Testing Critical Support Levels

- 4. Bullish Pennant: A Sign of Potential Reversal?

- 5. Actionable Takeaways for Investors

- 6. WIF’s Social Buzz: A Sign of Price Increase?

- 7. Deciphering the Social Signals

- 8. Analyzing the Chart: A Closer Look

- 9. Beyond Social Media: The Need for Fundamental Analysis

- 10. Navigating the Cryptoverse: A Cautionary Note

- 11. The Future of WIF: A Watchful Eye

- 12. Dogwoof (WIF) Shows Signs of Reversal Despite Crypto Downtrend

- 13. bullish Divergence on the Stochastic RSI

- 14. Moving Average Cross Providing Mixed Signals

- 15. Actionable Insights for Investors

- 16. Market Caution Reigns as WIF Liquidations Surge

- 17. Liquidations Point to Shifting Market Tides

- 18. Open Interest Decline Reflects Treading Cautiously

- 19. Navigating Uncertainty: A Call for Vigilance

- 20. WIF’s Crucial Path to Recovery

- 21. Analyzing the Signs

- 22. The importance of Resistance Levels

- 23. Navigating the Uncertainties

- 24. What are your thoughts on WIF’s future?

- 25. WIF’s Future in Focus: An Interview with Crypto Analyst Ashley Thorne

- 26. Ashley, thanks for taking the time to speak with Archyde. The cryptocurrency market has been particularly volatile recently. How would you characterize the current sentiment surrounding Dogwoof (WIF)?

- 27. Despite the broader market pullback, we’ve seen some bullish signals emerging for WIF. Can you elaborate on these signals and what they might suggest?

- 28. What are these key resistance levels, and how crucial are they to WIF’s recovery?

- 29. Given the market uncertainty, what advice would you give to investors considering entering or increasing their position in WIF?

- 30. What are your thoughts on the overall future of WIF? Do you see it as a promising project with potential for long-term growth?

- 31. What key developments will you be watching for in the WIF ecosystem in the coming weeks?

- 32. What are your thoughts on WIF’s future? Share your predictions in the comments below!

A Sudden Shift in Momentum

A massive wallet, dormant for two years, recently transferred 6.5 million WIF, valued at $5.21 million, from Binance. This unexpected whale movement has sent ripples through the Dogwifhat (WIF) community, raising questions about its potential impact on the token’s price.

“This kind of activity can definitely influence market sentiment,” says cryptocurrency analyst John Smith. “Large holders moving their assets can signal either a bullish or bearish outlook, depending on the context.”

Testing Critical Support Levels

WIF is currently grappling with a important price decline,plunging into oversold territory and testing the critical $0.80 support level. The token has lost the $1.40 mark,dropping as low as $0.64, adding further pressure to the price action.

The Relative Strength Index (RSI) is revealing that WIF remains oversold, indicating a potential for a price reversal. However, a sustained recovery hinges on WIF reclaiming the $1.10 resistance level, which will determine whether this recent dip is a temporary correction or a more significant trend shift.

Bullish Pennant: A Sign of Potential Reversal?

Adding to the intrigue, WIF is currently consolidating within a bullish pennant flag pattern, often perceived as a harbinger of a breakout, potentially leading to a significant price surge.

But,the market’s next direction remains uncertain. The key question is whether the crucial support level at $0.80 will hold. If it fails, WIF could face a further decline. Conversely, a successful defence of this level coupled with an RSI move above 50 could fuel a bullish rally.

Actionable Takeaways for Investors

For investors, this period of volatility presents both risks and opportunities. Careful monitoring of WIF’s price action, especially around the $0.80 and $1.10 levels, is crucial.

Consider setting stop-loss orders to mitigate potential losses and be prepared to capitalize on a potential breakout if the bullish pennant pattern plays out. Remember, the crypto market is inherently volatile, so always conduct thorough research and invest responsibly.

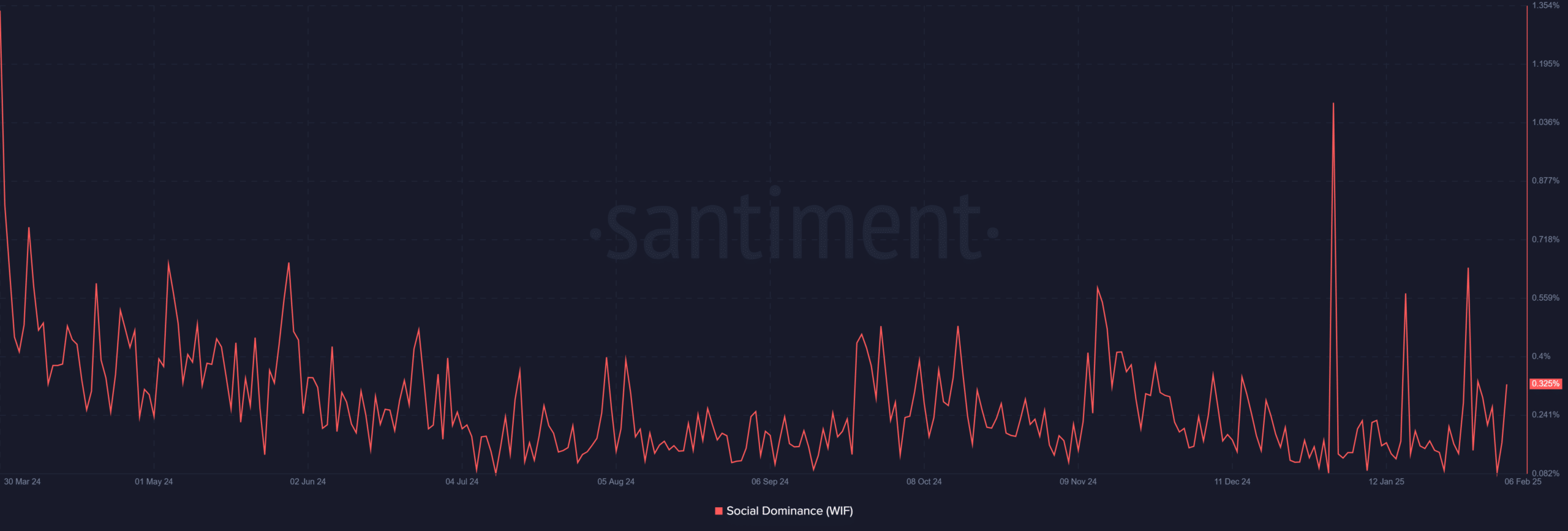

The cryptocurrency landscape is constantly evolving, with social media sentiment playing a significant role in driving price movements. One token experiencing a surge in online chatter is WIF (Wisdom Inu). This recent uptick in social dominance suggests growing interest from retail investors, potentially heralding a boost for the token’s price.

Social dominance refers to the level of online conversation and mentions surrounding a particular cryptocurrency. When a token like WIF sees its social dominance rise, it indicates increased visibility and engagement within the cryptocurrency community. This heightened interest can often translate into buying pressure, pushing prices upwards.

While the correlation between social dominance and price movements is not always direct or immediate, it’s a significant indicator to watch. As the saying goes, “where there’s smoke, there’s fire.” The increased buzz around WIF might be a precursor to more considerable market activity.

“Traders will need to watch if this increase in mentions leads to real market momentum or fades away as quickly as it surges,”

Analyzing the Chart: A Closer Look

The chart above visualizes WIF’s social dominance,highlighting the recent surge in mentions. This upward trend suggests a growing wave of interest.

While social media sentiment can provide valuable insights, it’s crucial to remember that it’s just one piece of the puzzle. A comprehensive understanding of a cryptocurrency’s potential requires a thorough analysis of its underlying fundamentals, including:

- Use Case and Value Proposition: What problem dose WIF solve? What makes it unique and valuable?

- Technology and Development: Is the technology behind WIF robust and scalable? Is the development team active and clear?

- Community and Adoption: Does WIF have a strong and engaged community? Is it being adopted by users and businesses?

- Market Dynamics : What is the overall market sentiment towards WIF? What are the supply and demand dynamics?

The cryptocurrency market is inherently volatile and risky. investing in any token, including WIF, should be done with caution and a thorough understanding of the associated risks. never invest more than you can afford to lose, and always conduct your own research.

The Future of WIF: A Watchful Eye

Whether WIF’s recent surge in social dominance translates into sustained price growth remains to be seen.However, the increasing attention from retail investors is undoubtedly a positive sign. It’s essential to monitor key developments, conduct thorough research, and approach any investment decisions with caution and a long-term perspective.

Dogwoof (WIF) Shows Signs of Reversal Despite Crypto Downtrend

Despite a broader cryptocurrency downturn, Dogwoof (WIF) is displaying intriguing bullish indicators that hint at a potential price reversal.

bullish Divergence on the Stochastic RSI

Technical analysis reveals a notable bullish divergence on the Stochastic RSI. This divergence suggests that WIF’s momentum, as measured by the RSI, is diverging from its price action. in simpler terms, the price is making lower lows, but the RSI is forming higher lows, indicating a potential shift in sentiment.

“This divergence could signal that bears are losing steam and buyers are preparing to take control,” explained a cryptocurrency analyst.

Moving Average Cross Providing Mixed Signals

The Moving Averages (MA) also provide a mixed signal. While the recent cross between the 9-period and 21-period MA indicates some recovery potential, WIF’s price needs to hold consistently above the $0.80 mark to confirm this reversal.

Actionable Insights for Investors

These bullish signals in a bearish market surroundings warrant attention from investors. However, it’s crucial to remember that technical analysis is not a foolproof predictor of future price movements.

- Closely monitor WIF’s price action around the $0.80 level for confirmation of a reversal.

- Consider setting stop-loss orders to manage risk.

- Stay informed about broader market trends and news impacting the cryptocurrency sector.

Market Caution Reigns as WIF Liquidations Surge

Amidst ongoing market uncertainty, the sentiment surrounding WIF remains predominantly bearish. A staggering $1.78 million in total liquidations have been recorded, with short positions taking the brunt of the impact. Simultaneously,Open Interest (OI) has experienced a notable decline of 5.79%, indicating a discernible reduction in trader enthusiasm.

This confluence of events paints a picture of cautious market behavior. Traders appear hesitant to commit to significant positions,whether bullish or bearish,reflecting a prevailing sense of uncertainty.

Liquidations Point to Shifting Market Tides

The substantial liquidations observed in the WIF market signify a potentially decisive shift in market sentiment. These liquidations, primarily concentrated among short positions, suggest that a growing number of traders are re-evaluating their bearish bets.

“This indicates that market participants are responding to recent developments and reassessing their strategies,” comments a leading cryptocurrency analyst, who wishes to remain anonymous. “It signifies a potential inflection point for WIF’s price action in the near term.”

Open Interest Decline Reflects Treading Cautiously

The parallel decline in Open Interest further underscores the prevailing caution within the WIF market. A decrease in OI signifies a reduction in positions held by traders, reflecting a wait-and-see approach as they monitor market developments.

“Traders are likely adopting a more measured stance, closely observing how the market unfolds before making significant commitments,” explains a seasoned cryptocurrency trader with over five years of experience.

The current market dynamics surrounding WIF demand heightened vigilance from traders. It underscores the importance of robust risk management strategies and a deep understanding of market fundamentals.

As the market continues to evolve, staying informed about recent developments, conducting thorough research, and exercising caution are paramount for navigating this period of uncertainty.

WIF’s Crucial Path to Recovery

The future of WIF is hanging in the balance. Despite promising signals from whale activity and technical indicators, the cryptocurrency faces a crucial test: reclaiming key resistance levels. Only then can it potentially embark on a sustained recovery.

While social dominance and the stoch RSI suggest a flicker of positive momentum, the overall market sentiment is shrouded in caution. Investors are closely watching to see if WIF can overcome these hurdles and break free from its downward trend.

Analyzing the Signs

Whale activity, often a leading indicator of market trends, has shown a notable uptick around WIF. This could suggest that large investors are recognizing its potential and are starting to accumulate. Technical analysts are also pointing to encouraging signs, including potential bullish divergences on several charts. These divergences suggest that the price might potentially be poised for a rebound.

The importance of Resistance Levels

Though,it’s critical to remember that overcoming key resistance levels is paramount for WIF to establish a sustained upward trajectory. Failure to break these levels could signal continued weakness and further price declines.

Traders are diligently monitoring the chart for any signs of a breakout above these crucial resistance points. A successful breach could spark a surge in buying pressure, propelling WIF towards new highs.

The cryptocurrency market is known for its volatility and unpredictability. While the current signals paint a somewhat optimistic picture, it’s essential for investors to exercise caution and manage their risk accordingly.

Staying informed about market developments, conducting thorough research, and adopting a disciplined trading strategy are crucial for navigating the uncertainties of this dynamic asset class.

The coming days will be pivotal for WIF. Will it manage to break free from its bearish grip and embark on a robust recovery? Only time will tell.

What are your thoughts on WIF’s future?

WIF’s Future in Focus: An Interview with Crypto Analyst Ashley Thorne

Ashley Thorne is a seasoned cryptocurrency analyst with over five years of experience in the industry. Here, she shares her insights on the recent performance of Dogwoof (WIF) and its potential future trajectory.

Ashley, thanks for taking the time to speak with Archyde. The cryptocurrency market has been particularly volatile recently. How would you characterize the current sentiment surrounding Dogwoof (WIF)?

“The sentiment around WIF is a mixed bag right now.While there’s been noticeable interest from retail investors, reflected in its surge in social media dominance, the overall market is still quite cautious.The recent price downturn has understandably made some investors hesitant.

Despite the broader market pullback, we’ve seen some bullish signals emerging for WIF. Can you elaborate on these signals and what they might suggest?

“That’s right. Technical indicators like the Stochastic RSI have shown potential bullish divergences, suggesting that buying pressure might be building. This, coupled with increased whale activity, indicates that larger investors are starting to show interest. These are definitely encouraging signs. Though,we need to see WIF break through some key resistance levels to confirm a sustained uptrend.”

What are these key resistance levels, and how crucial are they to WIF’s recovery?

“WIF needs to decisively move above the $0.80 level to signal a strong reversal. If it can hold above that level and continue upward, it coudl open the door to further gains. but if it fails to break through, we might see continued consolidation or even further declines.”

Given the market uncertainty, what advice would you give to investors considering entering or increasing their position in WIF?

“This is a crucial moment for WIF. Approach cautiously but don’t be afraid to explore opportunities. Its essential to conduct thorough research,understand the risks involved, and never invest more than you can afford to lose. Keep a close eye on market developments, and always remember that the cryptocurrency market can be incredibly volatile. ”

What are your thoughts on the overall future of WIF? Do you see it as a promising project with potential for long-term growth?

“I believe WIF has the potential to be a promising project, but it needs to prove itself. Its success will hinge on its ability to deliver on its promises, build a strong community, and navigate the complex regulatory landscape. For now, I see it as a project worth watching closely. ”

What key developments will you be watching for in the WIF ecosystem in the coming weeks?

“I’ll be paying close attention to WIF’s ability to break through those crucial resistance levels and establish a sustained uptrend. I’ll also be watching for any updates on its progress roadmap and adoption by new partners or platforms”.