According to data released by the United States on Monday (15th), the New York Fed’s manufacturing index plummeted to -31.3 in August, far below the market’s expected 5. Compared with the previous value in July, it fell by more than 42 points, the highest in the history of the index. The second-biggest drop, after April 2020, meant a sharp weakening of manufacturing activity in New York, the heart of the U.S. economy.

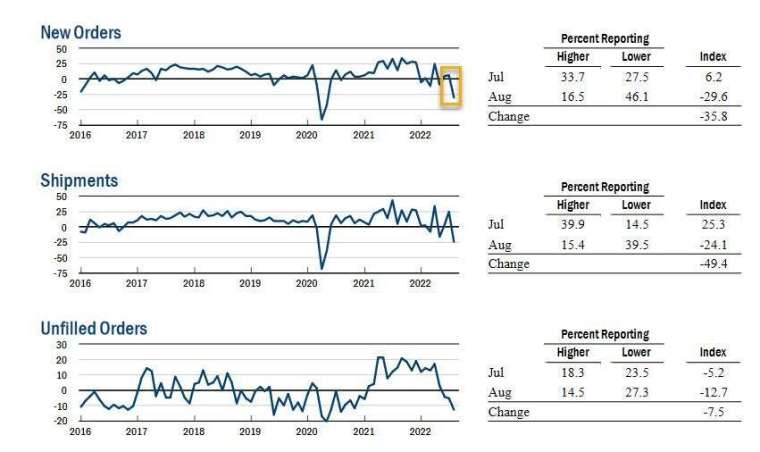

According to the breakdown of the data, various indicators have declined to varying degrees, the most serious of which is the index of new orders and shipments, indicating a sudden drop in demand. The data showed that the new orders index fell to -29.6 from 6.2 in July, and the shipment index plummeted to -24.1 from 25.3 in July, both hitting new lows since May 2020. In addition, the unfilled orders index fell to -12.7, the third straight month of contraction.

Respondents also revealed a pessimistic view, with 44% saying the situation had worsened and only 12% saying it had improved in August. These data all suggest that a hard landing for the U.S. economy may be inevitable.

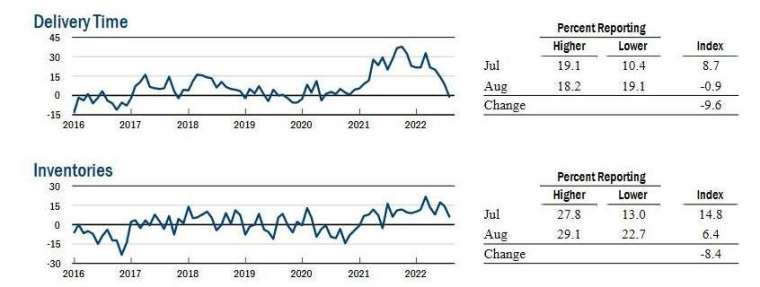

It is worth noting that the delivery time index fell to near zero, remaining stable for the first time in nearly two years. The inventory index fell to 6.4, indicating a slight increase in inventories.

Labor market payrolls rose slightly, with the employment index down 11 points to 7.4; however, the average number of hours worked per week fell, with the average workweek index falling to -13.1.

Elsewhere, the price paid index fell 9 points to 55.5, its lowest level in more than a year, indicating that cost increases were slowing, and the price charged index was little changed at 32.7.

Looking ahead, companies do not expect much improvement in business conditions in the next 6 months, with data showing future business conditions at 2.1, up from July.

Although the U.S. inflation data in July has fallen, the Federal Reserve (Fed) is likely to face an increasingly difficult situation, and the U.S. economy may be sinking deeper and deeper into the quagmire of recession.

Thomas Costerg, senior U.S. economist at Pictet Wealth Management, said that industries have placed a large number of orders during the new crown epidemic, and the reason for the sharp decline in orders may be that manufacturers are re-examining orders and even canceling them out of many considerations.