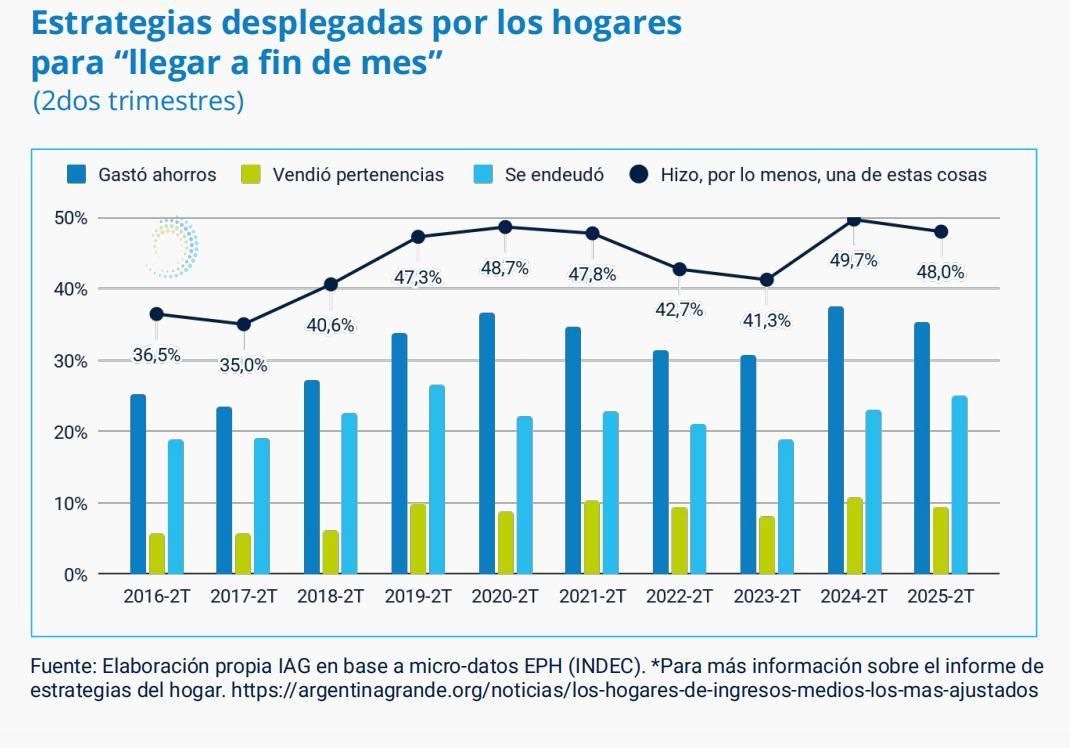

During 2025, the 48% of Argentine households had to deploy some kind of strategy to make ends meet. This is stated in the latest report of the Argentina Grande Institute (IAG)which registers a sustained growth of defensive practices such as the use of savings, the sale of personal assets and debt, in a context of depressed consumption and loss of income.

“The central phenomenon today in Argentina is the family over-indebtedness“, he pointed out Daniel Arroyoformer Minister of Social Development. “Families get into debt because they can’t afford it and they end up taking on debt to cover the previous one; when you enter that circuit, it stops being something temporary and becomes permanent.”

The report shows that the main tool to solve this situation was the use of savings: the 35.3% of households They were used to cover current expenses and the 9,4% sold belongings. Besides, one in four households He went into debt, either with financial institutions or with close people.

“In 2024 I spent all my savings to cover basic expenses: I sold years of dollars to support prepaid and my children’s school. Last year we asked for loans and went into debt. My wife and I work, but it’s not enough. Now we take out credit to pay the debt. It became something permanent, with the feeling of covering holes month after month,” he said. Carlos Fernández, 50 years old, administrative employee in an SME.

“I sold the computer, a bicycle and some furniture to be able to pay basic expenses and support my children during 2025. Little by little you start to let go of things that you need and, anyway, you don’t get there,” he said. Mariana Díaz, 42 years old, commercial employee and mother of three children.

Debts to cover the basics

Table of Contents

- 1. Debts to cover the basics

- 2. Defaults at record levels

- 3. What causes households to deplete savings and take new loans to pay existing debt?

- 4. The Race to Make Ends meet: Half of Households Burn Savings & Take Loans to Service Debt

- 5. The Perfect Storm: What’s Driving the Crisis?

- 6. The Impact on Different Household Types

- 7. The Cycle of Debt: How it effectively works

- 8. Real-World Example: The Smith Family

- 9. Strategies for Breaking the Cycle

- 10. Resources & Support

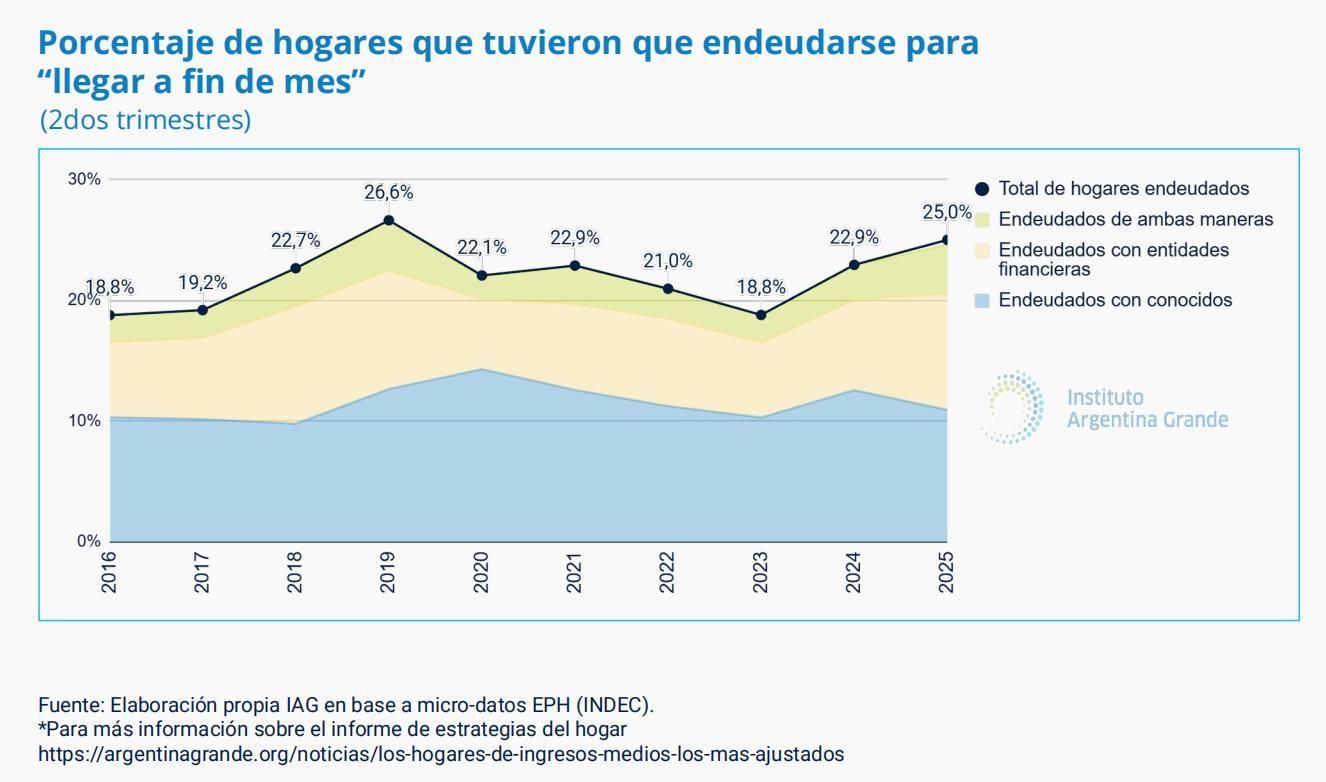

According to the IAG, debt is no longer associated with extraordinary consumption, but with the need to cover essential expenses. The percentage of households that go into debt specifically to “make ends meet” grew both compared to the second quarter of 2024 and in the year-on-year comparison with 2023.

“There are three clear questions: high fixed costsespecially electricity, gas and basic services; the cost of medicationstoday deregulated; and the cost of food“Arroyo listed. “Many people already ran out of money on the 10th and are beginning a very difficult race to make ends meet,” he added.

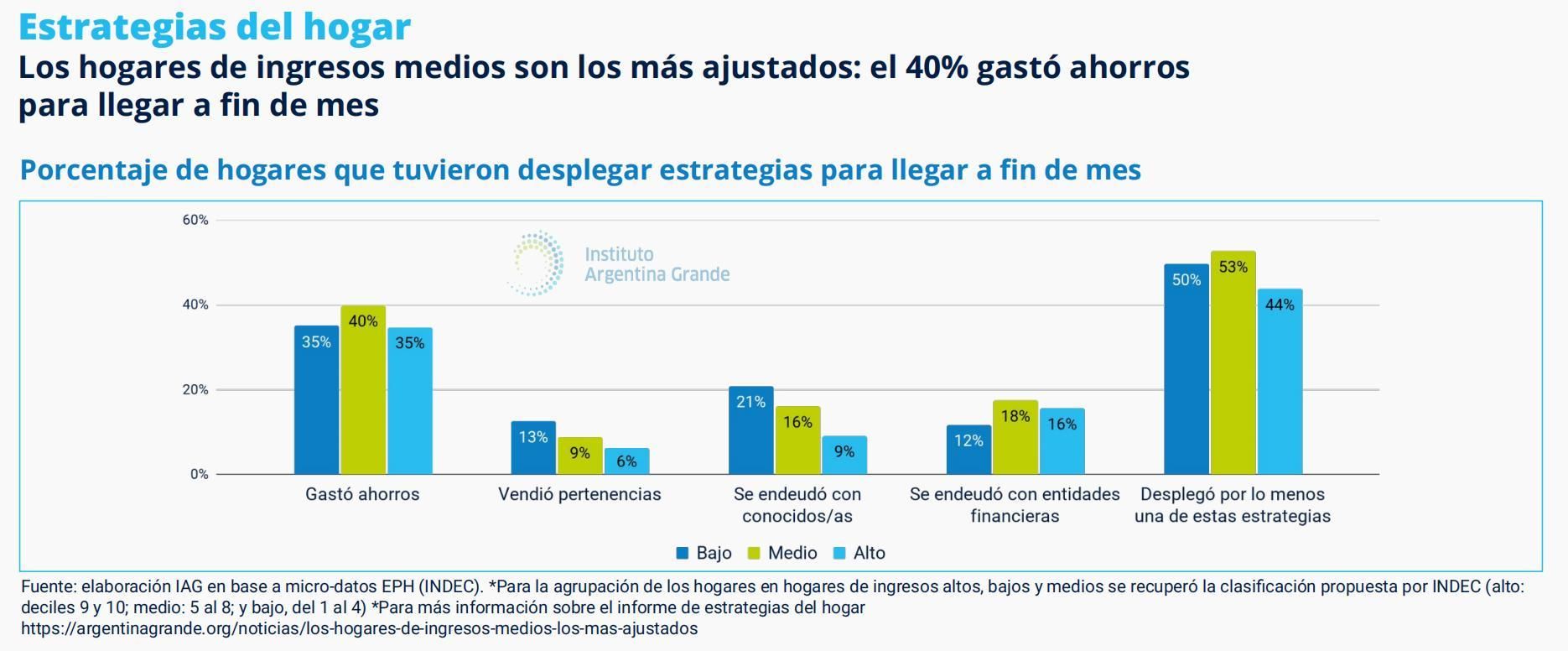

The report identifies the middle income households as the most stressed: the 40% resorted to savings, compared to 35% of lower-income households. Their access to formal credit is also greater: 18% became indebted to financial entities, against the 12% of low-income households.

Fernanda G. is 54 years old and has an extensive career as a journalist. She has been working as an editor for the same company for more than 20 years. She started selling a few dollars because she was not willing to give up some “little treats.” “I started to change to pay for something stupid, a gift for the kids, go to dinner one day, buy something for myself. First it was 100 dollars every two months, then it was 200 every month, until they were no longer just for those little treats, it was to make ends meet, pay the prepayment or the expenses. From 200 I went to 700 every month until the savings started to disappear. Then I started selling the clothes that we were already wearing. For me I work and I travel a lot and I take advantage of shopping abroad. They pay well for things from H&M or GAP here. I sold everything I could but I didn’t have anything left, not even savings or clothes or earrings or bracelets. My parents, who are almost 90 years old, help me. It’s very distressing and very unfair.

Defaults at record levels

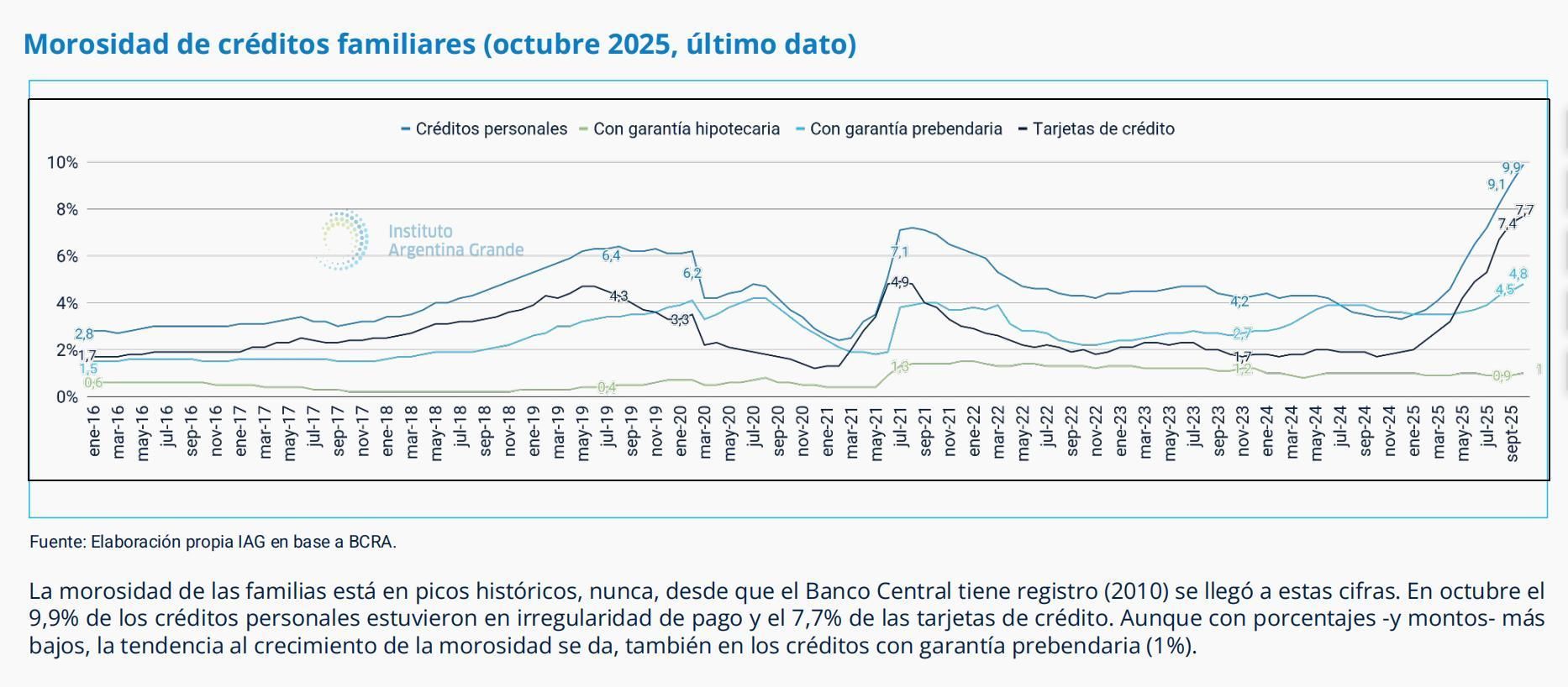

The advance of indebtedness is reflected in the indicators of late paymentwhich reached a new record. According to the Banco Centralthe families’ default reached 8,8%the highest level in more than 15 years, after 13 consecutive months of increases. The growth is mainly explained by consumer credit and the sharp increase in debt with non-banking entities, in a scenario of falling purchasing power of salaries.

In the non-banking circuit—which includes virtual wallets such as NaranjaX and Mercado Pago, as well as financial institutions and appliance stores— The delay is much greater and reaches 20.2%, according to a report by the consulting firm Eco Go, directed by Marina Dal Poggetto, prepared based on official data.

“I went into debt with a financial company to be able to buy the medications which I need every month, because with retirement it was no longer enough for me. At first it seemed like a small amount, but with the interest the debt became unpayable and I started to fall behind. Today they call me and send me seizure notices,” he said. Elena de Tellería, 71 years old, retired.

In this segment, indebtedness with financial entities grew 14% year-on-year and almost 67% compared to 2023. At the same time, the use of credit for everyday consumption increased: in November 2025, the 44,6% of supermarket purchases were paid by credit card, the highest level since records exist.

“The circuit usually starts by paying the minimum on the card, then the neighborhood financial institution appears, then another, and that ends in 500% annual rates“Arroyo warned.

The deterioration of disposable income appears as a key factor. According to the IAG, although registered private sector wages recovered nominal levels similar to those in 2023, the change in relative prices reduced the real margin after paying for services and transport. In the AMBA, these expenses went from representing the 4,8% from the median salary to 10,5% in two years.

This adjustment coexists with declining consumption: sales in supermarkets fell 10,2% real between January and November 2025 compared to 2023, with decreases in 23 of the 24 jurisdictions. At the same time, credit card delinquencies reached 7,4%the highest value recorded by the Central Bank.

In this context, opposition blocks of the Chamber of Deputies presented a bill aimed at household debt reliefwith a focus on the middle and lower sectors. The initiative proposes that the ANSES Sustainability Guarantee Fund (FGS) grant loans at a rate lower than that of the private financial system to cancel accumulated debts and establish a fee/income ratio that does not exceed the 30%.

For Arroyo, the social impact is already visible. “I am not talking about a social explosion, but about implosion“People who don’t arrive, live in debt and burst inside,” he stated. And he concluded: “When the debt is massive, it is a public policy problem. Without a cap on interest rates, there is no way out”.

LN/MG

What causes households to deplete savings and take new loans to pay existing debt?

The Race to Make Ends meet: Half of Households Burn Savings & Take Loans to Service Debt

The financial landscape for many households has become increasingly precarious. Recent data indicates a startling trend: roughly half of all households are now dipping into savings or taking on new debt simply to cover existing loan payments. This isn’t a story of lavish spending; it’s a reflection of stagnant wages,rising costs of living,and a complex web of financial pressures. Understanding the factors driving this trend, and exploring potential solutions, is crucial for navigating these challenging times.

The Perfect Storm: What’s Driving the Crisis?

Several interconnected factors are contributing to this widespread financial strain. It’s rarely a single issue, but a confluence of pressures that push families to the brink.

* Inflation’s Persistent Grip: While inflation rates have fluctuated, the cumulative effect of price increases – especially in essential areas like housing, food, and energy – has considerably eroded purchasing power. Even modest increases in these areas can strain a tight budget.

* Wage Stagnation: for many, wages haven’t kept pace wiht inflation. This means that even with employment, income isn’t stretching as far as it used to. The gap between income and expenses is widening.

* High Interest Rates: The response to inflation – raising interest rates – has ironically made debt more expensive to service. This creates a vicious cycle where more income is allocated to debt repayment, leaving less for other necessities.

* Household Debt Levels: Pre-existing debt, including mortgages, student loans, auto loans, and credit card balances, forms the foundation of this problem. Many households were already vulnerable before the recent economic pressures.

* The Rise of “Buy Now, Pay Later” (BNPL): While seemingly convenient, BNPL schemes can contribute to overspending and debt accumulation, particularly for those already struggling.

The Impact on Different Household Types

The burden isn’t shared equally. Certain demographics are disproportionately affected.

* Young Adults & Student Loan Debt: Millennials and Gen Z are often saddled with meaningful student loan debt, delaying homeownership and other financial milestones.The resumption of student loan payments in 2023 added further strain.

* Low-Income Households: Families with limited income are the most vulnerable to economic shocks. Even a small unexpected expense can trigger a financial crisis.

* Single-Parent Households: Single parents often face unique financial challenges, balancing work, childcare, and household expenses with limited resources.

* Fixed-Income Seniors: Seniors relying on fixed incomes, such as pensions or Social Security, are particularly susceptible to inflation, as their benefits may not adjust quickly enough to keep pace with rising costs.

The Cycle of Debt: How it effectively works

The situation frequently enough spirals into a dangerous cycle. Here’s a typical scenario:

- Initial Debt: A household takes on debt for a major purchase (home, car, education).

- Unexpected Expense: An unforeseen event occurs (medical bill, job loss, car repair).

- Savings Depletion: Savings are used to cover the expense, leaving little cushion for future emergencies.

- New Debt to Cover Existing Payments: When income is insufficient to cover existing debt payments and ongoing expenses,the household takes on new debt (credit card,personal loan) to make minimum payments.

- Escalating Debt: The new debt adds to the overall burden, making it even harder to get ahead. Interest accrues, and the cycle repeats.

Real-World Example: The Smith Family

The Smith family (names changed for privacy) provides a stark illustration. Both parents work full-time, but rising housing costs and childcare expenses consumed a large portion of their income. when one parent experienced a medical issue requiring expensive treatment, they depleted their savings and took out a personal loan to cover the bills and maintain their mortgage payments. Now, they are struggling to manage both the original medical debt and the new loan, leaving them with little discretionary income.

Strategies for Breaking the Cycle

While the situation is challenging,there are steps households can take to regain control of their finances.

* Budgeting & Expense Tracking: A detailed budget is the foundation of financial stability. Track income and expenses to identify areas where spending can be reduced.

* Debt Consolidation: Consolidating high-interest debt into a single loan with a lower interest rate can save money and simplify payments.

* Negotiating with Creditors: Contact creditors to explore options such as lower interest rates, payment plans, or temporary forbearance.

* Increasing Income: Explore opportunities to increase income, such as a side hustle, freelance work, or asking for a raise.

* Financial Counseling: Seek guidance from a qualified financial counselor. Non-profit organizations often offer free or low-cost counseling services.

* prioritizing Essential Expenses: Focus on covering essential needs (housing, food, transportation, healthcare) before discretionary spending.

* Building an Emergency Fund: Even a small emergency fund can provide a buffer against unexpected expenses. Aim to save at least 3-6 months of living expenses.

Resources & Support

several organizations offer assistance to individuals and families struggling with debt:

* National Foundation for Credit Counseling (NFCC): https://www.nfcc.org/

* Consumer Financial Protection bureau (CFPB): [https[https