(Bloomberg) — Bank of Japan Governor Haruhiko Kuroda has given investors a glimpse of what to expect when the world’s boldest experiment with ultra-loose monetary policy comes to an end.

Faced with continued market pressure, Kuroda surprised markets on Tuesday by saying he will allow the rate on Japan’s 10-year bonds to rise to 0.5%, double the previous ceiling of 0.25%.

It remains to be seen if this is a strategic adjustment to buy time on his yield curve control (YCC) until his decade-long term ends in April or if it is the beginning of the end of his easing. unprecedented money.

But one thing is clear: a crack has opened that markets around the world will continue to price in in the coming weeks and months.

“This is a step towards an exit, whatever the Bank of Japan calls it,” said Masamichi Adachi, chief Japan economist at UBS Securities and a former official at Japan’s central bank. “This opens the door to the possibility of a rate hike in 2023 under a new governor.”

strong rise of the yen

The yen strengthened strongly against the dollar after the decision and continued higher, briefly touching 132.00 from 137.16 immediately before the decision. The yield on 10-year Japanese government bonds rose to 0.46%, from 0.25% previously, following the Bank of Japan’s decision.

Japanese bank shares rose in afternoon trading as investors expected better earnings for financial institutions, but Tokyo shares broadly closed lower.

The ripple effect also spread outside of Japan, with repercussions ranging from US stock index futures to the Australian dollar and gold.

The market movements suggest that investors interpreted the decision as a tightening measure.

But another way of looking at the 78-year-old governor’s latest surprise is as a move to make the yield curve control program more, not less, sustainable.

“This confirms our view that the Bank of Japan is determined to maintain the policy of yield curve control even after a leadership change in April next year,” said Shigeto Nagai, a former Bank of Japan official and chief of staff. Japan research in Oxford Economics. “It appears that the BOJ has decided to accept effective tightening as a cost in order to make the YCC policy more sustainable.”

That was the message Kuroda conveyed at his post-decision press conference, saying the adjustment is designed to increase the effectiveness of his flagship program. Kuroda has two more meetings to oversee before he ends his term, which means it will be up to his successor to complete the path towards monetary policy normalization.

A path that seems irreversible

And Tuesday’s market swings underscore how difficult it will be to backtrack on policy, given the mix of unorthodox measures supporting the Bank of Japan stimulus: keeping interest rates negative in the short term, locking rates at 10 years close to zero, massive asset purchases and government intervention in currency markets to offset the fall in the yen.

Any misstep by the new governor could unleash global market turmoil.

“The Bank of Japan has created so much stress on the markets this year with its monetary policy – the spring has been so tight – that the shock could be huge when it finally decides to release it,” said Vishnu Varathan, head of economics and strategy at Mizuho bank. of Singapore, before the meeting on Tuesday. “It will destroy every aspect of the markets.”

A possible impact around the world

The biggest concern for the rest of the world is that it could cut the last remaining leash on global bond rates and trigger a sell-off of dollar assets in favor of the yen. Tuesday’s tightening capped a year in which virtually all major central banks have tightened monetary policy, China being the notable exception.

If sustained tightening causes Japanese investors such as banks and pension funds to dump their overseas investments, including global equities, it could even fuel contagion among assets, including those in emerging markets.

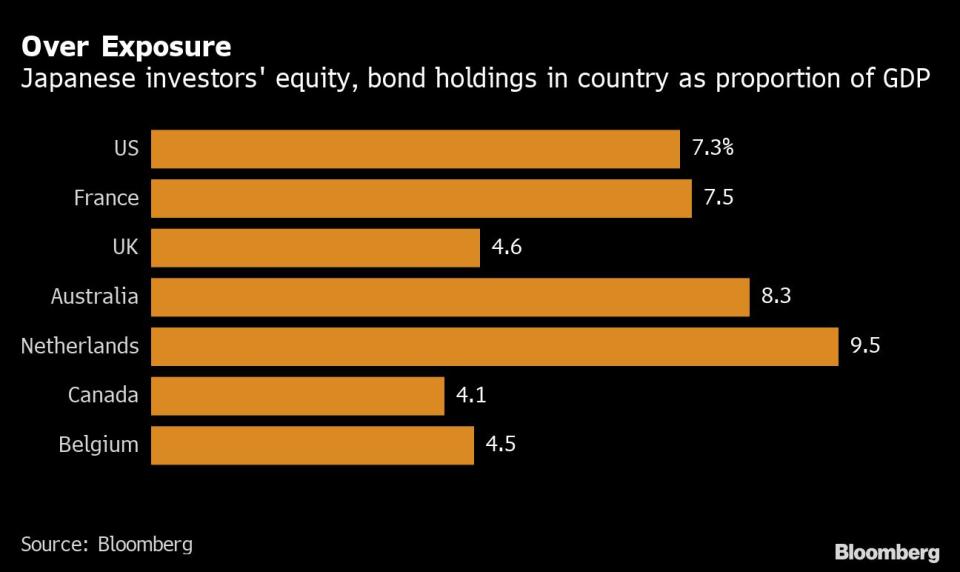

Japanese investors have more than $3 trillion invested in stocks and bonds abroad, more than half of them in the United States. Other countries such as the Netherlands, Australia and France are also vulnerable to a possible repatriation of Japanese funds, according to Bloomberg data.

Ahead of Tuesday’s meeting, Amir Anvarzadeh, a strategist at Asymmetric Advisors Pte, which has closely followed Japanese markets for three decades, said: “Allowing rates to rise could trigger a tsunami of Japanese money abroad coming home ”. “That’s the big ‘reset’ move.”

You may also be interested in | VIDEO: How the decisions of the Federal Reserve will affect our daily lives

//

Nota Original:Kuroda Shocker Is Just the Start of BOJ’s Risky Path Toward Exit

—With the collaboration of Taiga Uranaka, Isabel Reynolds, Yoshiaki Nohara, Yuko Takeo and Paul Jackson.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.