The Vanishing Digital Record: How Disaster Response is Entering the Age of Ephemeral Evidence

In the wake of the devastating 2024 ‘dana’ floods in Spain, a troubling pattern is emerging – a gap in the official record, not of events themselves, but of the communication surrounding them. While acting president Carlos Mazón detailed his phone calls during the crisis, crucial exchanges via WhatsApp, the ubiquitous messaging app, remain unaccounted for. This isn’t simply a Spanish issue; it’s a harbinger of a future where disaster response, and potentially all high-stakes decision-making, is increasingly shaped by – and obscured by – ephemeral digital evidence.

The WhatsApp Shadow: A New Frontier in Accountability

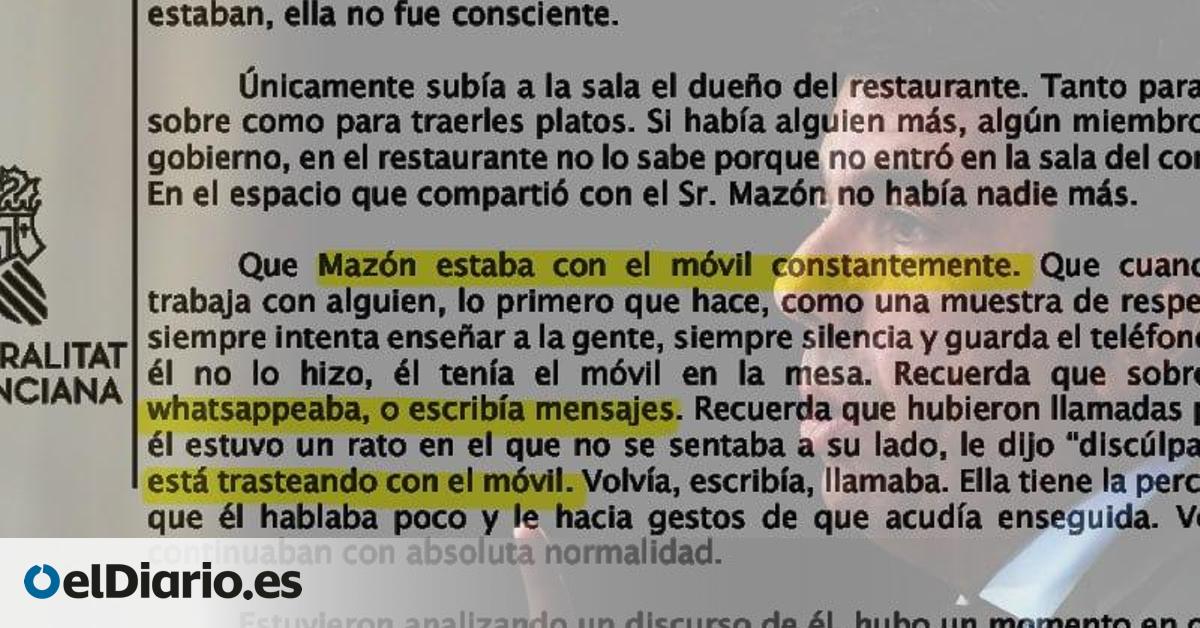

The case centers on discrepancies in the timeline of events following the October 29th disaster, which claimed 229 lives. Journalist Maribel Vilaplana’s testimony revealed Mazón was “constantly on his cell phone” while at a restaurant, raising questions about the content of those communications. Specifically, the focus is on WhatsApp, a platform favored for its speed and convenience, but also its inherent challenges for archiving and legal discovery. The fact that former councilor Salomé Pradas provided call logs but no messaging data, while Emilio Argüeso did submit WhatsApp records, highlights a critical inconsistency. This isn’t about proving wrongdoing, but about establishing a complete and transparent record of actions taken – or not taken – during a critical period.

Why Ephemeral Communication Matters in Crisis Management

The reliance on platforms like WhatsApp isn’t unique to this situation. Emergency responders, government officials, and decision-makers across all sectors are increasingly using instant messaging for rapid communication. This offers undeniable benefits – speed, accessibility, and the ability to share information quickly. However, these benefits come at a cost. Unlike traditional forms of communication like email or phone calls, instant messages are often not automatically archived, are easily deleted, and can be difficult to recover. This creates a “shadow record” – a parallel stream of information that exists outside of official channels and is vulnerable to loss or manipulation.

The Legal and Ethical Implications of Disappearing Data

The legal ramifications are significant. As seen in the ‘dana’ case, the absence of messaging data can hinder investigations and raise questions about transparency. But the issue extends beyond legal liability. Ethically, a complete record of communication is essential for learning from past mistakes and improving future responses. Without it, we risk repeating errors and undermining public trust. The potential for selective disclosure of information – presenting a curated narrative while withholding crucial context – is also a serious concern. RAND Corporation research highlights the growing challenges of preserving and analyzing digital evidence in legal and investigative contexts.

The Rise of ‘Dark Data’ and the Need for Proactive Preservation

This phenomenon contributes to the growing problem of “dark data” – information that organizations collect, process, and store during their regular business activities, but generally fail to use for other purposes. In the context of disaster response, dark data includes these unarchived WhatsApp messages, deleted emails, and temporary voice notes. The challenge isn’t just about collecting this data; it’s about proactively establishing policies and procedures for its preservation and analysis. This requires a shift in mindset, from viewing instant messaging as informal communication to recognizing its potential as a critical source of evidence.

Future-Proofing Disaster Response: Automated Archiving and AI-Powered Analysis

So, what can be done? The future of disaster response requires a multi-pronged approach:

- Automated Archiving: Implementing systems that automatically archive instant messages and other forms of digital communication, ensuring a complete and auditable record.

- Clear Policies: Establishing clear policies regarding the use of instant messaging for official business, including guidelines for data retention and disclosure.

- AI-Powered Analysis: Leveraging artificial intelligence to analyze large volumes of digital data, identifying patterns, anomalies, and potential risks. AI can help sift through the noise and highlight critical information that might otherwise be missed.

- Standardized Platforms: Encouraging the use of secure, standardized communication platforms designed for emergency response, with built-in archiving and audit trails.

The case of Carlos Mazón and the missing WhatsApp messages serves as a stark warning. As our reliance on ephemeral communication grows, so too does the risk of losing critical information during times of crisis. Proactive measures are no longer optional; they are essential for ensuring accountability, learning from the past, and building a more resilient future. The question isn’t whether digital evidence will play a role in future investigations, but whether we will be able to find it when we need it most. What steps will your organization take to ensure a complete digital record in a crisis?