Tesla (TSLA-US) on Wednesday (26th) announced fourth-quarter results that were stronger than market expectations, but after warning that there may be supply chain problems throughout 2022, the stock price fell as much as 5% after the market, and then rebounded to a small increase.

“Our own factories have been operating below capacity for several quarters with supply chain being the main limiting factor, and this is likely to continue into 2022,” Tesla said.

Tesla closed up 2.07% at 937.41 per share on Wednesday, as recently confirmed Dollar, rose 0.44% after hours to 941.56 per share Dollar。

Tesla Q4 Earnings (until 12/31) Key data vs. analyst expectations (Refinitiv survey)

- EPS (excluding one-time items): 2.52 Dollar vs. 2.36 cents

- Revenue: 65% YoY to 17.72 billionDollar vs. 16.57 billionDollar

- Net Profit: 760% YoY to 2.32 billionDollar (GAAP)、29Dollar (NON-GAAP)

- Gross profit margin: 27.4% from 26.6% in the previous quarter

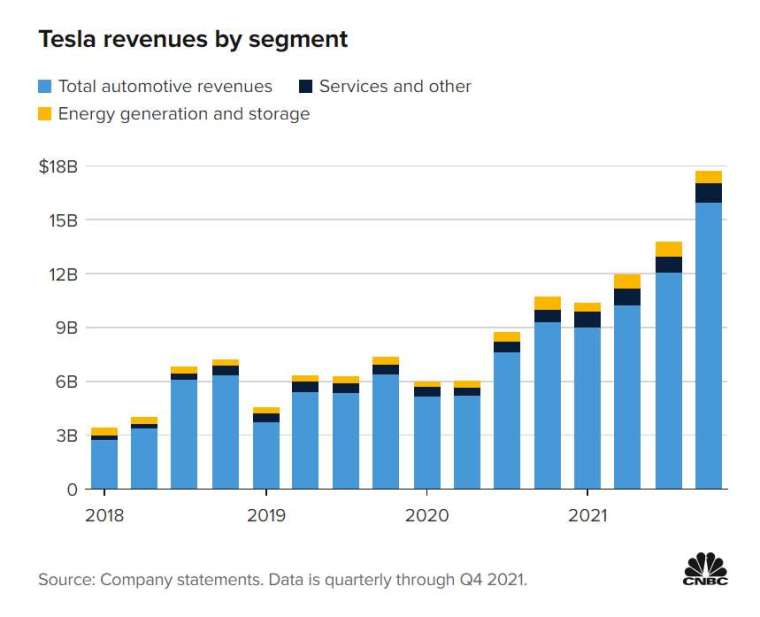

Q4 revenue distribution

- Car sales revenue: up 71% year-on-year to 15.97 billionDollar

- Energy production and storage revenue: down 8% y/y to 688 millionDollar (StreetAccount consensus estimate is 815.1 millionDollar)

Energy production and storage revenue came in below expectations and was the segment’s lowest revenue figure since the first quarter of 2021.

No new car launch this year, no heavy semi trucks and Cybertruck news

Musk said on a conference call Wednesday that he expects Tesla to remain constrained by chip supply in 2022 and that Tesla will not launch a new model this year. “We won’t be launching new models this year because parts supply is still limited.”

The company will instead focus on engineering and tooling for future vehicles, he said.

The Semi heavy-duty semi-truck and experimental Cybertruck hatchback that Tesla shareholders have been waiting for have been delayed.

Musk also mentioned that the company is not currently developing 25,000Dollar, which is a far cry from the ambitions he revealed in his Tesla Battery Day 2020 speech.

Musk tweeted last November, “This year has been a supply chain nightmare and it’s not over yet, I’ll provide an updated product roadmap on my next earnings call.”

FSD and Texas Plant Progress

Tesla revealed that its experimental driver assistance system testing program, called FSD Beta, has expanded to about 60,000 users in the United States.

Both the California Department of Motor Vehicles (DMV) and the U.S. National Highway Traffic Safety Administration (NHTSA) have launched investigations into Tesla and customers testing the unfinished new driver-assistance system on U.S. roads.

“Fully self-driving (FSD) software remains one of our key areas of focus,” Tesla said. “Our software-related earnings should accelerate overall company profitability over time.”

Tesla also confirmed that Model Y production will begin at the Austin, Texas plant at the end of 2021, and deliveries will begin at the plant after the certification process.

The company noted that Tesla’s Fremont, Calif., factory (Tesla’s first U.S. factory) produced record production in 2021 and now aims to have a capacity of more than 600,000 vehicles per year.