In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

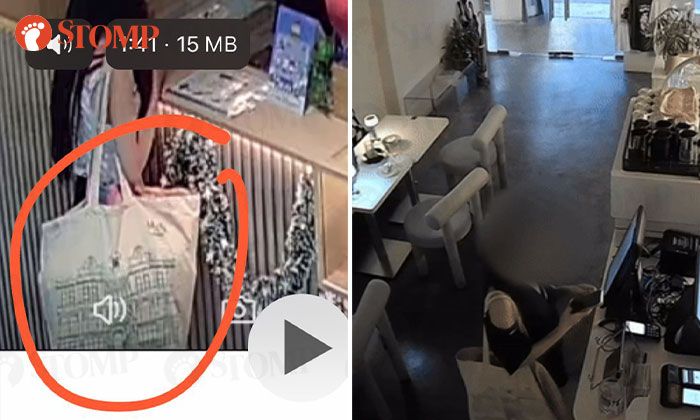

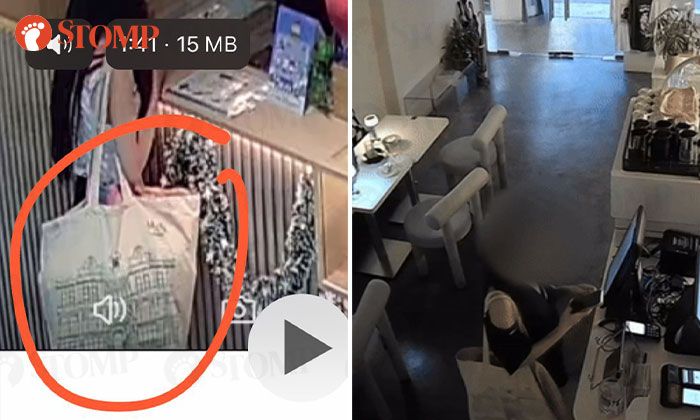

Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.

In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.

In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof. As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online. The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

A recent incident involving a woman attempting to purchase bubble tea using what appeared to be fraudulent proof of payment has sparked outrage and discussion online. The incident, which unfolded at a bubble tea shop, was captured and shared on social media, quickly going viral.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

A recent incident involving a woman attempting to purchase bubble tea using what appeared to be fraudulent proof of payment has sparked outrage and discussion online. The incident, which unfolded at a bubble tea shop, was captured and shared on social media, quickly going viral.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

A recent incident involving a woman attempting to purchase bubble tea using what appeared to be fraudulent proof of payment has sparked outrage and discussion online. The incident, which unfolded at a bubble tea shop, was captured and shared on social media, quickly going viral.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

A recent incident involving a woman attempting to purchase bubble tea using what appeared to be fraudulent proof of payment has sparked outrage and discussion online. The incident, which unfolded at a bubble tea shop, was captured and shared on social media, quickly going viral.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert

**Archyde:** Recently, there have been several incidents of individuals using fake payment confirmations to avoid paying for goods and services, frequently enough targeting small businesses like bubble tea shops. The term “Bubble Tea Bandit” has even emerged online.

Could you shed some light on how these scams work and what businesses can do to protect themselves?

**Expert:** Thank you for having me.

It’s alarming to see these “Bubble Tea Bandit” incidents becoming more common. they prey on the trust businesses place in digital transactions and the busyness of staff.

Typically, these scams involve manipulating screenshots of digital payment confirmations, frequently enough blurring key details like transaction dates and times to obscure their authenticity. Sometimes, they even use image editing software to fabricate entire confirmations.

**Archyde:** What steps can business owners take to avoid falling victim to these scams?

**Expert:** It’s all about vigilance and double-checking.

First, train your staff to be aware of common red flags like blurry screenshots, inconsistent transaction details, or a customer urgently insisting on a swift transaction.

Second, implement a system for secondary confirmation. This could be verifying the transaction directly through the payment platform, asking for a second ID document, or even calling the customer’s bank to verify the payment. Remember, it’s better to be safe than sorry.

Lastly, invest in reliable point-of-sale (POS) systems and payment gateways that offer robust fraud detection mechanisms. These systems can flag suspicious transactions and alert you in real-time.

**Archyde:** This seems manageable for larger businesses, but what about smaller businesses with limited resources?

**Expert:** I understand the concerns.

While robust POS systems and dedicated fraud detection software can be costly, even small businesses can implement cost-effective measures.

Encourage customers to use trusted mobile payment platforms like Apple Pay or Google Pay which often offer built-in fraud protection. Implement a simple QR code system connected to your payment gateway for quick and verifiable transactions.

Most importantly, document everything. Keep records of suspicious transactions, screenshots, and customer interactions. This can be valuable evidence if you need to involve law enforcement.

**Archyde**:We appreciate your insights. What message would you like to leave for our viewers?

**Expert:**

Digital scams are evolving rapidly, but by staying informed and implementing simple protective measures, businesses of all sizes can minimize their risk and protect themselves from becoming victims. Remember,vigilance is key.Never hesitate to question a transaction that seems off, and prioritize the security of your business.

Bubble Tea Bandit Strikes Again

Table of Contents

Bubble tea Scam Rocks singapore

A brazen scam attempt at a popular bubble tea shop in Singapore has left authorities searching for the culprit. On December 18th, 2024, a woman tried to defraud the yi Fang Taiwan Fruit Tea outlet in Clarke Quay using a manipulated payment screenshot. The audacious act has shocked the community and highlighted the growing issue of digital fraud.A Digital Deception

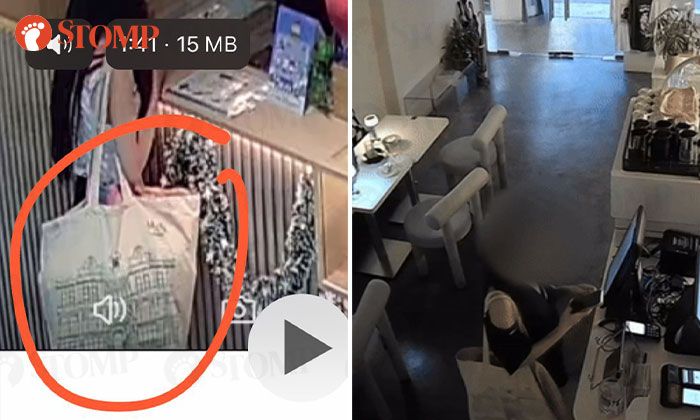

Details surrounding the attempted scam are still emerging, but authorities have confirmed that the woman presented a falsified payment confirmation to the Yi Fang staff.The incident serves as a stark reminder for businesses to remain vigilant against increasingly sophisticatedscamming tactics. Police are currently investigating the incident and are appealing to the public for any information that could lead to the apprehension of the suspect.Dining and Dashing: A Suspicious Screenshot Sparks Inquiry

A woman caught on CCTV camera at a restaurant has sparked an investigation after allegedly using a doctored PayNow screenshot to evade a substantial bill. The woman seemed to take her time studying the menu before placing a sizable order worth IDR 950,000, roughly equivalent to $62 USD. When it was time to settle the bill, the woman presented what appeared to be a legitimate paynow confirmation. However, a closer inspection revealed that key details, including the date and time of the purported transaction, had been deliberately blurred, raising suspicions about the payment’s authenticity. Authorities are currently looking into the incident, attempting to determine whether the woman intentionally used a fabricated screenshot to skip out on her bill. The case highlights the evolving tactics used by individuals attempting to defraud businesses and the importance of verifying payment confirmations thoroughly.A recent incident involving a woman attempting to purchase bubble tea using what appeared to be fraudulent proof of payment has sparked outrage and discussion online. The incident, which unfolded at a bubble tea shop, was captured and shared on social media, quickly going viral.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

The woman, whose identity has been withheld, allegedly presented what looked like a screenshot of a mobile banking transaction showing a payment of 950,000 rupiah for her bubble tea order.However, the shop’s staff reportedly grew suspicious and challenged the legitimacy of the payment proof.

As tensions escalated, the woman insisted she had made a genuine payment, but the staff remained unconvinced.The situation culminated in a heated exchange, which was captured on video and subsequently circulated online.

The incident has ignited a debate online, with many expressing sympathy for the bubble tea shop staff while others question the woman’s intentions. Some have criticized her for attempting to defraud the establishment, while others have raised concerns about the potential for misunderstandings regarding online payment confirmations.

Questionable PayNow Payment Screenshots Raise Concerns

Concerns have been raised over the authenticity of online PayNow payment screenshots circulating recently. A representative from Taiwanese beverage company Yi fang Taiwan fruit Tea revealed that after meticulously examining these screenshots, they noticed a peculiar pattern: crucial date and time stamps had been deliberately removed from marked areas. “After studying screenshots of alleged PayNow payments, we noticed the marked areas had critically important date and time stamps removed,” the representative explained. “After studying this, we were able to see the erased marks where the date and time stamp should have been.” Authorities suspect a woman is behind a string of audacious scams targeting establishments across the country. This latest incident follows a previous case earlier this year at an East Coast cafe, where authorities believe the same individual employed a strikingly similar modus operandi. From her appearance to her choice of accessories, the similarities between the two incidents are uncanny. “This wasn’t the woman’s first attempt at this deceptive tactic,” stated a law enforcement official.In today’s digital world,the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam, underscoring the vulnerabilities that exist in digital transactions. They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

In today’s digital world, the convenience of online payments comes with an increased risk of fraud. A recent case involving a local bubble tea shop highlights this growing concern.

The shop fell victim to a scam,underscoring the vulnerabilities that exist in digital transactions.They have since filed a police report and are urging the public to be cautious and report any suspicious activity.

“The public should remain vigilant against such scams,” the shop stated.

## Interview wiht a Cyber Security Expert