The fight once morest “inflationary pressures” took over the shocks in the banking sector: the Bank of England (BoE) also raised its key rate on Thursday March 23, imitating the American Federal Reserve (Fed), the European Central Bank (ECB) and the central banks in Switzerland and Norway.

>> Euro zone: rate hikes will not stop in March

“new risks” for the economy”>>> The recent financial tensions are creating “new risks” for the economy

| The Governor of the Bank of England, Andrew Bailey, during a press conference on February 2 in London. |

| Photo: AFP/VNA/CVN |

The BoE tightened its rate for the eleventh consecutive time, by 0.25 points, a magnitude similar to that of the all-powerful Fed the day before.

The Swiss National Bank (SNB) followed the path of the ECB earlier in the day last week by raising its rate by 0.50 percentage points.

The BoE’s key rate is now at 4.25%, its highest since the end of 2008. The institution warns that “if the pressures” inflationary “persistent, a further tightening of monetary policy would be necessary”same cautious message as in February.

Already on Wednesday evening, the Fed had tried with a modest increase to spare the goat and the cabbage following the turbulence of the last few days but a persistent price waltz.

Earlier Thursday, March 23, the Swiss National Bank (SNB), which worked to secure the takeover of Credit Suisse over the weekend, opted for a 50 basis point hike, like the ECB a week ago and like economists expected it. In Norway, the central bank chose 25 basis points.

In the three European countries at work on Thursday 23 March, the number one objective of monetary policy remains to achieve inflation of 2%, which is still far from being the case.

But the bankruptcy of the Californian Silicon Valley Bank (SVB), then of two other American regional banks, showed how much the banking sector had been weakened by the frantic rate hikes of recent months.

|

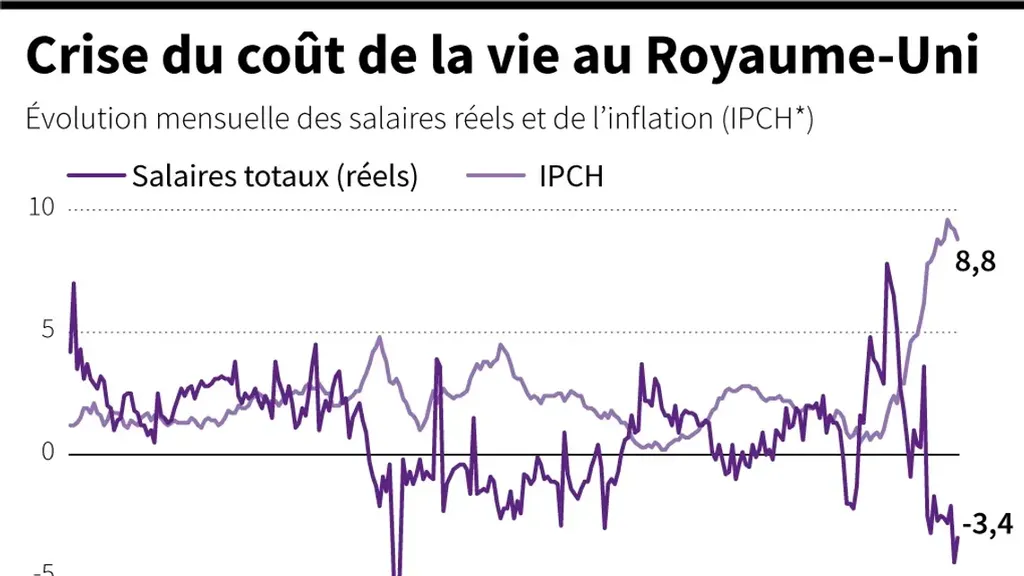

| UK cost of living crisis. |

| Photo: AFP/VNA/CVN |

“New Risks”

The Fed is now hinting that the end of its monetary tightening cycle is approaching. It now adopts the conditional to evoke that“a future tightening of monetary policy may be necessary” instead of an affirmative mode.

The Fed warned following its meeting that the recent banking crisis was “susceptible (…) to weigh on economic activity, hiring and inflation”pointing out that “the magnitude of these effects is uncertain”.

And the risk is not limited to the United States, as proved by the takeover of Credit Suisse by UBS at a knockdown price. ECB President Christine Lagarde acknowledged on Wednesday 21 March that tensions in the banking sector were causing “new risks” for the economy.

On the UK side, “there remain channels through which UK economic conditions might be affected”especially in case “of tensions on non-British banks”warned the Central Bank on Wednesday March 21 in a letter to Parliament.

|

| The Bank of England. |

| Photo : ANP/EPA/CVN |

The BoE had signaled at its last meeting that following ten consecutive hikes, it might keep its rate unchanged, at 4%, if inflation evolved in line with expectations.

But since then, the economy has held up better than expected across the Channel, and the Minister of Finance estimated during his presentation of the budget that the country would technically avoid recession, with a mere contraction of the economy of 0.2% in 2023.

And, last surprise for the British market, inflation in the United Kingdom, rebounded in February and still exceeds 10%, enough not to slow down too early in the efforts to contain it.

Swiss and Norwegian supers

In Switzerland, inflation remains significantly lower than in the rest of Europe, at 3.4% over one year in February, but has accelerated in recent months.

Last week, some economists still expected a much stronger tightening of the central bank, which therefore opted for a less marked increase due to tensions in the banking sector.

And in Norway, the central bank raised its rate to 3%, while inflation, although it slowed in February, remains at 6.3%.

Both the Norwegian krone and the Swiss franc barely flinched following these announcements in a market focused on a weak dollar.

AFP/VNA/CVN