This week, 12 analysts participated in the Kitco News Gold Survey, in which experts appear to have largely dismissed any downside risks to gold prices in the near term.

Gold price today February 11: World gold has established a solid bottom

The most impressive moves in the gold market were made earlier this week, when trading began Sunday night above $2,041 an ounce, then fell once more to a weekly low of $2,016 on Monday. at 9 a.m. (European time) on Monday morning.

Evolution of world gold prices. Source: Tradingeconomics

Gold prices then largely traded within that range, although the spot market set a weekly high of $2,042.53 on Wednesday morning and tested support near $2,021 on Thursday as well. and Friday.

Kitco News’ latest weekly gold survey shows that Wall Street and Main Street both appear to be in agreement on price expectations. Both see little chance of a significant sell-off in the coming days as the market comes to a consensus forecast of “stable with a chance of a profit” next week.

Adrian Day, Chairman of Adrian Day Asset Management, sees gold price action continuing to move sideways in a positive direction. “Gold fell once more following Federal Reserve Chairman Jerome Powell quashed expectations for a near-term rate cut,” he said. Gold appears to have established a solid bottom and will soon start rising once more.”

James Stanley, senior market strategist at Forex.com, has returned to the bullish camp following casting doubt on gold’s short-term potential last week. “Gold has held above the $2,000 support zone and even as the US Dollar had its biggest two-day rally in a year, gold still held high support,” he said. So the bullish structure is still there and there are still many factors protecting that structure.”

Stanley believes that the next price trend will be driven by the CPI report. “If we see the core CPI rise above 4% year-on-year, that might pose some risks that might be negative for gold,” he said. However, the strategist expects the CPI to decline. light and that might present an opportunity for bulls.

Bob Haberkorn, Senior Commodities Broker at RJO Futures, said Friday’s weakness in gold prices was due to the market reacting to China data while betting on US data next week. Haberkorn also pointed out that the rising stock market is weighing on gold prices. “The US stock market is currently trading with the S&P above 5000 and the NASDAQ is hitting highs, so gold will lose a bit of its appeal,” he said.

He said currently gold prices are stuck between $2,000 and $2,075. Gold needs a rise above $2,075 to breakout. He thinks this might happen next week with data coming out. However this week, the US stock market is strong, China’s inflation data is weaker than expected, this is an environment where gold is unlikely to have any price increase.

Haberkorn also sees downside risks next week. He said that if gold returns to $1,950 and possibly even beyond, some bulls might push prices even lower to reset gains. He emphasized that gold’s short-term direction will really depend on inflation data. “If the results are better than expected here, gold prices will likely recover which would signal to the Fed that they are more likely to cut interest rates,” Haberkorn said. If it is higher than expected, gold might lose the $2,000 mark.”

Haberkorn agrees that the Biden administration’s retaliatory strikes once morest Iran’s allied groups were predetermined when they occurred and that markets are now awaiting the next geopolitical impact.

This week, 12 analysts participated in the Kitco News Gold Survey, and Wall Street appears to have largely dismissed any downside risk to gold prices in the near term. Four experts, or 42%, expect to see higher gold prices next week, while only one analyst, representing a meager 8%, predicts prices will fall. 6 experts, accounting for half of those surveyed, predict gold prices will move sideways next week.

Meanwhile, 165 votes were cast in Kitco’s online polls, with a near majority of Main Streeters maintaining an optimistic attitude. 77 retail investors, accounting for 47%, expect gold to increase next week. Another 37%, or 22%, predicted lower prices, while 51 respondents, or 31%, had a neutral view on the near-term outlook for precious metals.

US inflation data will once once more take center stage next week, with the release of the January CPI report on Tuesday morning, the final PPI print for December on Wednesday and the first PPI of the month 1 on Friday.

Markets will also pay attention to weekly US jobless claims and retail sales in January, as well as the Philly and New York Fed manufacturing indexes, all due for release on Wednesday. Thursday morning, followed by housing starts and building permits for January as well as the first UMichigan consumer figures for February on Friday.

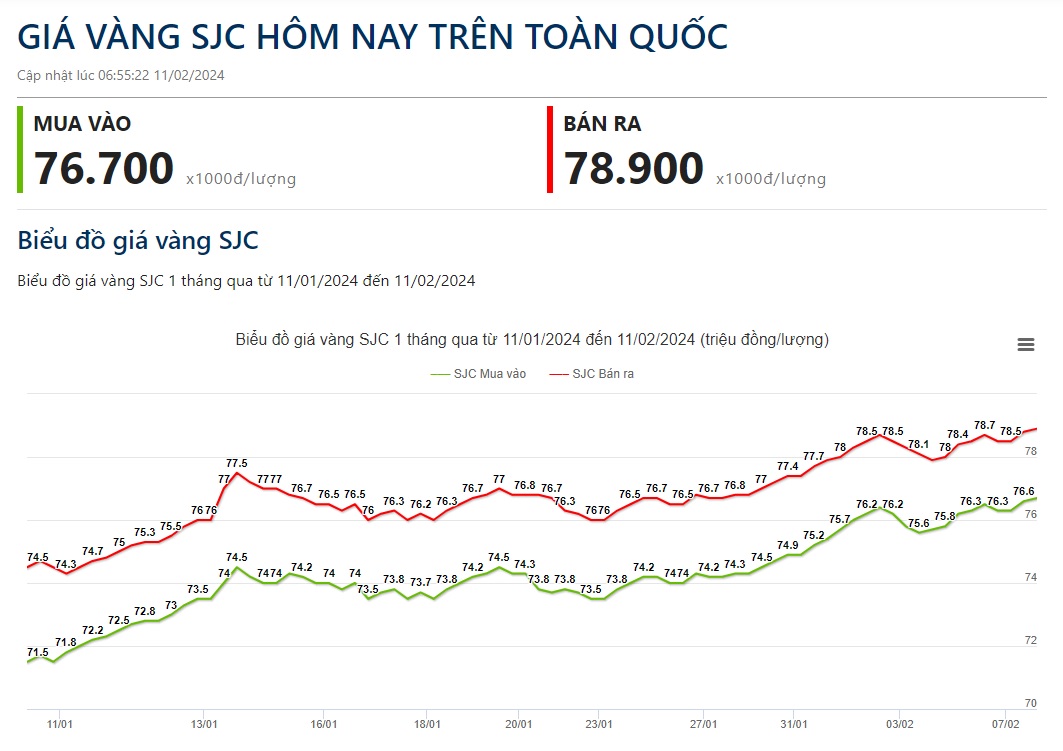

Gold price today February 11: Domestic gold is anchored at nearly 79 million VND/tael

Today’s SJC gold price is anchored by brands at nearly 79 million VND/tael nationwide, specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 76.7 million VND/tael purchased and 78.92 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang but selling is 20,000 VND lower.

SJC gold bar price was listed by Phu Quy at 76.65 million VND/tael purchased and 78.9 million VND/tael sold.

Meanwhile, SJC gold bars are being bought by PNJ brand at 76.7 million VND/tael and sold at 78.9 million VND/tael.

Bao Tin Minh Chau is listed at 76.75 million VND/tael and 78.85 million VND/tael respectively.

Meanwhile, DOJI listed the price of SJC gold bars at 76.55 million VND/tael purchased and 78.85 million VND/tael sold.

The difference between domestic and world gold prices is regarding nearly 19 million VND.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael