“`html

Undersea Cable Security becomes a Global Flashpoint as AI Demand Surges

Table of Contents

- 1. Undersea Cable Security becomes a Global Flashpoint as AI Demand Surges

- 2. The Rise of Subsea Cable Importance

- 3. Geopolitical Competition Heats Up

- 4. Growing Threats and Vulnerabilities

- 5. Defensive Measures and Technological advancements

- 6. The Rise of Tech Giant Involvement

- 7. How might China’s control over undersea cables impact the development and deployment of AI technologies globally?

- 8. US-China Undersea Internet Cables: A Critical Battleground for AI’s Future Connectivity and Power Dynamics

- 9. The Subsea Infrastructure Race: Why It Matters for AI

- 10. The Importance of Low Latency for AI Applications

- 11. China’s Expanding Subsea Cable Network

- 12. US Response: Countering China’s Influence

- 13. The Role of Private Companies & cable Ownership

- 14. Geopolitical Hotspots & Key Cable Routes

- 15. The Impact on Data Sovereignty and cybersecurity

washington and Beijing are engaged in a silent battle for dominance beneath the waves, as the critical infrastructure of the internet – undersea cables – becomes a focal point of geopolitical tension. This escalating competition, fueled by the exponential growth of Artificial Intelligence, is prompting governments worldwide to strengthen defenses against potential sabotage and espionage.

The Rise of Subsea Cable Importance

The modern internet relies heavily on a network of over 400 submarine cables spanning the ocean floors. These cables, a far cry from the telegraph lines of the 1850s, transmit 99% of global data traffic.Today’s artificial Intelligence boom is dramatically increasing demand, with spending on cable systems projected to jump to $15.4 billion by 2028, up from $900 million in 2023. This surge in investment is also driving growth in data centers located near cable landing points.

This infrastructure isn’t just about speed; it’s about economic power. The countries hosting these cable landings and data centers are poised to reap significant economic benefits.

Geopolitical Competition Heats Up

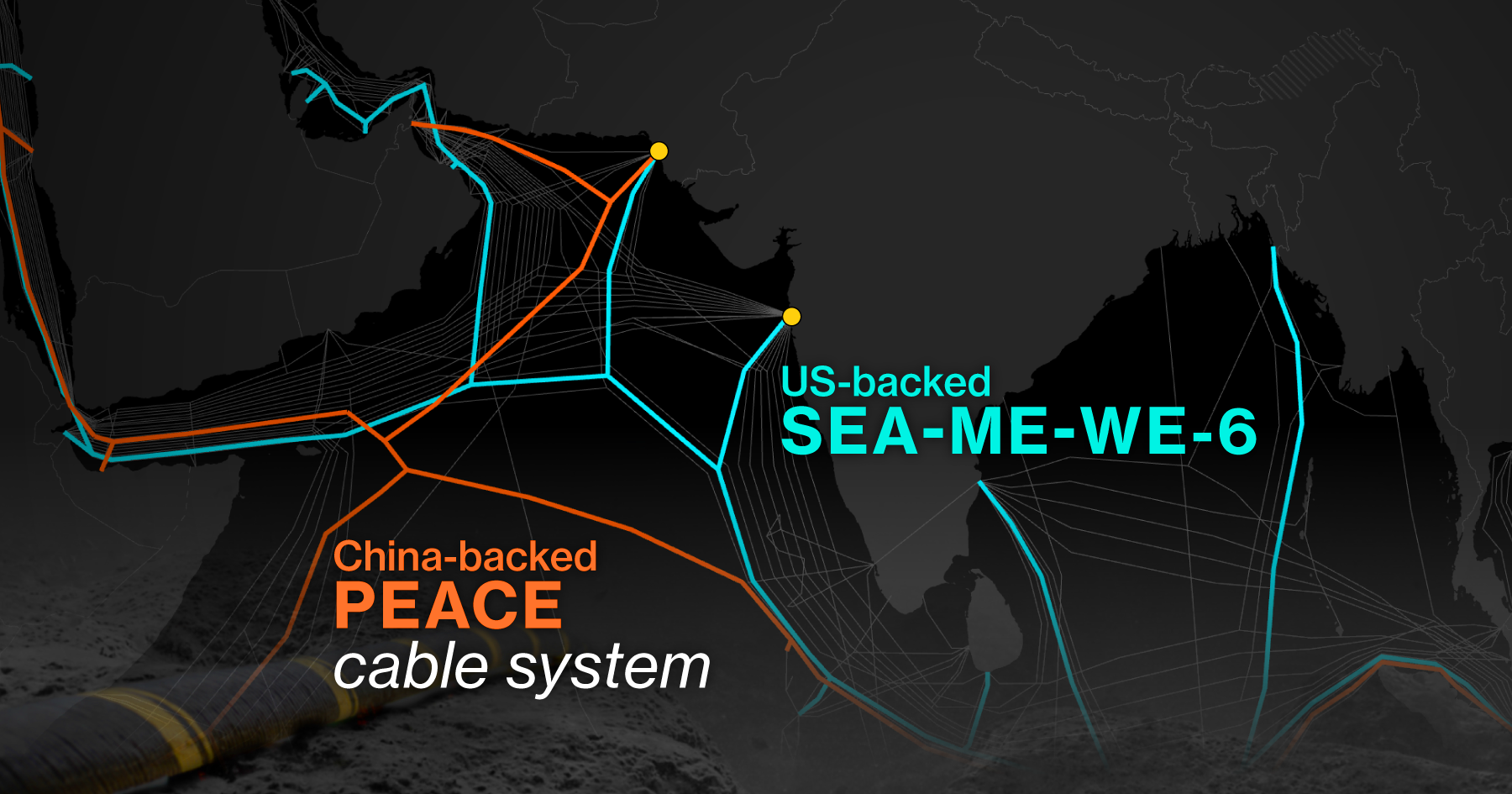

China is actively seeking to expand its influence in this domain, encouraging nations to opt for its cable networks, often with attractive financing options. Companies like HMN Technologies offer construction costs 20% to 30% lower than their competitors. The United States is responding with its own incentives, applying diplomatic pressure to dissuade countries like Vietnam from becoming overly reliant on Chinese infrastructure.

In 2021, a U.S. government agency reportedly offered training grants to telecom companies that chose SubCom over HMN Technologies for a $600 million network project, framing the decision as a matter of national security. New regulations approved by U.S. communications authorities in August aim to shield subsea cables from potential security threats by restricting the use of certain Chinese equipment.

Growing Threats and Vulnerabilities

Governments are increasingly concerned about the vulnerability of these cables. Approximately 200 cable faults occur each year, and physical access presents opportunities for espionage, sabotage, and disruption. While documented instances of malicious activity remain limited, the sheer scale and exposure of the network are prompting heightened vigilance.

Recent incidents have amplified these anxieties. In December 2024, an anchor dragging from a Russian ship severed five data and power cables in the Gulf of Finland, causing at least €60 million ($70 million) in damages. Former Russian President Dmitry Medvedev even warned in 2023 of potential retaliation against Western infrastructure if Russia were implicated in the Nord Stream pipeline explosions.

| incident | Location | Date | Impact |

|---|---|---|---|

| Anchor Damage | Gulf of Finland | December 2024 | Five cables severed,€60M+ damage |

| Nord Stream Warnings | Baltic Sea | 2023 | Threats of retaliation against undersea infrastructure |

Defensive Measures and Technological advancements

Europe is actively investing in new technologies to bolster cable security. NATO is utilizing Artificial Intelligence and deploying drones as part of its “Task Force X” initiative to monitor the Baltic Sea, with plans for a similar program in the North Sea. They are also investing in submersible robots capable of 3D-printing repairs to damaged cables. Denmark’s Prime Minister Mette Frederiksen recently warned of increased hybrid attacks and possible cable sabotage by Russia.

China is also enhancing surveillance capabilities. In 2015, China State Shipbuilding Corp. announced plans for an “Underwater Great Wall” – a network of undersea sensors in the South China Sea.

Private defense companies, such as Saildrone, are stepping in to fill the gap in maritime surveillance, as navies and coast guards lack the manpower to fully protect these critical assets.

The Rise of Tech Giant Involvement

The customary consortium model for building cable networks is being challenged by the growing dominance of U.S. tech giants like meta, Google, Microsoft, and Amazon. These companies are directly funding their own subsea cables to ensure reliable bandwidth and cater to the demands of cloud computing and data-intensive services. Amazon’s CAP

How might China’s control over undersea cables impact the development and deployment of AI technologies globally?

US-China Undersea Internet Cables: A Critical Battleground for AI’s Future Connectivity and Power Dynamics

The Subsea Infrastructure Race: Why It Matters for AI

The future of Artificial Intelligence (AI) isn’t just about algorithms and processing power; it’s fundamentally reliant on connectivity. And a important portion of that connectivity – roughly 99% of international data – travels through a vast,largely unseen network of undersea internet cables. This infrastructure is now a key arena of strategic competition between the United States and China, impacting everything from AI development and deployment to national security and economic dominance. The escalating tensions surrounding transpacific cables are reshaping the digital landscape.

The Importance of Low Latency for AI Applications

AI applications, notably those requiring real-time processing, are incredibly sensitive to latency – the delay in data transmission.Consider these examples:

* High-Frequency Trading: Milliseconds matter. Lower latency gives firms a competitive edge.

* Autonomous Vehicles: Real-time data exchange is crucial for safety and functionality.

* Remote Surgery: Precise, immediate feedback is essential for successful procedures.

* Cloud Gaming: A seamless experience demands minimal lag.

* Large Language Models (LLMs): faster response times improve user experience and scalability.

These applications, and the burgeoning field of edge computing that supports them, demand the highest possible bandwidth and lowest possible latency. Fiber optic cables are the current standard, but even incremental improvements in infrastructure can yield significant advantages. China’s push for dominance in AI is directly linked to its investment in and control over these critical pathways.

China’s Expanding Subsea Cable Network

China has been aggressively expanding its subsea cable network, both independently and through partnerships. This expansion isn’t simply about increasing capacity; it’s about establishing strategic control.

* HGC Global Communications: A key player in building and operating cables connecting China to southeast Asia,Europe,and the Middle East.

* china Mobile International: Investing heavily in cables to enhance connectivity across Asia and beyond.

* The Digital Silk road: A component of China’s Belt and Road Initiative, explicitly focused on building digital infrastructure, including undersea cables.

This expansion raises concerns about potential surveillance, data interception, and the ability to disrupt communications in times of conflict. The US government has actively scrutinized and, in certain specific cases, blocked cable projects with perceived security risks. Submarine cables security is a growing concern.

US Response: Countering China’s Influence

The United States is responding to China’s advances through a multi-pronged approach:

- Increased Investment: The US government is incentivizing the development of new cables, particularly those that bypass China-controlled infrastructure. This includes funding for research and development of advanced cable technologies.

- Strategic Partnerships: Strengthening alliances with countries like Japan, Australia, and India to build alternative cable routes. The APG cable system is an example of a collaborative effort.

- Security Reviews: Rigorous vetting of cable projects to identify and mitigate potential security threats. The Committee on Foreign Investment in the United states (CFIUS) plays a crucial role.

- Diversification of Routes: Encouraging the construction of cables landing in diverse geographic locations to reduce reliance on single points of failure.

- Promoting Open Standards: Advocating for open and interoperable standards for undersea cable technology to prevent vendor lock-in and ensure fair competition.

The Role of Private Companies & cable Ownership

the landscape of undersea cable ownership is complex. While governments play a role in funding and regulation, the majority of cables are owned and operated by private companies, including:

* TE SubCom: A leading provider of submarine cable systems.

* Alcatel Submarine Networks: Another major player in the industry.

* Reliance Jio: An indian telecommunications company investing heavily in subsea cables.

These companies navigate a delicate balance between commercial interests and geopolitical considerations. The debate over cable landing rights and access is a key point of contention. The concentration of cable ownership in a few hands also raises concerns about market power and potential manipulation.

Geopolitical Hotspots & Key Cable Routes

Several regions are particularly critical in this undersea cable battleground:

* South China Sea: A highly contested area with significant cable traffic. China’s territorial claims and military presence pose a threat to cable security.

* Taiwan Strait: A potential flashpoint for conflict, with numerous cables crossing the strait.

* Arctic region: As the Arctic ice melts, new cable routes are becoming viable, offering shorter distances between Europe and Asia. This is attracting increased interest from both the US and china.

* Indian Ocean: A vital transit route for cables connecting Asia, Africa, and Europe.

The Impact on Data Sovereignty and cybersecurity

the reliance on undersea cables raises vital questions about data sovereignty and cybersecurity.

* Data Localization: Countries are increasingly enacting laws requiring data to be stored within their borders. Under