archyde news

- The US30 made a strong bullish rebound at the 23.6% Fibonacci retracement level. The bullish rebound from the US30 might indicate a larger potential upside correction.

- The GBP/USD made a bullish swing of 500 pips. But despite the sharp rise, the price action is technically still in a downtrend. let’s review

- Bitcoin (BTC/USD) hit the -27.2% Fibonacci target around the round psychological level of $20,000. Let’s review what’s next for the major cryptocurrency

Our weekly Elliott Wave analysis reviews the GBP/USD 4-hour chart, the cryptocurrency Bitcoin 4-hour chart and the US30 daily chart.

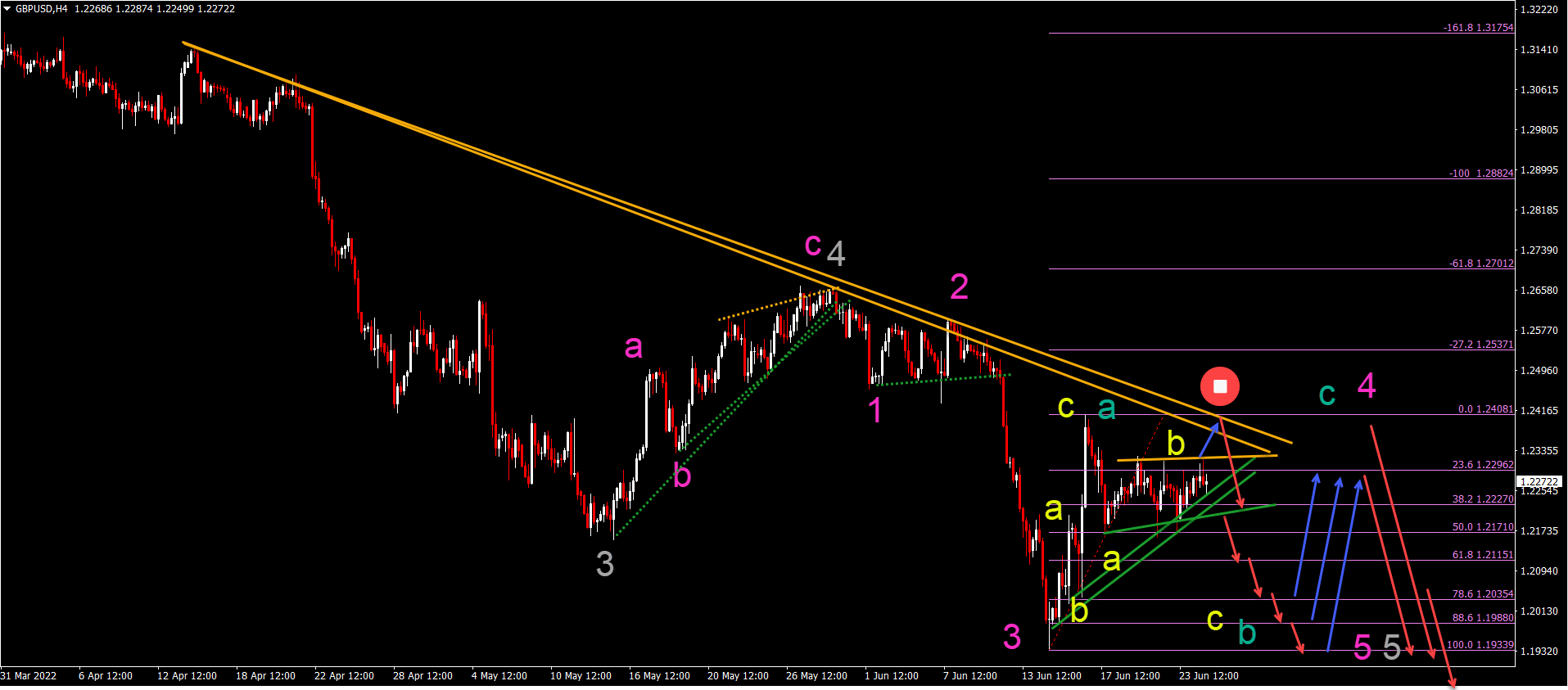

Bullish GBP/USD price swing in wave 4?

The GBP/USD made a bullish swing of 500 pips. But despite the sharp rise, the price action is technically still in a downtrend. Let’s review:

archyde news

- GBP/USD broke below the 1.20 round level but the bulls regained control quickly and unexpectedly.

- The bullish price swing, however, appears to consist of an internal ABC pattern (yellow) within wave A (green).

- Our Elliott Wave analysis therefore favors a bearish ABC (yellow) within wave B (green).

- Wave B (green) might reach 78.6%, 88.6% or even the previous low (100%).

- A larger ABC (green) bullish correction might complete a wave 4 (pink). This remains valid as long as the price action stays below the wave 1 low.

- A break above the 1.2475-1.25 resistance zone would indicate a potential trend reversal or retracement.

- A new downtrend might see targets at 1.1850, 1.1750, 1.1650 and 1.15.

BTC/USD struggling to find bullish legs?

Bitcoin (BTC/USD) hit the -27.2% Fibonacci target around the round psychological level of $20,000. Let’s review the following for the main cryptocurrency:

- BTC/USD is attempting to construct a bullish retracement but price action remains hesitant to move away from the 20k area.

- However, it looks like the price action will complete a bullish ABC (green) in a choppy correction from wave 4 (pink).

- The most logical target for wave C (green) of wave (pink) is the 38.2% Fibonacci retracement level, but sometimes price action can retrace deeper.

- An upside break above the trend line (orange) and the 78.6% Fibonacci level renders the current bearish Elliott Wave analysis unlikely and invalid.

- A choppy and long bullish correction is typical of a wave 4 and would confirm this expected wave pattern.

- The downside target for wave 5 (pink) wave 5 (grey) wave A (purple) is around $17,500. A larger Wave B pattern might emerge from a larger ABC once Wave A is over.

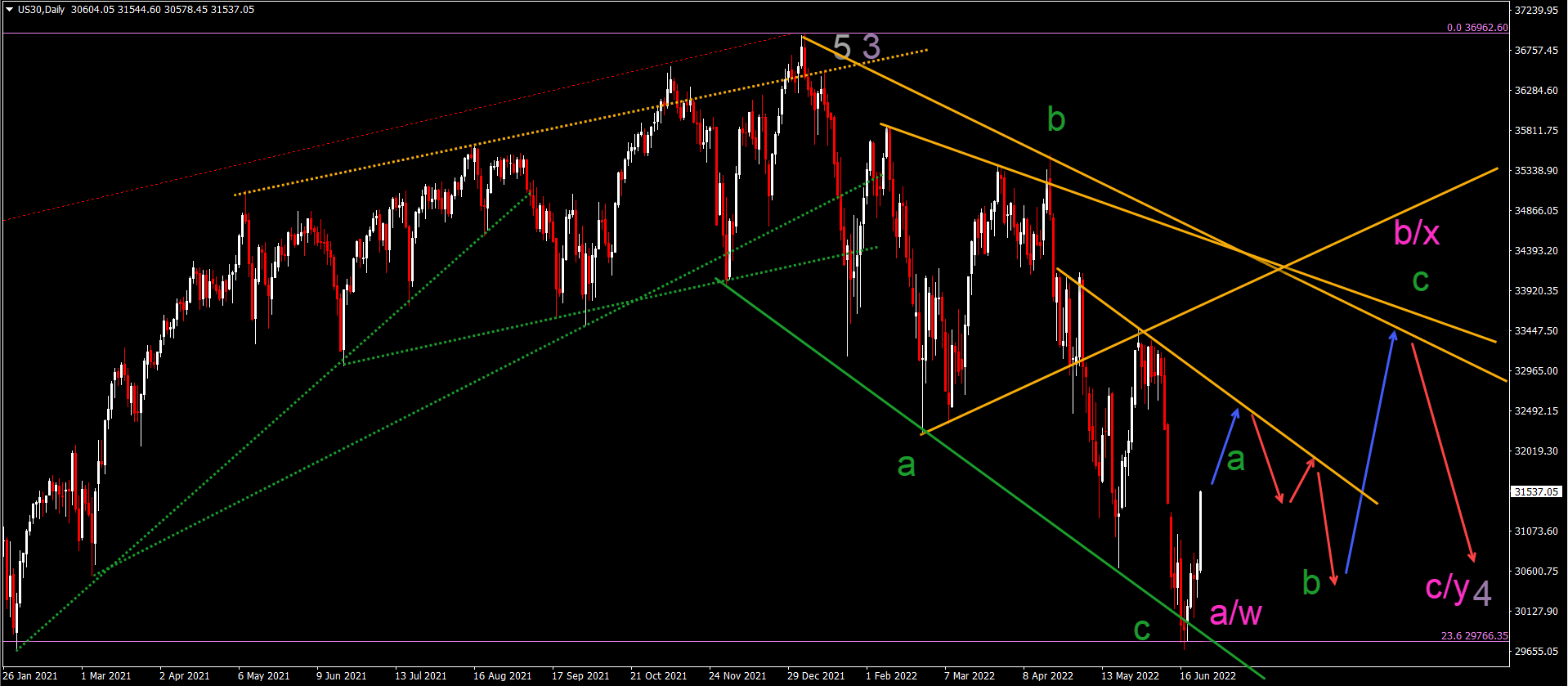

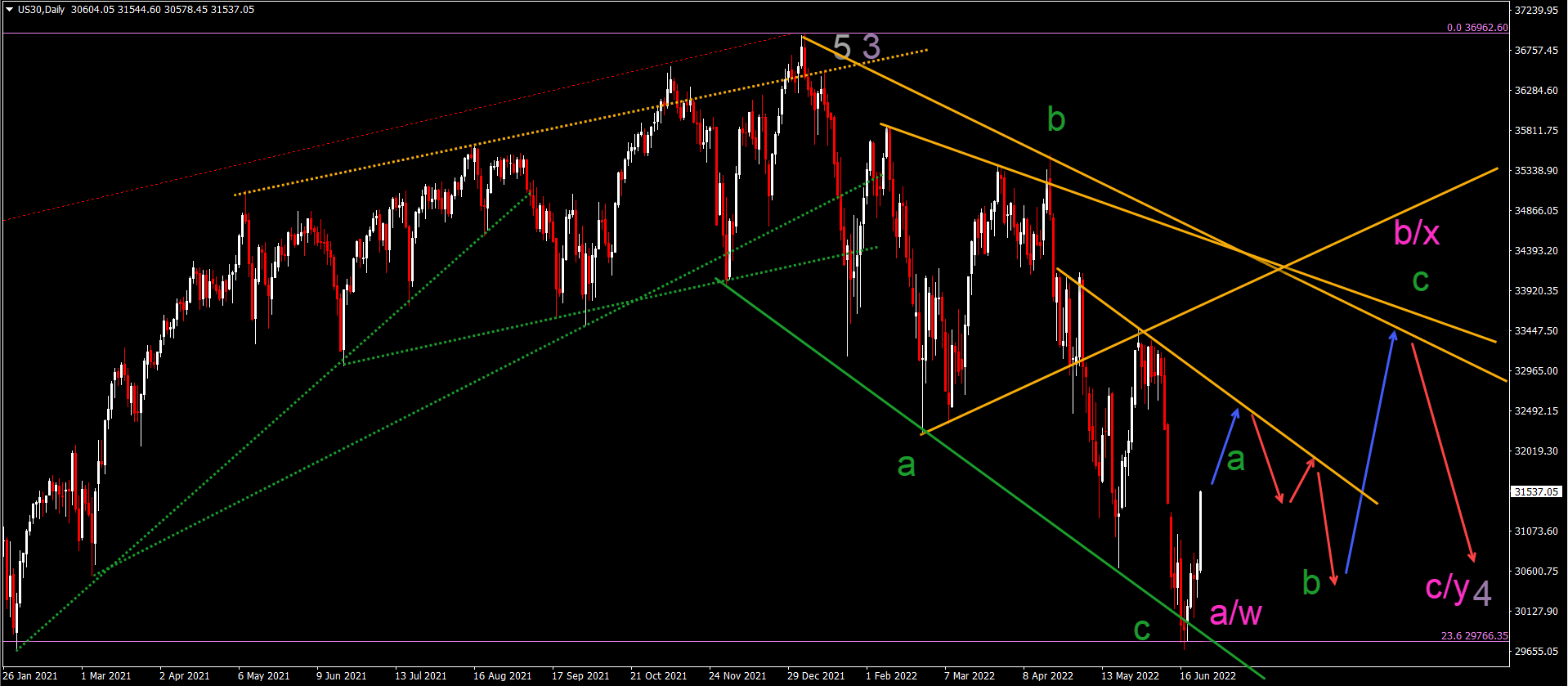

US30 Large Whipsaw but bearish remains in control

The US30 made a strong bullish bounce at the 23.6% Fibonacci retracement level:

- The bullish rebound from the US30 might indicate a larger potential upside correction.

- The price action, however, remains in a downtrend and the bullish bounce is likely a retracement.

- The downside correction likely completed an A or W (pink) wave of a larger ABC or WXY (pink) correction.

- If price action sets a higher low, then a bullish ABC (green) in wave B or X (pink) might see price action move towards resistance trend lines (orange).

- A bearish bounce and a continuation of the downtrend should emerge in a broad complex wave 4 (blue).