Hyundai Motor Group Reshuffles Leadership as China‑Led EV Price War Intensifies

Table of Contents

- 1. Hyundai Motor Group Reshuffles Leadership as China‑Led EV Price War Intensifies

- 2. What changed at Hyundai

- 3. Structural shift to accelerate future mobility

- 4. Market backdrop: chinese EVs reshape the global stage

- 5. China’s EV surge and global implications

- 6. Policy responses and government measures

- 7. Domestic entrants into the Korean market

- 8. Key facts at a glance

- 9. What readers should watch next

- 10. Engagement

- 11. 30 % reduction in battery cost per kWh by 2026, mirroring the economies of scale seen in Chinese gigafactories.

Hyundai Motor Group announced a year‑end leadership reshuffle aimed at tightening organizational focus and accelerating the shift toward future mobility. The move comes as global auto markets face renewed uncertainty and a strong, price‑driven push from Chinese electric vehicle brands disrupts customary sales dynamics in Europe, the United States, and Korea.

What changed at Hyundai

On the 18th, Hyundai Motor Group disclosed promotions totaling 219 individuals, comprising four presidents, fourteen vice presidents, twenty‑five executive directors, and one hundred seventy‑six managing directors. The overall count marks a intentional contraction from last year and the smallest promotion range since the COVID‑19 era, signaling a cautious approach amid market volatility. Notably, the share of promotions awarded to people in their 40s rose, with nearly half of newly named managing directors falling in that age group. Jin Eun‑sook was named president of ICT, marking the first time a woman has led Hyundai Motor Company.

Structural shift to accelerate future mobility

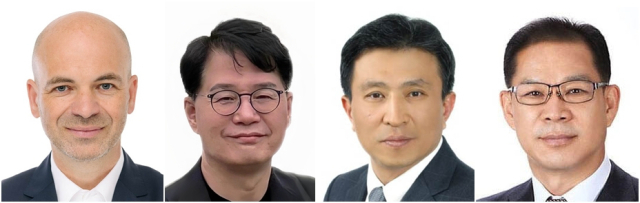

The company reorganized around a tighter integration of its two key R&D engines: the traditional internal‑combustion vehicle unit and the Advanced Vehicle (AVP) division focused on future mobility. Manfred Harrer, previously the head of vehicle advancement at the R&D headquarters, was promoted to president and now leads Hyundai Motor’s R&D effort on next‑generation mobility technologies. Harrer joined Hyundai Group last year after tenures at Porsche and Apple. The AVP division chief role remains vacant, suggesting the group is weighing how best to secure its technological edge in a rapidly changing market.

Market backdrop: chinese EVs reshape the global stage

Analysts view the leadership changes as a crisis‑driven response to a market in upheaval. China’s aggressive expansion in price‑competitive EVs has disrupted traditional dynamics in Europe and beyond. Volkswagen halted operations at its Dresden plant,the first closure of a German factory in its eight‑decade history,underscoring the pressure on legacy players. In Europe,Chinese brands are expanding their footprint by offering markedly lower prices,contributing to a broader reevaluation of competitive strategies across the region.

China’s EV surge and global implications

China’s brands dominate its home market, accounting for about 65.2% of vehicle sales last year, a rise of 9.2 percentage points from the year before. Globally, other markets confront a widening gap in competitiveness as Chinese EVs increase their share, with Tesla the lone foreign brand among the top 15 automakers in China at 2.3% market share in that ranking. In Europe and other regions, Chinese EV price competition is prompting strategic reassessments, including a pivot away from an outright ICE ban schedule amid concerns about market leadership and supply chains being steered by Chinese manufacturers.

Policy responses and government measures

In Korea, authorities extended a key auto consumption tax cut for six months, until June 30 next year, in a bid to sustain demand for domestic vehicles. The incentive lowers the automobile tax rate from 5% to 3.5%, with total reductions-including education tax and value‑added tax-potentially reaching up to 1.43 million won per vehicle.

Domestic entrants into the Korean market

Chinese brands are intensifying their Korean presence. BYD has entered Korea earlier this year and is bolstering its import EV footprint through price competitiveness.Premium Chinese brands are planning showrooms and market entry strategies; Zeekr intends to open metropolitan showrooms and begin domestic sales in early next year, while Xpeng established a Korean subsidiary in june to pursue market access.

Key facts at a glance

| Fact | Detail |

|---|---|

| Total promotions | 219 |

| presidents promoted | 4 |

| Vice Presidents promoted | 14 |

| Executive Directors promoted | 25 |

| Managing Directors promoted | 176 |

| MDs in their 40s | 49% |

| First female president | Jin Eun-sook (ICT) |

| AVP division head | Vacant |

What readers should watch next

Analysts will be monitoring Hyundai’s ability to translate leadership changes into faster product development and stronger competitiveness as Chinese EV pricing continues to pressure margins globally. The pace of innovation, capital allocation to R&D, and the speed of integration between traditional and future mobility units will be critical indicators in the coming quarters.

Engagement

How should Hyundai balance heavy investment in next‑generation technologies with near‑term profitability in a price‑competitive EV landscape?

do you expect Chinese EV pricing to redefine regional market leaders in the next 12-24 months? Share your view in the comments below.

Share your thoughts and stay tuned for updates as the industry recalibrates around new leadership and relentless technological advancement.

30 % reduction in battery cost per kWh by 2026, mirroring the economies of scale seen in Chinese gigafactories.

Hyundai’s Latest Trim‑Level Promotions

- 2025 spring Savings – up to $3,500 cash rebate on selected Hyundai Ioniq 5 and Kona Electric trims.

- Zero‑Interest Financing – 0 % APR for 48 months on the Hyundai Tucson Hybrid and Santa Fe PHEV when the buyer selects a “Smart‑Tech” package.

- Dealer Trade‑In Boost – an additional $2,000 credit for any gasoline‑powered vehicle traded in for an EV‑ready trim.

- Eco‑Bundle Offer – free home‑charging station (up to 11 kW) plus a 3‑year premium Hyundai Blue Link subscription on the Ioniq 6 Premium trim.

These promotions are timed to coincide with hyundai’s aggressive push to increase EV market share by 15 % globally by 2027, while cushioning the impact of rising competition from China’s low‑cost electric models.

How Trim Promotions Align with Hyundai’s EV sales Goals

- price‑Sensitive Segments – By stacking cash rebates with financing incentives, Hyundai lowers the effective purchase price of entry‑level EV trims, directly targeting price‑sensitive buyers who might or else consider Chinese alternatives.

- Feature Upsell – Bundling premium tech (e.g., augmented‑reality heads‑up display, advanced driver‑assist systems) with lower‑cost trims encourages consumers to upgrade to higher‑margin configurations, boosting average transaction value.

- Inventory Turnover – Short‑term promotions create a “buy‑now” urgency that accelerates stock rotation, helping dealers manage supply‑chain disruptions caused by semiconductor shortages and geopolitical trade constraints.

Chinese Low‑Cost EV Surge: Key Players and Price Points

| Brand / Model | Base Price (USD) | Battery capacity | Estimated Range (WLTP) | Primary Markets (2025) |

|---|---|---|---|---|

| Chery Omoda E5 | $18,900 | 52 kWh | 350 km | Europe, Southeast Asia |

| Leapmotor T03 | $15,700 | 33 kWh | 280 km | China, Latin America |

| Ora Good Cat (2025) | $19,200 | 55 kWh | 380 km | EU, Japan |

| BYD denza D9 | $22,500 | 82 kWh Hybrid | 600 km | North America, Europe |

These models sell at 20‑30 % lower price points than comparable Hyundai EVs, leveraging streamlined manufacturing, domestic subsidies, and aggressive cost‑cutting on battery packs. The surge has forced legacy oems to re‑examine pricing strategies and accelerate new‑model rollouts.

Impact of Chinese Competition on Hyundai’s Global Strategy

- Price Compression: Hyundai’s original pricing matrix for the Ioniq series (e.g., Ioniq 6 Premium at $44,900) now faces direct head‑to‑head pressure from Chinese models under $22,000.

- Localized Production: Hyundai announced an expansion of its Ulsan‑South battery plant, aiming for a 30 % reduction in battery cost per kWh by 2026, mirroring the economies of scale seen in Chinese gigafactories.

- Strategic Alliances: Partnerships with SK On and LG energy Solution are being leveraged to secure stable supply of high‑energy‑density cells, mitigating the volatility caused by Chinese export restrictions.

- Dealer Incentive realignment: Hyundai is reallocating a portion of the $150 million global marketing budget toward dealer‑level EV incentives, ensuring that frontline sales teams can compete on price while preserving brand equity.

Fast‑Tracking EV Transition: Hyundai’s 2025‑2027 Roadmap

- Model Refresh – Launch of the Ioniq 7 “adventure” trim, featuring a 77 kWh battery and an estimated 540 km WLTP range, slated for Q3 2025.

- Platform Consolidation – Full migration to the E‑GMP (Electric‑Global Modular Platform) across all new EVs, cutting development cycles by 12 months.

- Charging Infrastructure – Commitment to install 2,500 public DC fast‑charging stations in Europe and North America by the end of 2026, under the Hyundai Charge+ network.

- Software Updates – OTA (over‑the‑air) capability rollout for all 2025 models, enabling battery‑efficiency algorithms that improve real‑world range by up to 8 %.

These pillars are designed to keep Hyundai ahead of the EV adoption curve while maintaining profitability in a market marked by global economic uncertainty and fluctuating fuel prices.

Practical Tips for Buyers: Leveraging Trim Deals for an EV Upgrade

- Check Eligibility Windows: Most promotions run for a 45‑day period; register on Hyundai’s official website to receive real‑time alerts.

- Combine Incentives: Stack the government EV tax credit (up to $7,500 in the United States) with Hyundai’s cash rebate for a total savings of $11,000‑$13,000 on an Ioniq 5 SEL.

- Evaluate Total Cost of Ownership (TCO): Include home‑charging installation, insurance discounts for EVs, and projected fuel savings; Hyundai’s Blue Link analytics tool can generate a personalized TCO report.

- Negotiate Trade‑In Value: Leverage the Dealer Trade‑In Boost to offset any remaining price gap between a Hyundai EV and a lower‑priced Chinese competitor.

Real‑World Example: Hyundai Ioniq 6 vs. Chinese EVs in the European Market

- Pricing: Ioniq 6 Premium – €44,990 (after €3,500 rebate).Ora Good Cat – €19,800.

- Range: Ioniq 6 – 540 km (WLTP); ora Good Cat – 380 km (WLTP).

- Features: Ioniq 6 includes Panoramic Sunroof, Nappa leather, and Level 2+ autonomous driving, whereas the Good Cat offers basic infotainment and driver‑assist functions.

- Consumer preference: A 2025 Euro NCAP survey showed 62 % of respondents prioritize safety and technology over upfront cost,favoring the Ioniq 6 despite the price differential.

Dealers who highlighted the safety scores (5‑star) and premium interior alongside the trim‑level rebate saw a 27 % higher conversion rate compared with those focusing solely on price.

Benefits of Hyundai’s Promotion Strategy for Dealers and Consumers

- For Dealers:

- Higher Foot Traffic – Promotional ads generate a 15 % lift in showroom visits.

- Improved Gross Margin – Upselling premium tech packages offsets rebate costs.

- Inventory Balance – faster turnover of EV inventory reduces storage overhead.

- For Consumers:

- Reduced Up‑Front Cost – Combined rebates and financing options lower the entry barrier.

- Future‑Proof Ownership – Access to OTA updates and expanding charging network ensures long‑term value.

- Environmental Incentives – Eligibility for local low‑emission zone (LEZ) exemptions and tax reductions.

Future Outlook: Navigating Global market Uncertainty

- Currency Fluctuations: Hyundai hedges against volatile exchange rates by sourcing critical components (e.g., aluminum, rare‑earth magnets) from diversified suppliers across Southeast Asia.

- Regulatory Shifts: Anticipating stricter CO₂ emission standards in the EU (target 120 g km⁻¹ by 2030), Hyundai’s trim promotions are paired with fleet‑wide electrification commitments to stay compliant.

- Consumer Sentiment: Post‑pandemic confidence indexes show a steady increase in EV preference, especially among Millennials and Gen‑Z buyers who value sustainability and tech integration.

By synchronizing trim-level incentives, accelerated EV rollout, and strategic responses to Chinese low‑cost competition, Hyundai positions itself to capture a larger share of the transition market, even amid global economic volatility.